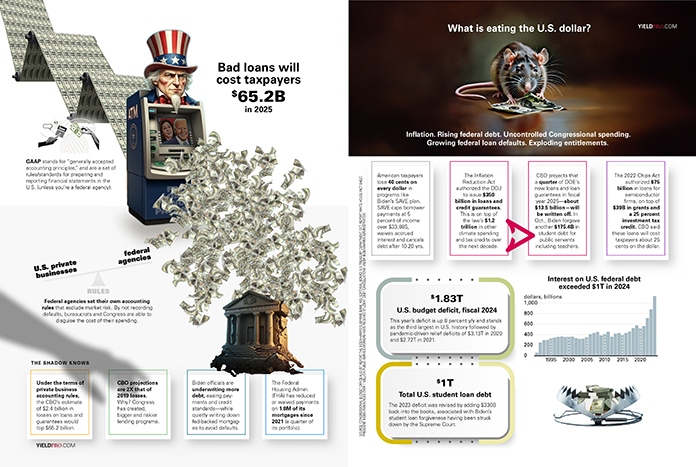

GAAP stands for “generally accepted accounting principles,” and are a set of rules/standards for preparing and reporting financial statements in the U.S. (unless you’re a federal agency).

RULES = U.S. private businesses + Federal agencies

Federal agencies set their own accounting rules that exclude market risk. By not recording defaults, bureaucrats and Congress are able to disguise the cost of their spending.

THE SHADOW KNOWS

Under the terms of private business accounting rules, the CBO’s estimate of $2.4 billion in losses on loans and guarantees would top $65.2 billion.

CBO projections are 2X that of 2019 losses. Why? Congress has created, bigger and riskier lending programs.

Biden officials are underwriting more debt, easing payments and credit standards—while quietly writing down fed-backed mortgages to avoid defaults.

The Federal Housing Admin. (FHA) has reduced or waived payments on 1.8M of its mortgages since 2021 (a quarter of its portfolio).

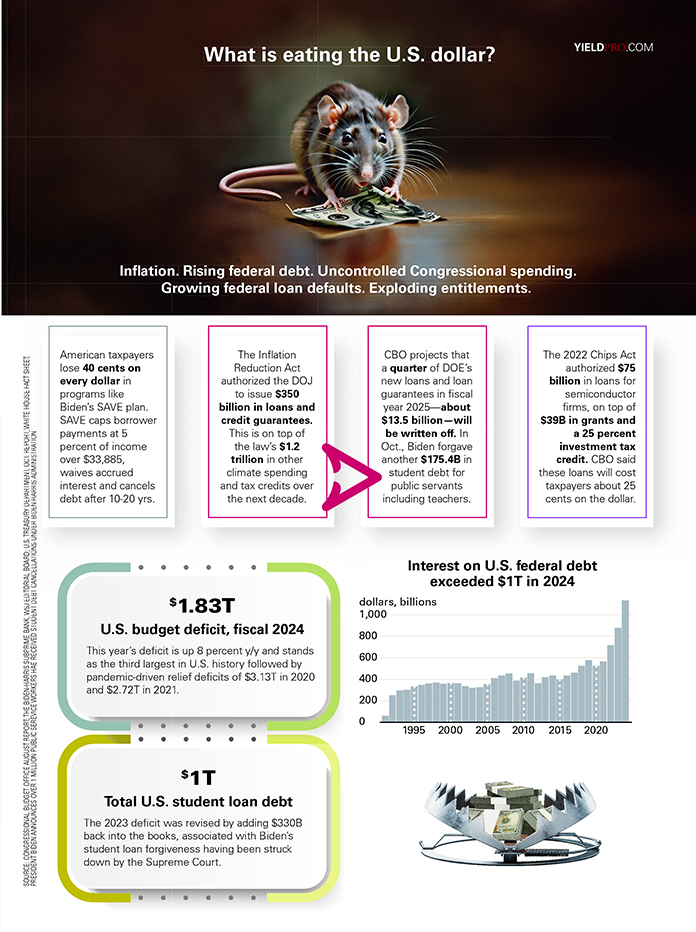

What is eating the U.S. dollar?

Inflation. Rising federal debt. Uncontrolled Congressional spending. Growing federal loan defaults. Exploding entitlements.

American taxpayers lose 40 cents on every dollar in programs like Biden’s SAVE plan. SAVE caps borrower payments at 5 percent of income over $33,885, waives accrued interest and cancels debt after 10-20 yrs.

The Inflation Reduction Act authorized the DOJ to issue $350 billion in loans and credit guarantees. This is on top of the law’s $1.2 trillion in other climate spending and tax credits over the next decade

CBO projects that a quarter of DOE’s new loans and loan guarantees in fiscal year 2025—about $13.5 billion—will be written off. In Oct., Biden forgave another $175.4B in student debt for public servants including teachers.

The 2022 Chips Act authorized $75 billion in loans for semiconductor firms, on top of $39B in grants and a 25 percent investment tax credit. CBO said these loans will cost taxpayers about 25 cents on the dollar.

$1.83T U.S. budget deficit, fiscal 2024. This year’s deficit is up 8 percent y/y and stands as the third largest in U.S. history followed by pandemic-driven relief deficits of $3.13T in 2020 and $2.72T in 2021.

$1T Total U.S. student loan debt. The 2023 deficit was revised by adding $330B back into the books, associated with Biden’s student loan forgiveness having been struck down by the Supreme Court.

Interest on U.S. federal debt exceeded $1T in 2024 in billions of dollars

Source: Congressional Budget Office August report; the Biden-Harris subprime bank, WSJ editorial board; U.S. Treasury Department, Oct. report; White House fact sheet, President Biden announces over 1 million public service workers have received student debt cancellations under Biden-Harris Administration