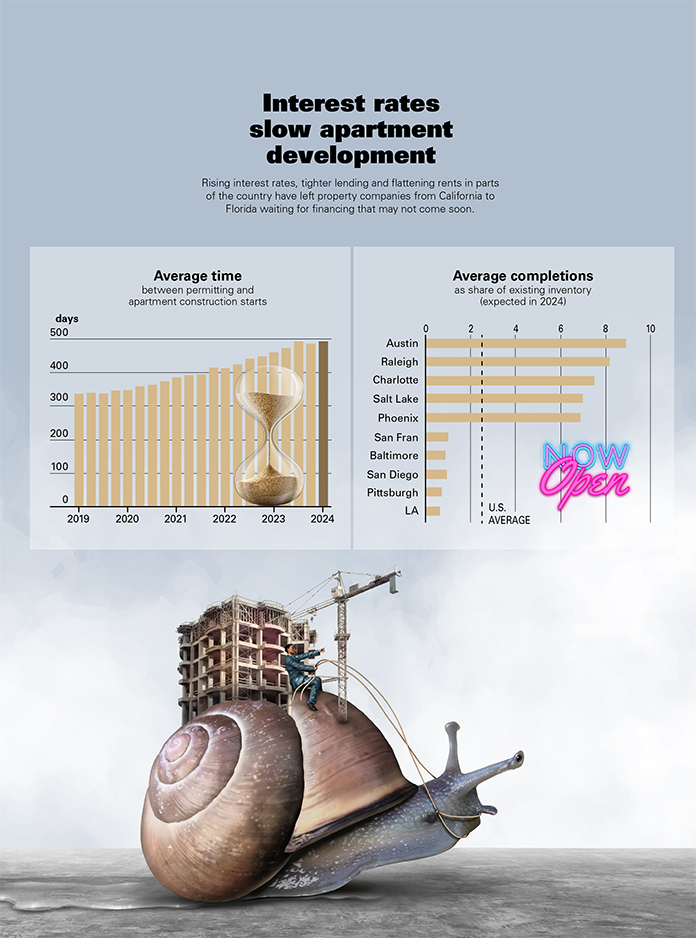

Rising interest rates, tighter lending and flattening rents in parts of the country have left property companies from California to Florida waiting for financing that may not come soon.

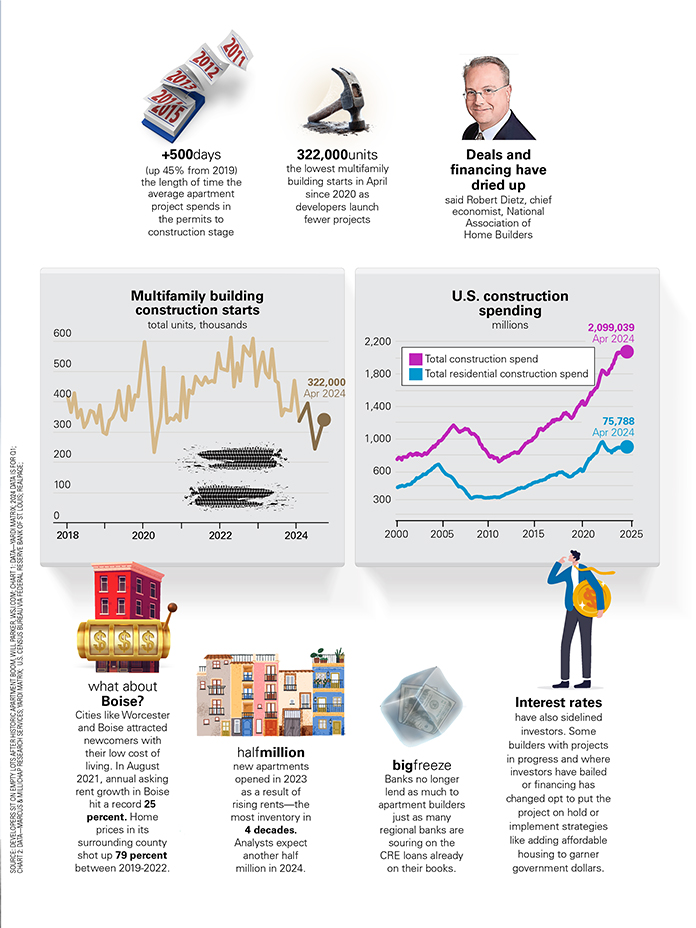

+500 days (up 45% from 2019) the length of time the average apartment project spends in the permits to construction stage

322,000 units the lowest multifamily building starts in April since 2020 as developers launch fewer projects

Deals and financing have dried up said Robert Dietz, chief economist, National Association of Home Builders

Multifamily building construction starts total units, thousands: 322,000 Apr 2024

U.S. construction spending millions: Total construction spend 2,099,039, Apr 2024

Total residential construction spend: 75,788, Apr 2024

What about Boise? Cities like Worcester and Boise attracted newcomers with their low cost of living. In August 2021, annual asking rent growth in Boise hit a record 25 percent. Home prices in its surrounding county shot up 79 percent between 2019-2022.

Half million new apartments opened in 2023 as a result of rising rents—the most inventory in 4 decades. Analysts expect another half million in 2024.

Big freeze Banks no longer lend as much to apartment builders just as many regional banks are souring on the CRE loans already on their books.

Interest rates have also sidelined investors. Some builders with projects in progress and where investors have bailed or financing has changed opt to put the project on hold or implement strategies like adding affordable housing to garner government dollars.

Source: Developers sit on empty lots after historic apartment boom, Will Parker, wsj.com; chart 1: data—Yardi Matrix; 2024 data is for q1; chart 2: data—Marcus & Millichap research services; Yardi Matrix; U.S. Census Bureau via Federal Reserve Bank of St. Louis; Realpage