The multifamily housing market is showing promising signs of recovery, with recent data from CoStar Group revealing a significant increase in demand and stabilization of vacancy rates.

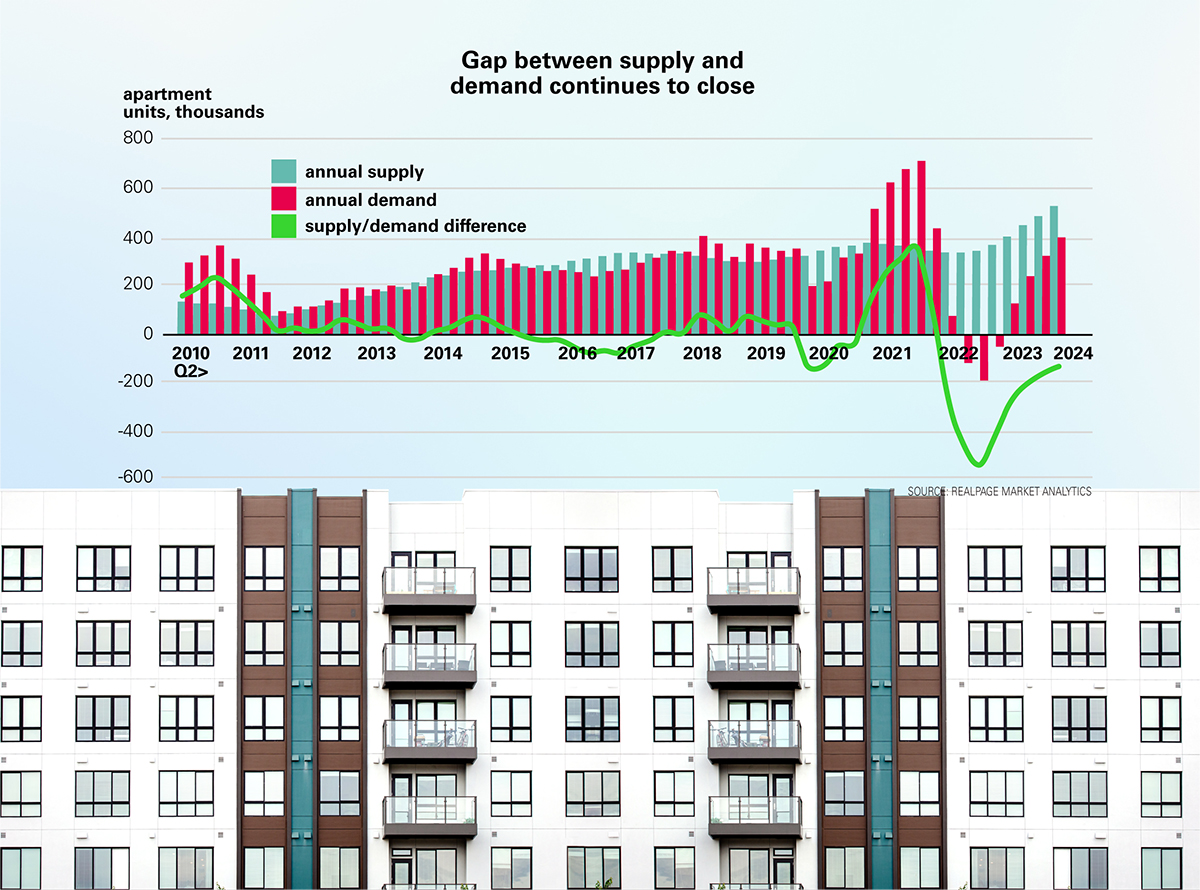

Absorption rates have notably risen from 118,000 units in the first quarter to 166,000 in the second, fostering optimism among industry experts about a potential shift from decelerating fundamentals to a growth phase. “We’re seeing a very good movement in demand upward from the levels that we saw in 2023,” CoStar’s national director of multifamily analytics, Jay Lybik, said. “The spread between supply and demand has been the lowest we’ve seen in the last 11 quarters,” Lybik added.

Despite these positive trends, challenges remain, particularly in the Sun Belt region where oversupply continues to hinder rent growth. As the market navigates these complexities, the outlook for 2025 is pivotal, with expectations for a peak in vacancy rates followed by a gradual decline, setting the stage for renewed investment and expansion in the multifamily sector.

While the market absorbed 166,000 units in the second quarter, 189,000 new units were delivered, leading to a slight increase in the vacancy rate to 7.9 percent by the end of the second quarter, up from a low of 4.8 percent in the third quarter of 2021. The vacancy rate is anticipated to peak at 8.1 percent in early 2025 before declining, according to Lybik.

This anticipated peak and subsequent decline are attributed to improved demand and a slowdown in new deliveries as the construction pipeline contracts.

Meanwhile, rent growth has been modest, with the national rate inching up 1.1 percent at the end of the second quarter, and is only projected to rise to 1.7 percent by the year-end. “We think that rents are going to start to increase in the second half of this year,” due to a combination of decreasing supply and robust demand, Lybik said.

The Sun Belt region has been struggling, with the ten worst-performing markets in terms of rent growth located there, led by Austin with a 5.7 percent drop at the end of the second quarter.

In contrast, the Midwest and Northeast are performing better, with projected rent growth rates of 4.7 percent and 3.9 percent, respectively, for 2025.

Market stability has led to increased investment activity, with notable portfolio purchases by Blackstone and Lennar. As a result, institutional investors view the market as poised for recovery and expansion, Lybik said, driven by stable asking rents and a slight decline in the 10-year Treasury yield, which has spurred acquisition interest.

In short, the market is on a path to recovery, with demand outpacing supply, leading to stabilizing vacancy rates and moderate rent growth, Lybik said. “I feel very optimistic about the direction of the market right now… multifamily is definitely poised to go from decelerating fundamentals to stable to expanding fundamentals in the next six to 12 months.”