Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (September 2021: Household Formation Drives Housing Demand). Now that household formation has slowed, and multifamily completions have increased, rents are under pressure.

Apartment List: Asking rent growth—0.8 percent year-over-year

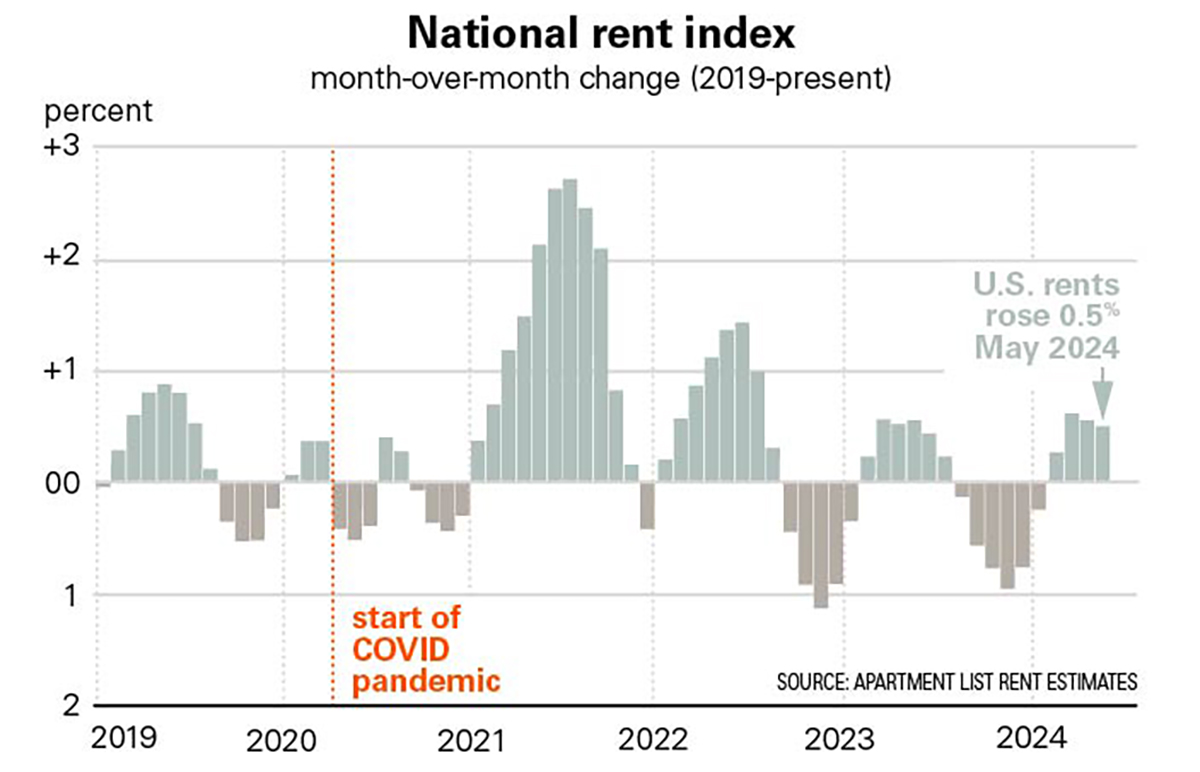

From ApartmentList.com: Apartment List National Rent Report—Rents are up 0.5 percent month-over-month, down 0.8 percent year-over-year:

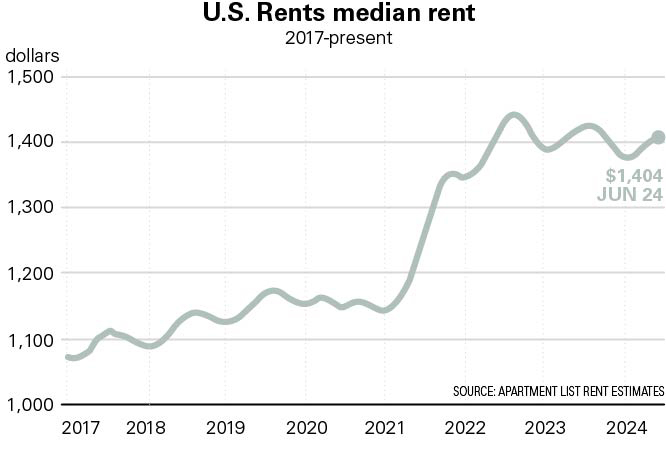

Rent prices ticked up for the fourth straight month in June, but rent growth over the course of 2024 as a whole remains modest, signaling ongoing sluggishness in the market. The national median rent increased by 0.5 percent in May and now stands at $1,404, but the pace of growth slowed slightly this month. This is typically the time of year when rent growth is accelerating amid the busy moving season, so sluggish growth this month indicates that the market is headed for another slow summer.

