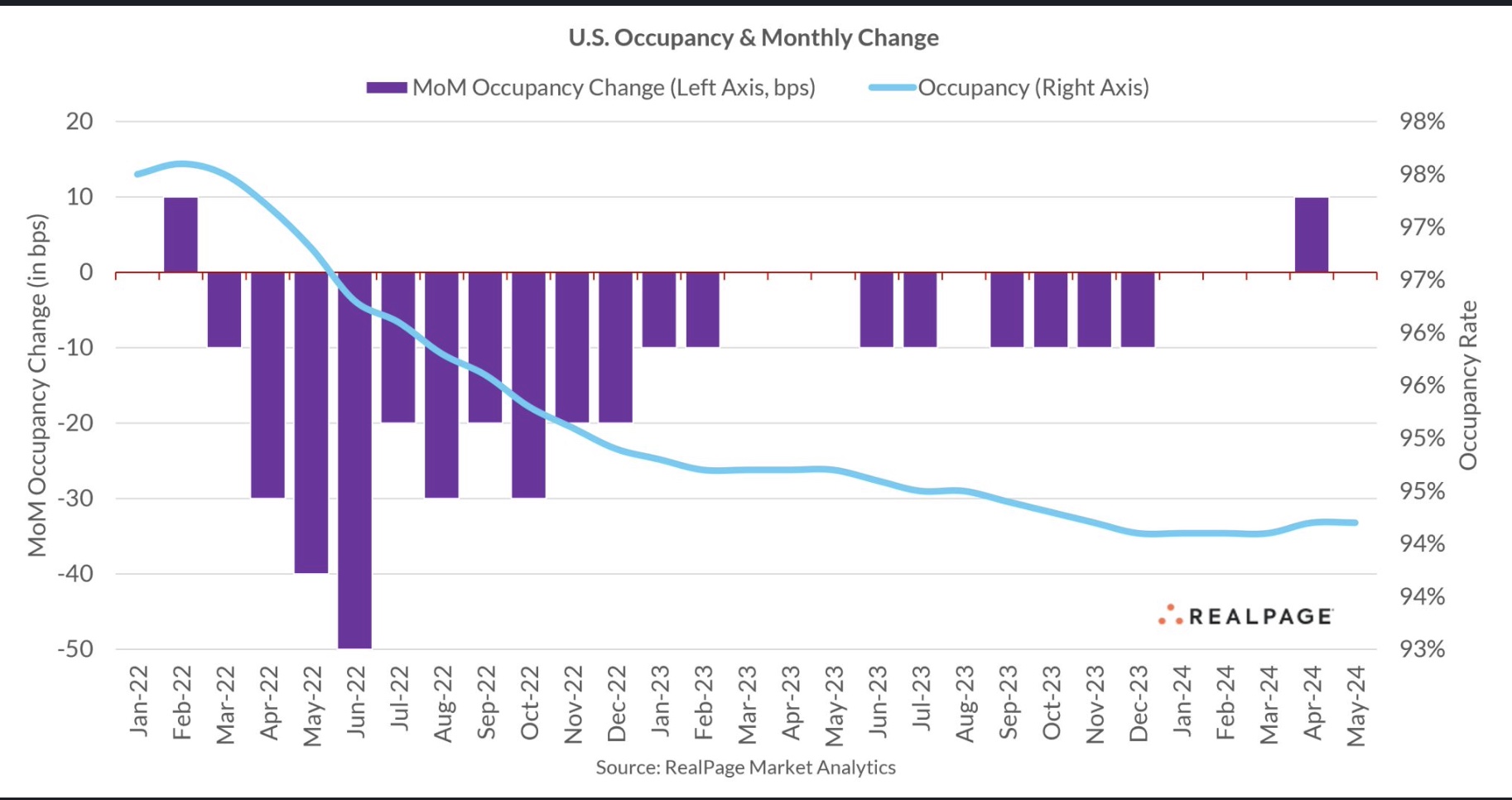

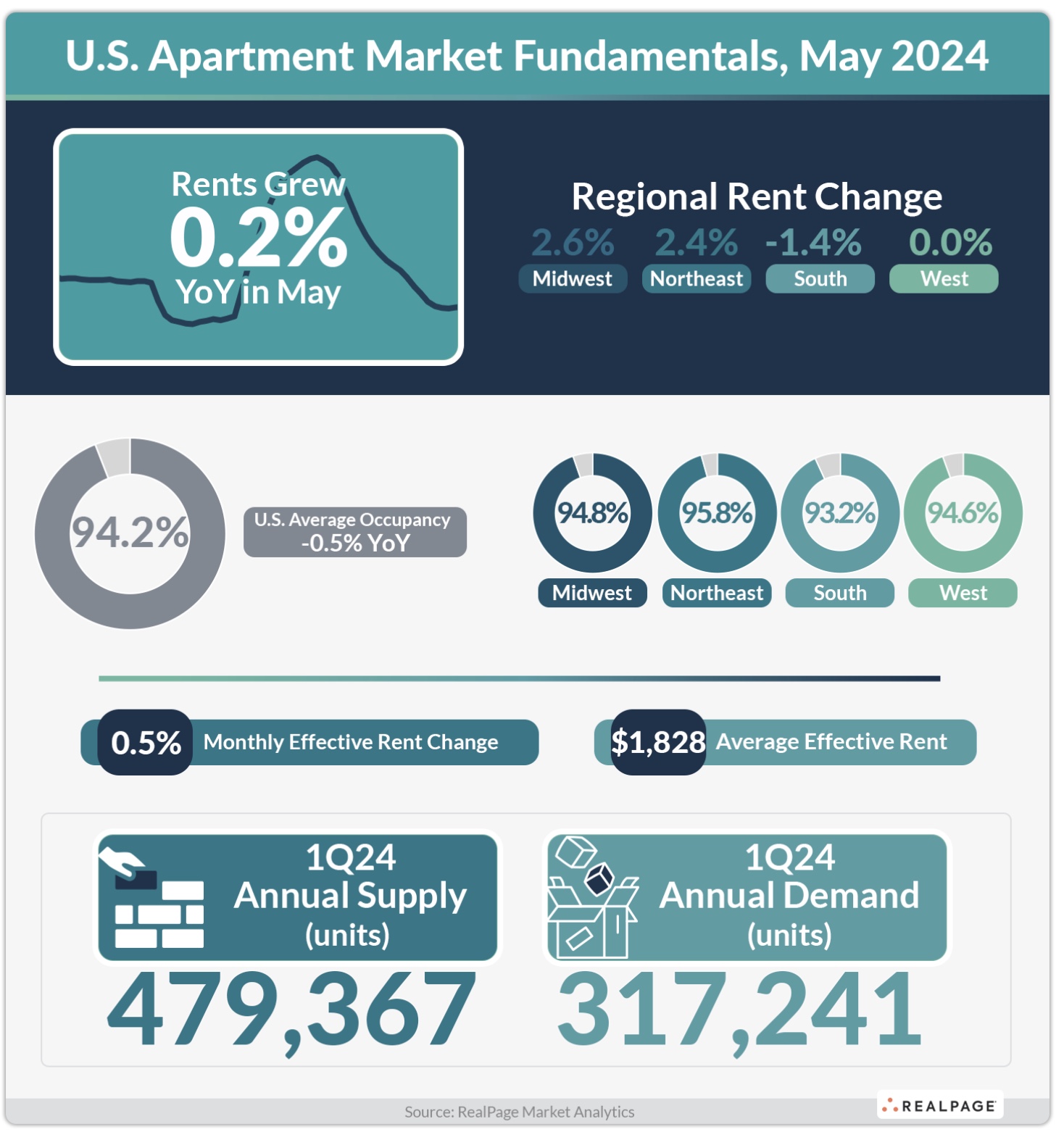

Apartment occupancy held steady in May, marking the seventh straight month in which occupancy remained at or above 94.1 percent. Rent change fundamentals also remained steady, solidifying the idea that the nation has reached a point of stabilization, according to RealPage Market Analytics.

Occupancy softened throughout most of 2022 and 2023, noted RealPage, but reached 94.2 percent in May. Although this rate was static month over month and remains below past cycle norms, RealPage Chief Economist Carl Whittaker thinks it’s an impressive testament to the depth of demand considering the nation is already at a 40-year supply peak.

While occupancy eased downward slightly over 2023, it hasn’t moved more than 10 basis points in either direction over the past 17 months and has held essentially stable for the first five months of 2024, said RealPage.

