Fannie Mae’s National Housing Survey revealed that 80 percent of renters believe that this is a bad time to buy a home. This is in line with the beliefs of other consumers.

Long term look

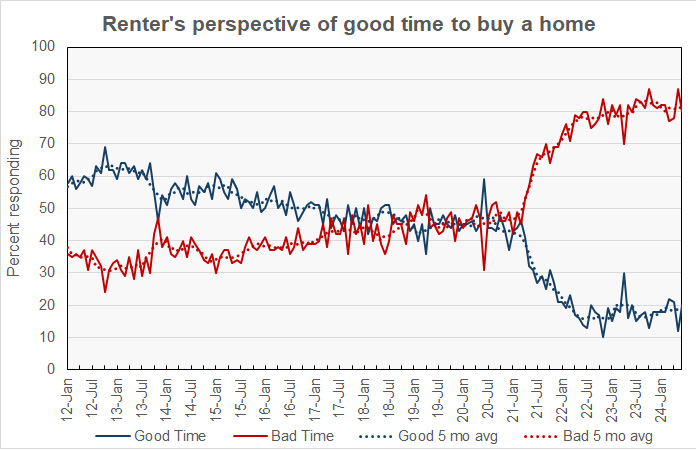

The chart, below, provides the history of renter’s responses to the good time/bad time to buy survey since 2012. The chart shows the percentage of renters responding that it is a good time to buy a home, along with the 5-month moving average of their responses. It also shows the same data for renters responding that it is a bad time to buy a home.

The chart shows that renters’ pessimism about home buying conditions had been trending higher since at least 2012. However, that pessimism intensified in the spring of 2021 at about the time that inflation took off. Interestingly, mortgage rates did not jump until January 2022, so renters were increasingly pessimistic about home buying even before the rise in mortgage rates.

For the last 2 years, renters’ outlooks have stabilized, with a little under 20 percent believing that it is good time to buy a home.

Incidentally, homeowners agree with renters on this point, with only 18 percent saying that now is a good time to buy a home.

Renters’ outlook

Fannie Mae provided information on renters’ and homeowners’ outlooks on their personal situations and on their expectations for the direction of the economy.

Unsurprisingly, since the years 2012 to 2013, the share of renters who believe rents will rise has increased. It is now 66 percent as compared to 54 percent for the earlier period. However, the share of renters who believe that rents will fall has also increased, rising from an average of 4.8 percent in 2012-2013 to an average of 12 percent over the last 3 months.

Regarding job security, renters have historically been somewhat more concerned that they would lose their jobs than have homeowners. In the current survey, the three-month average of renters who were concerned about losing their jobs was 26.0 percent while the figure for homeowners was 20.0 percent. These numbers are nearly unchanged from the average from the 2012 to 2013 period, indicating that neither group of consumers has perceived a recent softening in the labor market.

Equal shares of renters and homeowners think that their personal situations are likely to get worse, at around 20 percent. However, fully 46 percent of renters believe that their personal situations will get better, compared to only 28 percent of homeowners.

Financing a home

Renters’ and homeowners’ views of the mortgage market are very different. Fully 80 percent of renters believe that it would be difficult for them to get a mortgage. For homeowners, the figure is 40 percent.

Looking ahead, 43 percent of renters believe that mortgage interest rates will rise, while only 17 percent believe that they will fall. Among homeowners, 27 percent believe that mortgage interest rates will rise while 28 percent believe that they will fall.

Fannie may has been conducting this survey since 2010. The June results are available here.