Since the second half of 2022, seasonal declines have been steeper than usual and seasonal increases have been more mild. As a result, apartments are on average slightly cheaper today than they were one year ago. Year-over-year rent growth nationally currently stands at -0.8 percent and has now been in negative territory since last summer.

Since the second half of 2022, seasonal declines have been steeper than usual and seasonal increases have been more mild. As a result, apartments are on average slightly cheaper today than they were one year ago. Year-over-year rent growth nationally currently stands at -0.8 percent and has now been in negative territory since last summer.

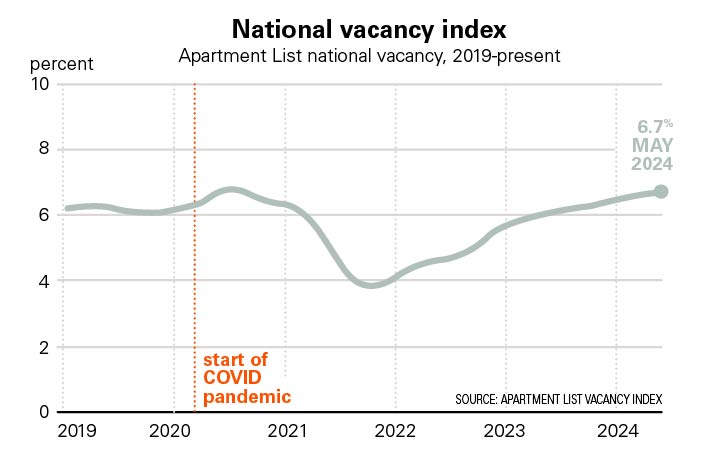

On the supply side of the market, our national vacancy index continues trending up and stands today at 6.7 percent. After a historic tightening in 2021, multifamily occupancy has been slowly but consistently easing for over two years. And with this year expected to bring the most new apartment completions in decades, we expect that there will continue to be an abundance of vacant units on the market in the year ahead.

