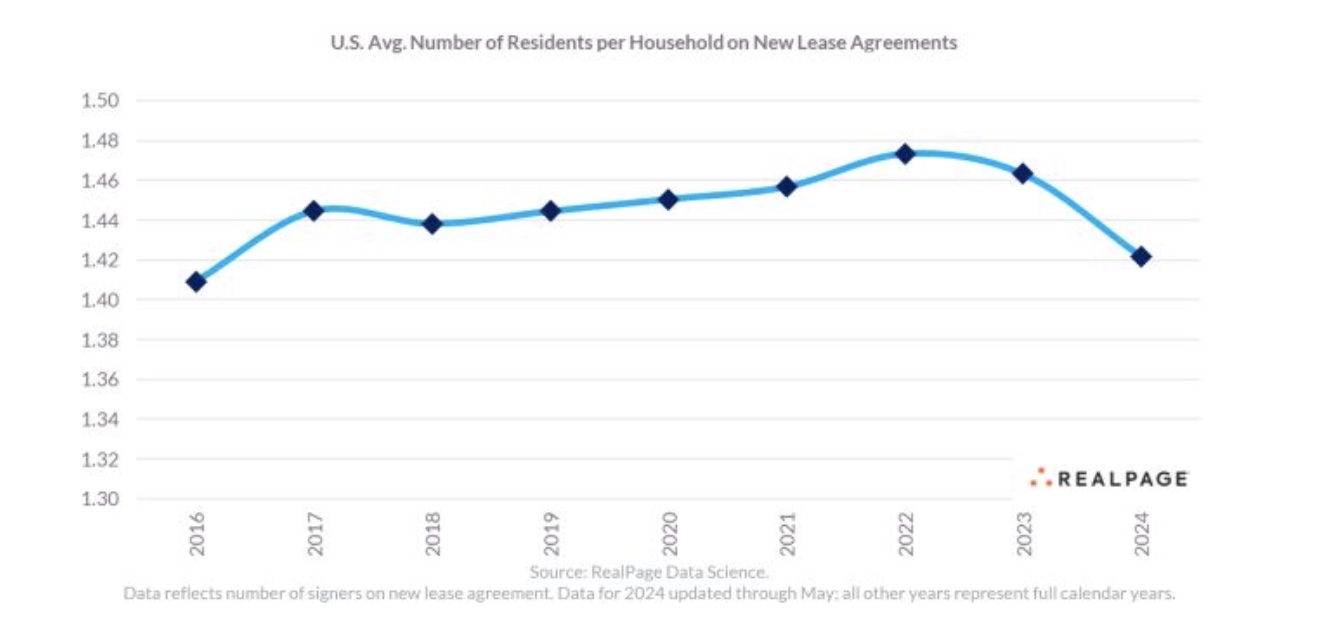

This year’s average renter household size, based on the number of adult signers on new leases, is at its lowest level since 2016. This low average renter household size could signal a decoupling of shared apartments, posits RealPage chief economist Carl Whittaker.

Average household size for market-rate, professionally managed apartments of all asset classes has fallen three percent year-over-year through May compared to full-year 2023, according to data from RealPage Analytics.

Whittaker shared this data on his LinkedIn page, noting it could be a sign that renters are choosing to live alone rather share an apartment. While there hasn’t been much doubling up of tenants over the past couple of years, roommate agreements ramped up during the Covid pandemic. According to Pew Research, the majority of renters lived with at least one other person in 2021.

Whittaker surmises that a combination of strong wage growth and the massive amount of new competing properties delivering into the market has been enough to lure renters into newly built apartments as single lease signers.

“But a vacancy created anywhere means there’s an opportunity to backfill that unit regardless of price point. It’s almost a picture-perfect example of how new supply, even at its higher price point, actually helps alleviate housing availability downstream,” said Whittaker, noting that the three percent decline mentioned above might not sound very significant, but considering the average apartment is 1.6 beds, “there’s realistically a fixed amount that the average household size can move from that benchmark,” he said.

What’s important, as noted in the chart below, is the direction of the trendline, he said.

“We began to see a tiny bit of movement between household size in 2022 and 2023, but really no more than a rounding error. But the 2024 figures support the idea that 2023 was indeed the start of a ‘real’ trend and not just data noise,” said Whittaker.

Supporting this phenomenon as a real trend is that almost all of the nation’s largest apartment markets saw a similar change, he points out.

“Among markets with enough observations to confidently report, which comes out to roughly 50 metros, just eight markets saw +/-two percent change from prior years. Everywhere else saw at least a two percent decline in household size,” he said, adding that there is no obvious geographic trend for where shrinking household size is and isn’t happening, but it does not appear to be rent driven.

Jay Parsons head of investment strategy with Madera Residential shared Whittaker’s findings on his own LinkedIn page, proposing several reasons why the shared apartment trend could be ending. Number one, he said, is improved spending from wage growth, which has outpaced new lease growth for the past 18 months.

Compare this to February 2022, when year-over-year rent growth was four times higher than March 2020—the onset of the pandemic, while household wealth during the period saw very little growth.

Number two, he said, is that apartment supply nearing 50-year highs has unleashed pent-up demand, offering renters more options. “While most pent-up demand tends to come from other sources such as living with family, there’s a chunk that comes from temporary roommate situations in traditional apartments,” said Parsons.

Parsons also noted that the work-from-home/hybrid work environment could be having an effect. He pointed to a study last year revealing 34 percent of renters work from home full or part time.

“Doubling up is more likely to occur when market-rate renters are stretched financially, and that just isn’t happening yet at any scale, which is a great sign for both renters and for apartment operators/investors,” Parsons said.