According to data from RealPage Analytics, apartment fundamentals stabilized in July. Rent growth and occupancy remained relatively steady during the month. National occupancy was 94.2 percent for the third straight month, which is historically typical for July, while effective asking rents grew slightly by 0.3 percent, less than July’s typical pace since the 2010 decade, but representing a 10-basis point (bps) increase year-over-year. Meanwhile, rents grew 2.2 percent year-to-date in 2024, in line with last year’s pace during the same period.

According to RealPage’s data, the annual change of recent rent growth has been pushed to 0.3 percent, while concessions have started to level off. Only 14 percent of units were offering some concession during the month, in line with June, while the average offered discount increased to 28 days, although performances vary by market.

A look at the nation’s regions reveals that the West is close to seeing occupancy level off, with occupancy at 94.6 percent in July, down just 10 bps year-over-year, but still more than 100 bps below the 10-year norm.

Occupancy was split in the West between non-coastal and coastal markets. Phoenix, Salt Lake, Vegas and Denver were below 94 percent, while Orange County, the Bay Area and San Diego were above 95 percent, said the report.

Rents in the Southern apartment markets continue to be impacted by generationally high supply, but performance across the region has ranged widely, said RealPage. Both month-over-month and year-over-year rent cuts were reported in 18 of the region’s 65 key markets in July, with Florida making up 10 of those 18 markets.

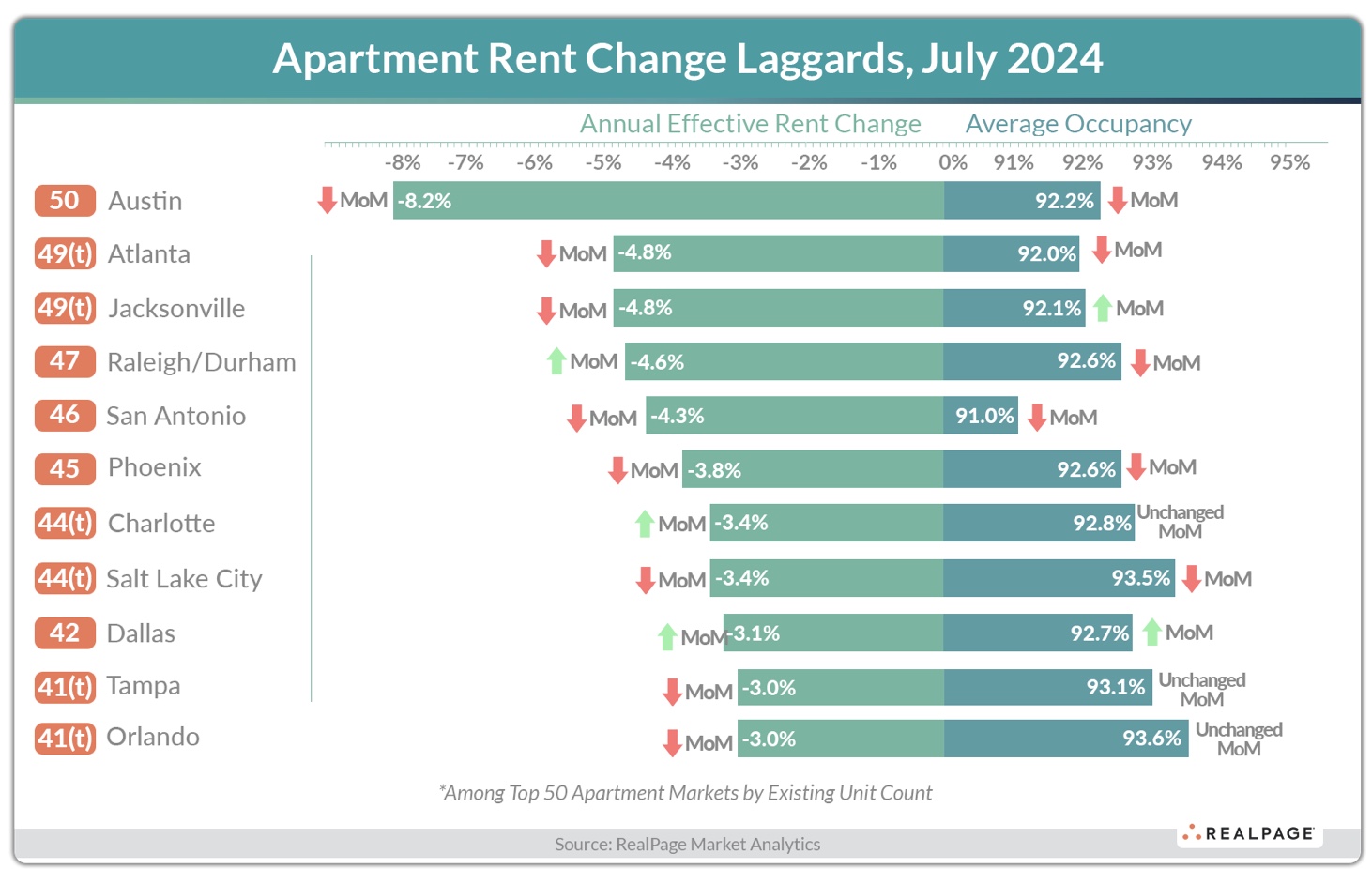

In Texas, rent cuts were reported in Austin and San Antonio, while rents increased in both Charlotte and Raleigh/Durham. Raleigh saw three straight months of rent increases, while Charlotte marked four straight months of positive rent gains month-over-month in July.

