With national elections around the corner, some of the nation’s largest apartment companies are facing antitrust litigation over usage of a product that has become increasingly important to the industry since the first multifamily revenue management (RM) software came on the scene three decades ago.

The lawsuits challenge the use of algorithmic-based tools to set rents, claiming their use violates the Sherman Antitrust Act of 1890, which prohibits any activity that restricts interstate commerce and competition in the marketplace.

The complaints allege that rental providers colluded with one another and with RM software companies to unlawfully coordinate rent raises in what is being called a price-fixing scheme.

The trouble began in 2022, when ProPublica, a nonprofit newsgroup that investigates abuses of power, began releasing a series of articles attacking the multifamily industry’s usage of RM software that has been employed throughout multifamily and many other industries for more than 30 years.

The ProPublica articles spurred an avalanche of state and federal lawsuits and proposed legislation targeting RM that included antitrust enforcement reforms aimed at closing gaps that occurred over time as the technology evolved.

Both Colorado and New York have introduced bills that would make it illegal for RM to use confidential non-public data to coordinate pricing. And, a Democrat-sponsored bill would make it illegal for property owners to contract with companies that coordinate rent prices and housing supply information, and ban two or more apartment operators from coordinating on such information. Also banned would be mergers between two information-coordinating companies that “reduce competition” in the market.

Dom Beveridge, multifamily industry consultant and principal of 20for20, cautions that there is plenty of evidence to suggest lawmakers, especially in blue states, may see these kinds of legislation as vote-winners.

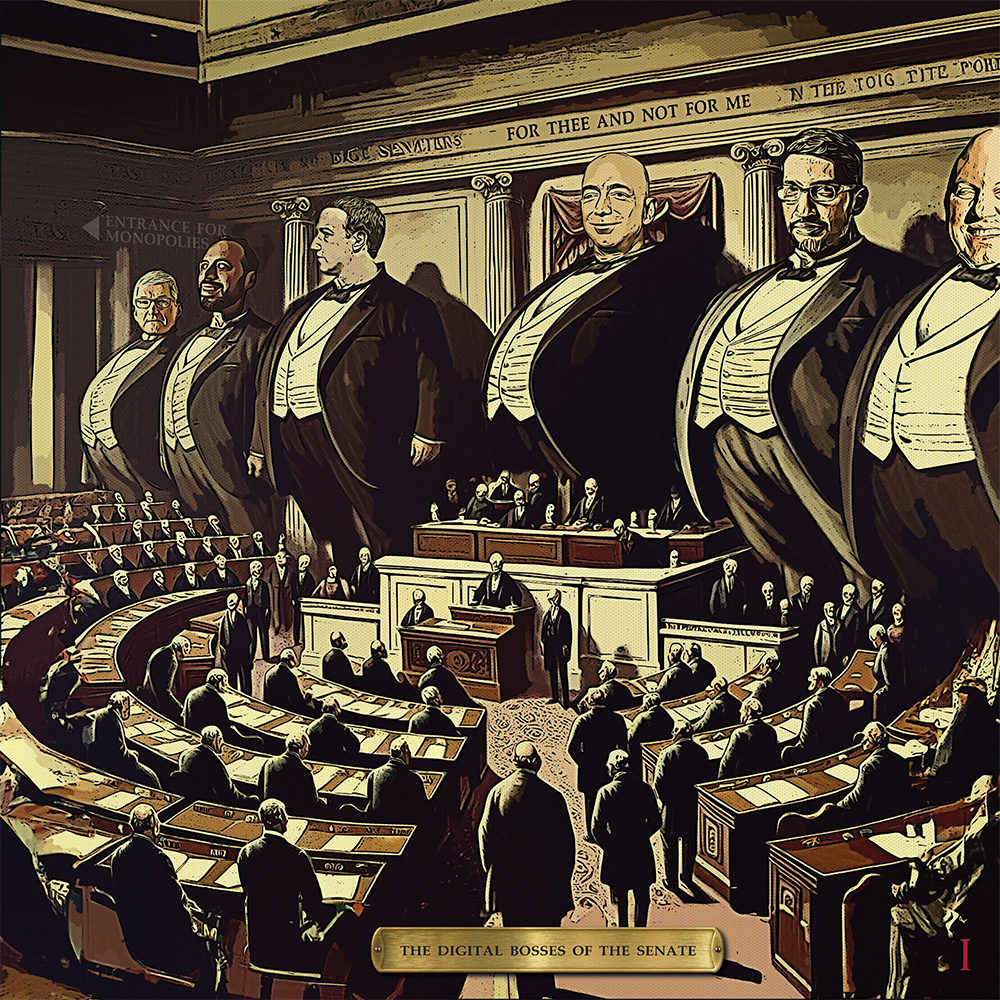

The Biden administration has platformed the issues in its bid for re-election, enlisting the U.S. Department of Justice and Federal Trade Commission as antitrust enforcers, while vowing to crack down on “big landlords who break antitrust laws by price-fixing and driving up rents.”