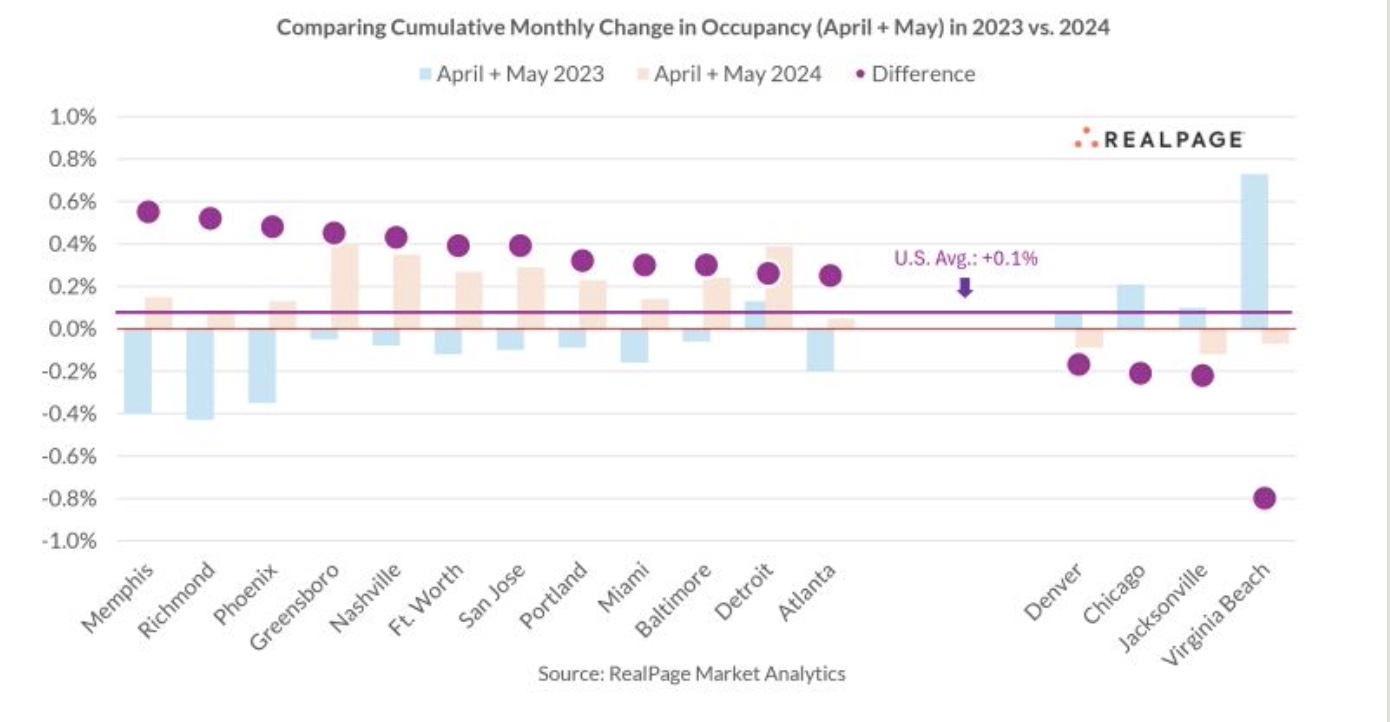

In April and May combined, the nation saw a 0.1 percent increase in occupancy, compared with the same time last year when “occupancy rates ticked down by a rounding error of -0.02 percent,” said Whittaker on his LinkedIn page.

“Even though that was a miniscule drop, the fact that occupancy was falling during some of the busier leasing months suggested 2023 was going to be tough sledding. And as shared earlier this week, a 0.1 percent increase for April and May 2024 is modest by historic comparisons. But you have to keep in mind the sheer volume of units delivering to appreciate the relative resilience of occupancy,” he said.

A relatively unchanged occupancy at a time of unprecedented supply indicates renters are continuing to absorb the new units at healthy rates. As shown in the chart below, April 2024 marked the first time that occupancy increased month-over-month since February 2022.

Occupancy across all four apartment regions either marginally ticked up or remained unchanged in May. In the Midwest and Northeast, occupancy increased 10 bps month-over- month, while occupancy month-over-month in the South and West remained unchanged.

On a year-over-year basis, an increasing number of major markets are seeing occupancy rates rise, with eight of the nation’s 50 largest markets managing to log a hike in local occupancy year-over-year in May. Only two markets, Minneapolis and San Francisco, recorded occupancy increases year-over-year at the start of this year by comparison.

Meanwhile, apartment markets across the Sun Belt are still suffering lower occupancy readings among record supply. All five of the major Texas apartment markets, Dallas, Fort Worth, Houston, Austin and San Antonio, were less than 93 percent occupied as of May, said RealPage.

Whittaker notes that many metros are finally seeing demand catching up more closely to supply. But in markets like Memphis, Greensboro/Winston-Salem, and Baltimore, he thinks it’s less about demand catching back up to supply and more about finding their floors.

“Memphis, for example, saw occupancy fall by 0.4 percent between April and May in 2023. This year however, rates increased by about 0.2 percent, resulting in that year-over-year change (purple dot on below chart) of about 0.6 percent. That’s a big swing in the grand scheme of it all,” he said.

Phoenix, Nashville and Ft. Worth recorded modest-to-strong occupancy improvement so far this year. It appears the story with those markets is one of demand catching back up to supply, said Whittaker, adding that Richmond can also be included in that story. “There’s still a lot of work left to be done in those markets because deliveries will continue to mount. But all considered, demand is doing its fair share of the work,” he said.

He is encouraged to add West Coast markets San Jose and Portland to the list.

“Might those local economies be seeing some greenshoots after a really tough 2022/2023, thereby improving demand going into the summer?” he asks.

He remains wary for the coming months of Denver and Jacksonville, the latter of which saw occupancy fall over the past two months and is now at 92 percent.

“With another eight percent of existing inventory scheduled to deliver in the coming 24 months, Jacksonville may be in a difficult spot,” Whittaker notes, adding that he has consistently been wrong about Denver for the past few quarters, forecasting weaker occupancy than what actually transpired, but thinks the data still indicates Denver could face some challenges this year and next.

“With June to go, we’ll have to wait and see what second quarter apartment absorption looks like nationally. But considering that supply in year-ending Q1 2024 (480k units) is expected to increase another 10 percent to 531k units in the year-ending Q2 2024 while occupancy is holding stable suggests that Q2 realized demand is going to be excellent by historic standards,” said Whittaker.