Meanwhile, rents in Atlanta fell 0.5 percent in July, marking an almost five percent reduction in rent growth year-over-year. The chart below highlights the rent growth laggards for the month of July.

The Midwest and Northeast followed similar occupancy trajectories in July, both besting their January percentages. The Midwest’s occupancy of 94.8 percent in July was 20 bps above January figures, while the Northeast’s 95.7 percent occupancy during July matched its January occupancy figures.

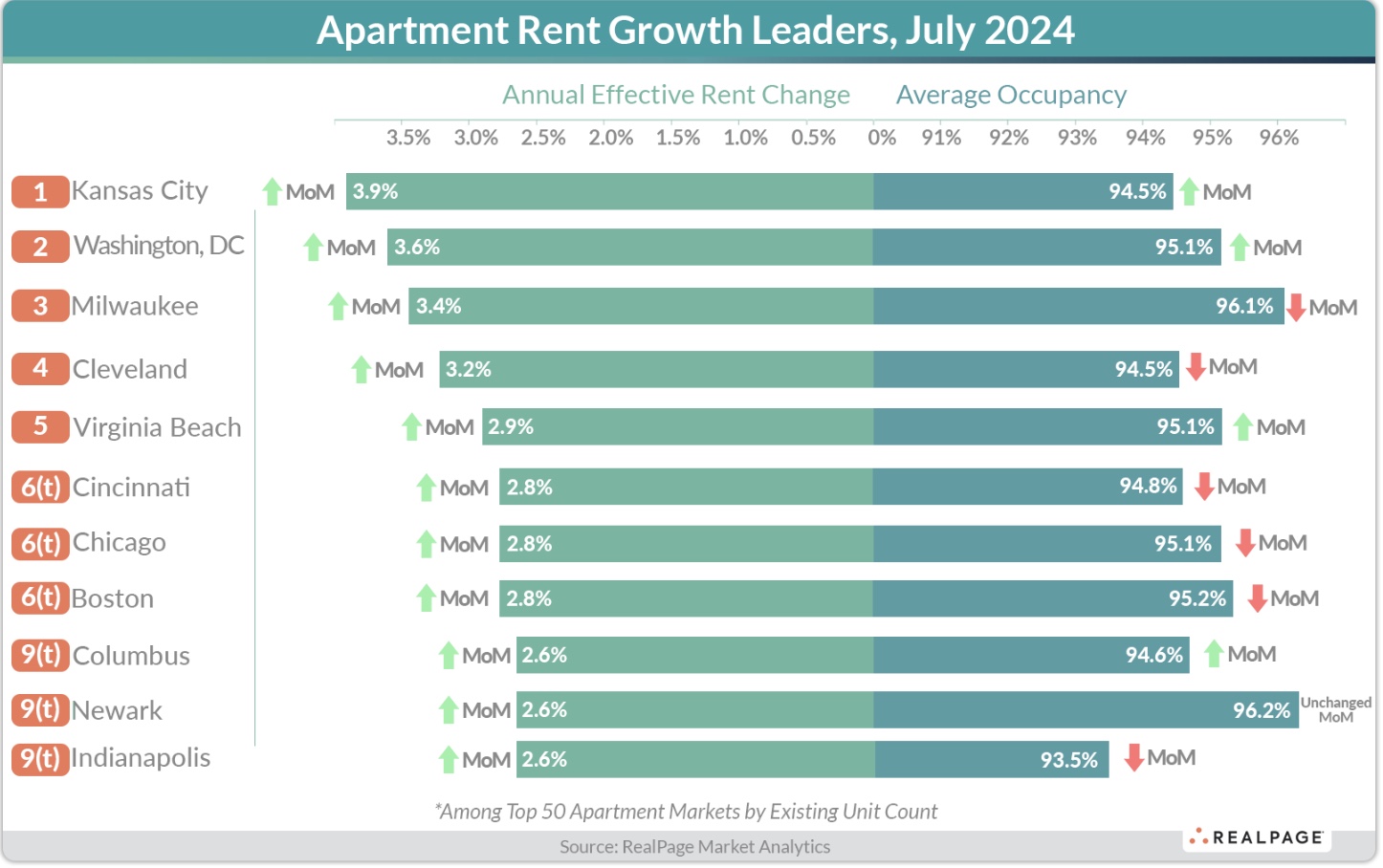

The Midwest also leads the nation in rent growth, with rents increasing 2.8 percent over the past 12 months. Of the nation’s four major markets that posted more than three percent annual rent increases in July, three were in the Midwest. Washington D.C was the outlier.

Rents in the Northeast were up in July by 2.7 percent over the past 12 months. Remarkably, only one of the key markets that comprise the Northeast and Midwest regions, Sioux Falls, saw a year-over-year rent cut, said RealPage, claiming this to be a rarity on par with Sunbelt, not Midwest, standards. The below chart features the nation’s leading rent growth markets in July.

The full release is available here.