Beveridge testified in front of the first house committee meeting on the Colorado bill that he calls a crazy over-reach, based on a complete misunderstanding of what RM software actually does.

“The experience teaches an important lesson about our industry’s approach to advocacy, but the bigger take away is that progressive state legislators really don’t like multifamily housing,” he wrote on his LinkedIn page, prompting a reader to liken the proposed legislation to banning GPS in cars in favor of reverting to use of paper maps.

Beveridge explained that those who understand multifamily RM know that outperforming the market is not the same as inflating prices, as ProPublica suggests.

“Operators improve performance by making better, more analytically informed decisions further in advance. Sophisticated algorithms predict future supply and demand and avoid problems that would otherwise result in underperformance. When operators make fewer bad decisions, revenue performance improves, but none of this entails price gouging,” he said.

Rents at issue

ProPublica’s stories surfaced toward the tail end of the COVID pandemic, when rents in some markets saw double-digit increases. Rents plunged at the start of the pandemic in the most expensive neighborhoods, while rents in low-income markets barely budged. Then rent moratoriums put a hold on payments, but once the pandemic was declared over, they became due at the higher rates.

“The DOJ has been explicit that they’re not happy with rising rents and are looking for ways to tackle that and they’re trying to use the antitrust laws in a way that the laws are not designed to do,” said David Cross, a partner at San Francisco-based Morrison & Foerster’s antitrust litigation practice.

Putting rent increases in perspective, he points out that the prices of many products increased by similar magnitude during the same period, while rental housing demand was rising and the single-family housing market was falling off. “These are just some of the factors driving the increase in rents,” he said.

Cross believes the investigations, litigation and proposed legislation targeting RM are driven by two factors—money and politics. “I think the plaintiffs see this as an opportunity to cash in with large class actions, and on the agency side, you’ve got a lot of political pressure coming out of Congress and other sources on rising rents,” he said.

A snowball of litigation

Renters filed dozens of federal lawsuits against RealPage and many of the nation’s biggest landlords after the release of ProPublica’s articles, alleging that the use of RM tools constitutes a form of pricing cartel. Congressional lawmakers called for an investigation of RealPage by the DOJ, which later backed the tenants’ lawsuits.

In September 2023, the agency filed a brief in concert with the Federal Trade Commission in an antitrust case involving Yardi Systems and 18 landlords in the western district of Washington. And, in addition to the civil investigations launched in late 2022, the DOJ this March opened a criminal investigation into RealPage and some of the owners and managers that use the company’s pricing software to determine if they are facilitating price fixing.

If successful, the lawsuits could set a precedent for how antitrust laws are applied to the tech tools used in multifamily and potentially lead to more stringent regulations on how data can be used to drive decisions, not only in the apartment sector, but other industries as well.

Fighting back

Beveridge points out that in building a bogus case against RM software and the companies that use them, ProPublica relied heavily on quotes about rent increases. “Its allegations of collusion are based on innuendo, a misunderstanding of basic economics and out-of-context quotes,” he said.

One quote mentioned by ProPublica was from an article called “The Bottom Line on Revenue Management” written for YieldPro in 2007, when multifamily RM was in its infancy.

ProPublica had construed “A rising tide lifts all boats” to mean the industry learned that hiking rents at the same time benefited all landlords. This implied that the purpose of RM tools is to artificially inflate rents simultaneously, when what former CEO of Archstone Scot Sellers was actually saying was that companies who used any of the RM tools available at the time were better equipped to compete against each other than those who manually set rents and manage revenue.

Landlords have always been the low hanging fruit for negative press, said Beveridge. For instance, a recent bill passed in Kansas City targets discriminatory practice in leasing. It prohibits property owners from refusing to rent to anyone with a housing voucher, which industry experts say interferes with the ability of the property owner to screen potential renters, to the detriment of the owner and residents of the property who depend upon their landlord to make sure the community is safe for them and their families.

But targeting landlords who provide much needed housing for Americans is counterintuitive, since adding more rental supply actually helps reduce rents, not increase them.

“We have a housing crisis in the U.S. and there is only one way to solve it—build much more housing. And, you cannot solve a supply and demand problem like housing affordability by trying to make providers less profitable,” said Beveridge.

Best practices for protection

For antitrust claims to be successful, the plaintiffs in the class action lawsuits must prove that the defendants violated the Sherman Act, explained Cross.

“For collusion to exist there must be an agreement between or among horizontal competitors to engage in some conduct that would reduce the amount of supply of a product available in the market and enable them all to push prices up above the competitive level.