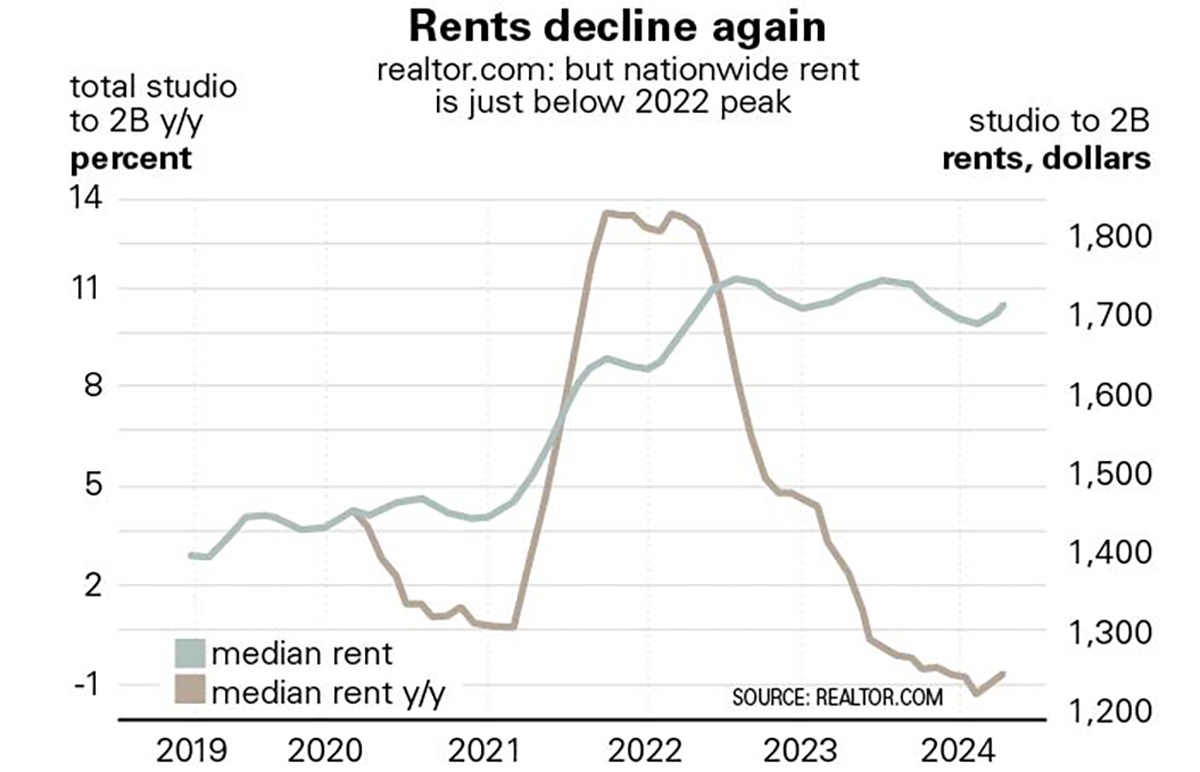

Realtor.com: Ninth consecutive month with y/y decline in rents

From Realtor.com: April 2024 Rental Report: Median Asking Rents Continue To Drop

In April 2024, the U.S. median rent continued to decline year over year for the ninth month in a row, down 0.7 percent for zero- to two-bedroom properties across the top 50 metros, a pace lower than the -1.1 percent seen in March 2024. The median asking rent was $1,723, up by $16 from May following a typical seasonal trend

Despite the nine months of decline, the U.S. median rent was just $33 (-1.9 percent) less than the peak in August 2022. Notably, it was still $316 (22.5 percent) higher than the same time in 2019 (before the COVID-19 pandemic).

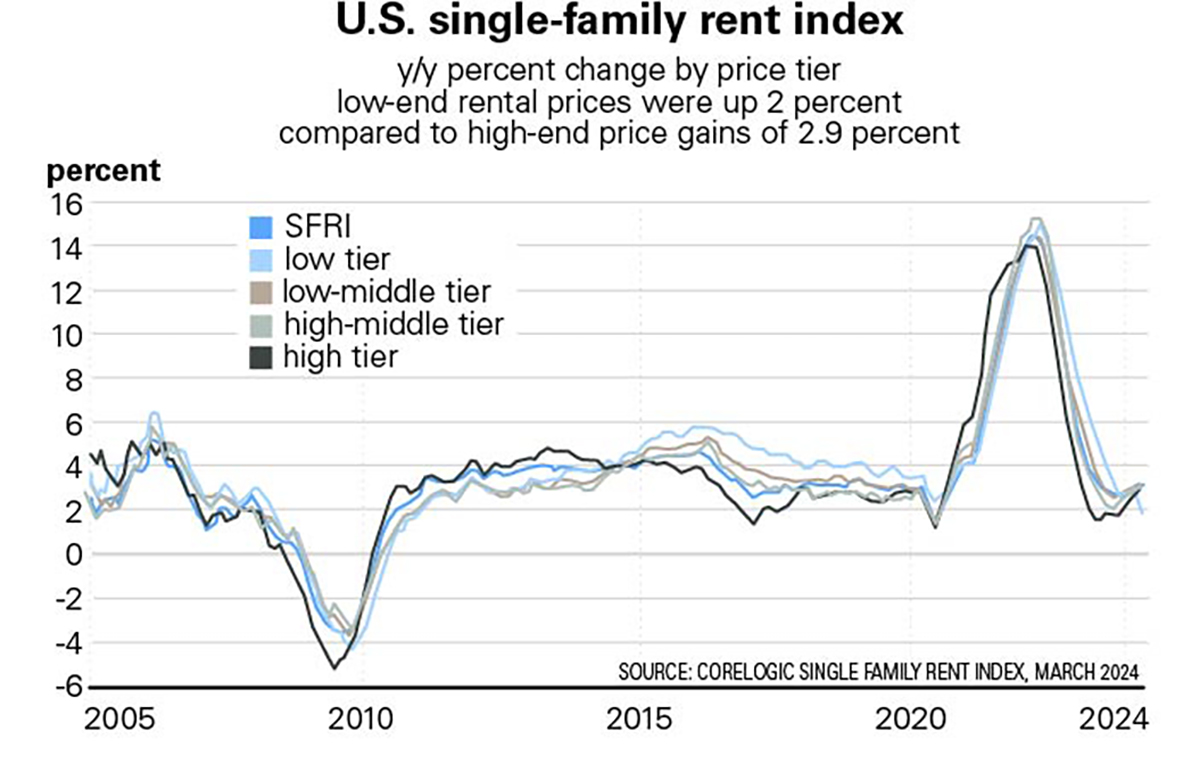

CoreLogic: Attached single-family rental prices post first annual decrease in 14 years

CoreLogic also tracks rents for single family homes: CoreLogic: Attached Single-Family Rental Prices Post First Annual Decrease in 14 Years in March

U.S. single-family rent growth continued to slowly increase year over year in March to 3.4 percent.