“The issue with the ongoing litigation is that the only agreement that’s been alleged with any kind of facts is that individual owners and operators have agreed in a vertical bilateral arrangement with a software provider to use the software to help, among many other inputs and many other considerations, to set rents.

“What you don’t have, and what’s required for collusion, is a horizontal agreement among competing property operators to all use that software and to delegate their rent setting authority to a third party.

“From what I’ve seen, and from what we’ve been able to discern from the industry, there’s nothing like that happening,” Cross said.

Cross said there are steps operators can take to avoid risk, although these steps shouldn’t be needed to insulate lawful, independent action against antitrust exposure. He warns that sharing certain types of commercially sensitive information can increase this risk even when entirely lawful due to growing actions by private plaintiffs and antitrust enforcers.

“One thing to keep in mind is that maximizing revenue is not the same as price maximization. Sometimes maximizing revenue involves reducing prices to increase sales volume, which RM software often recommends.

“Therefore, maintaining a record highlighting each independent action and decision, including the reasons for the decisions, can help to show government enforcers and courts that any concerns about collusion with competitors are ill-founded,” he said.

The steps include:

- Use software as a recommendation

- Document each and every decision

- Understand the software and how it works

- Identify each source of information

- Provide training to anyone who touches pricing

He also recommends operators implement an antitrust policy and compliance program that address RM and other emerging technologies and take reasonable measures to mitigate risk, including consulting experienced antitrust counsel.

“It’s actually not that expensive. We usually recommend keeping policies very short and simple, so they’re easily understood by employees at all levels,” he said.

His firm typically puts together two or three pages laying out the basic do’s and don’ts to help operators avoid running afoul of antitrust laws.

“We also come in and do one or two broad trainings with anyone who touches pricing and or makes business strategy decisions. Then we have a training for the highest-level executive in the company so they understand the risk profile and how to avoid inadvertently stepping into something with the antitrust laws,” said Cross.

Knowing when to fold ‘em

Plaintiffs and their attorneys know that lawsuits are costly and time consuming, no matter how specious, and oftentimes bank on defendants settling rather than dragging out costly litigation.

This could be the impetus for the February settlement agreement in the cases against Pinnacle Property Management Services LLC and Apartment Income REIT Corp., claiming they artificially inflated rental prices using RealPage’s revenue management software.

The agreements are the first to come out of the more than 30 consolidated lawsuits that accuse RealPage of colluding with residential owners and operators to leverage their price-setting algorithm in order to inflate rents beyond competitive levels.

Other large REITs that fall under the purview of the antitrust litigation include Camden Property Trust, Essex Property Trust, Equity Residential and Mid-America Apartment Communities.

AVB’s smart move

Arlington, Va.-based AvalonBay (AVB) stands out as the one large REIT that has extricated itself from the legal embroilment, noting in a Q2 2023 earnings call and 10-Q that it’s been dismissed as a defendant in the cases implicating RealPage and its clients.

The dismissal appears to stem from the REIT’s foresight in demanding strong contractural language in its agreement with The Rainmaker Group, and subsequently RealPage, to prevent any misuse of its data that could lead to antitrust violations.

AVB contracted with RealPage in 2017 when RealPage acquired LRO from its largest competitor in a deal that drew the renewed interest of the DOJ, which oversees mergers of a certain size, but ultimately went through.

National digital media company Bisnow reported it received court filings that suggest AVB’s proactive legal strategy and specific demands for data privacy and non-sharing clauses in its contracts with Rainmaker and RealPage effectively shielded it from the lawsuit’s allegations of collusion.

The REIT declined in its Aug 2, 2023 earnings call to add further color to the dismissal, pointing analysts to the court record. All AVB CEO Benjamin W. Schall would say is, “We were dismissed from the consolidation of the class-action lawsuits and there are no other litigations related to RealPage that we’re aware of that we have not been dismissed from.”

Prosecutors wrote in their lawsuit that, “AvalonBay was apparently so concerned by the possibility that Rainmaker and RealPage’s (RM solutions software) might use AvalonBay’s data to set competitors’ prices and/or use competitors’ prices to set AvalonBay’s prices that AvalonBay insisted on even further protection.”

This begs the question whether AVB’s foresight into protecting itself could be used against the remaining litigants that didn’t seek a similar protective agreement.

“It’s really a shame. It’s all belt and suspenders, because we see that no one has done anything wrong. But the plaintiffs are so aggressive and are pursuing these massive settlements that they hope to get because they can just run up costs in lawsuits and force folks to settle. Not to mention the DOJ and state agencies, which have their own political agenda. Unfortunately, all of these rental housing providers are in a difficult spot,” said Cross.