After registering a 2.9 percent annual gain in February, attached rental appreciation lost ground in March, posting a -0.6 percent loss.

The 3.4 percent y/y increase in March was up from 2.6 percent y/y in February.

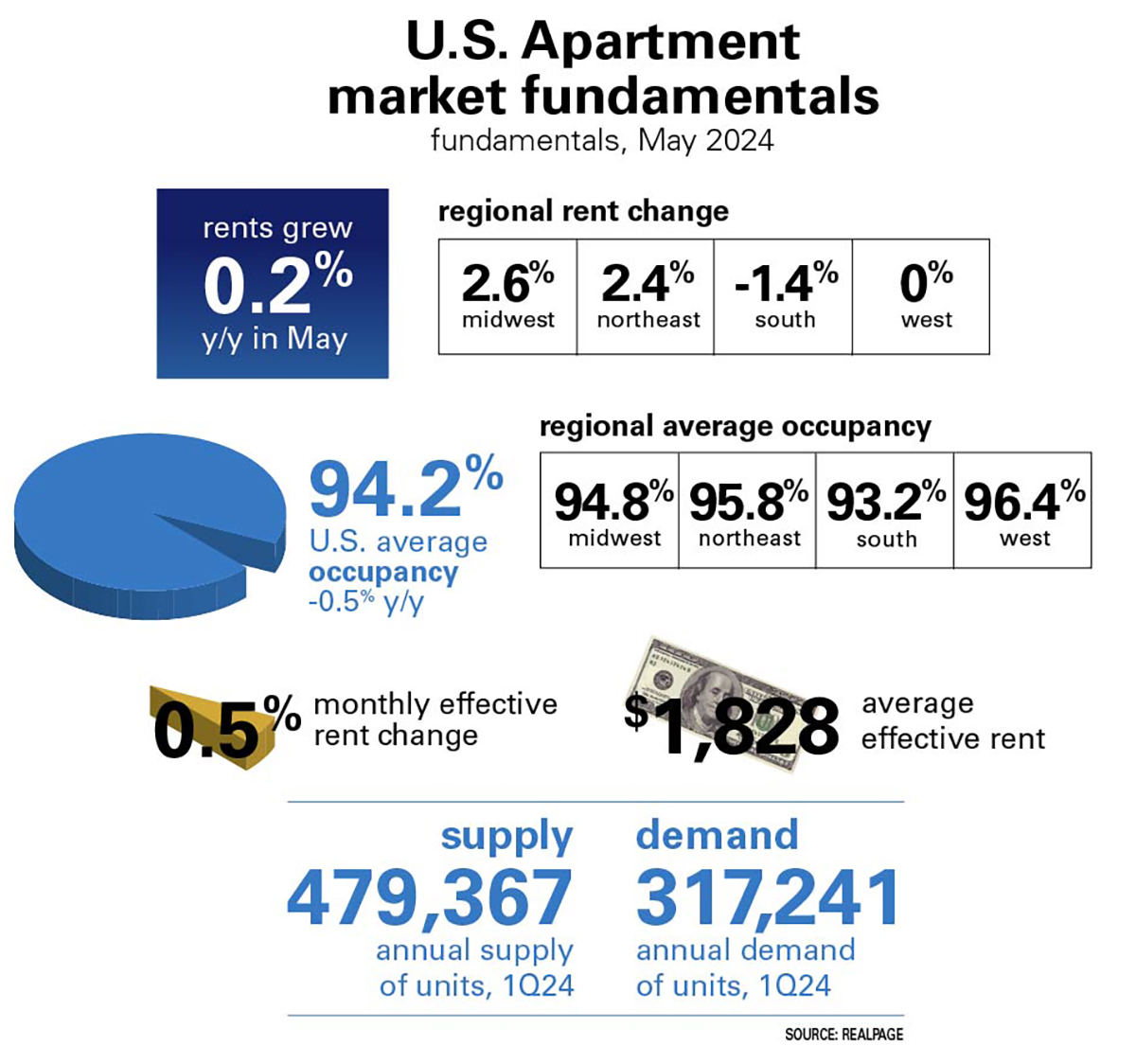

Real Page: “Apartment Rent Change Remains Tepid”

Real Page: U.S. Apartment Occupancy Demonstrates Resilience Amid Historic Supply

Meanwhile, though annualized rent change remained muted by historical standards, monthly rent change for apartments looked more seasonal. Effective asking rents for professionally managed apartments ticked up just 0.2 percent year-over-year in May 2023, with change measured on a same-store basis.

Author Bill McBride, CalculatedRisk