Who’s to blame for the affordability crisis? Jay Parsons, multifamily housing analyst and head of investment strategy and research for Madera Residential, suggests that the media is pointing fingers in the wrong direction on this topic. On his LinkedIn page, he provides data that suggests renters of REIT-owned apartments have lower rent-to-income ratios than most renters.

The data that shows rental households living in apartments owned by REITs and other institutions spend a lower share of income toward rent than most U.S. renters illustrates the bifurcation of rental affordability, said Parsons.

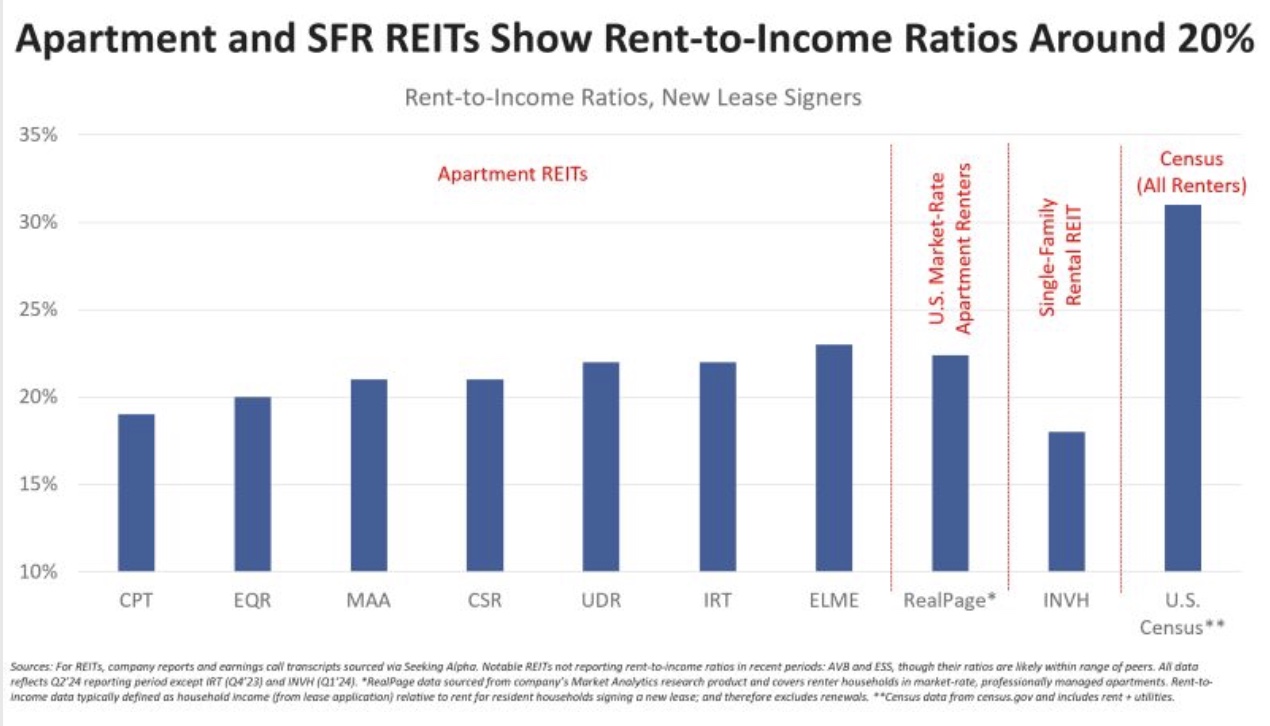

According to the U.S. Census Bureau, half of American renter households spend more than 30 percent of their income on rent while the typical rent-to-income ratio nationally has hovered around 31 percent for more than ten years. By comparison, the rent-to-income ratios among new lease signers reported by apartment REITs who actually reported their data this year ranges between 18 and 23 percent.

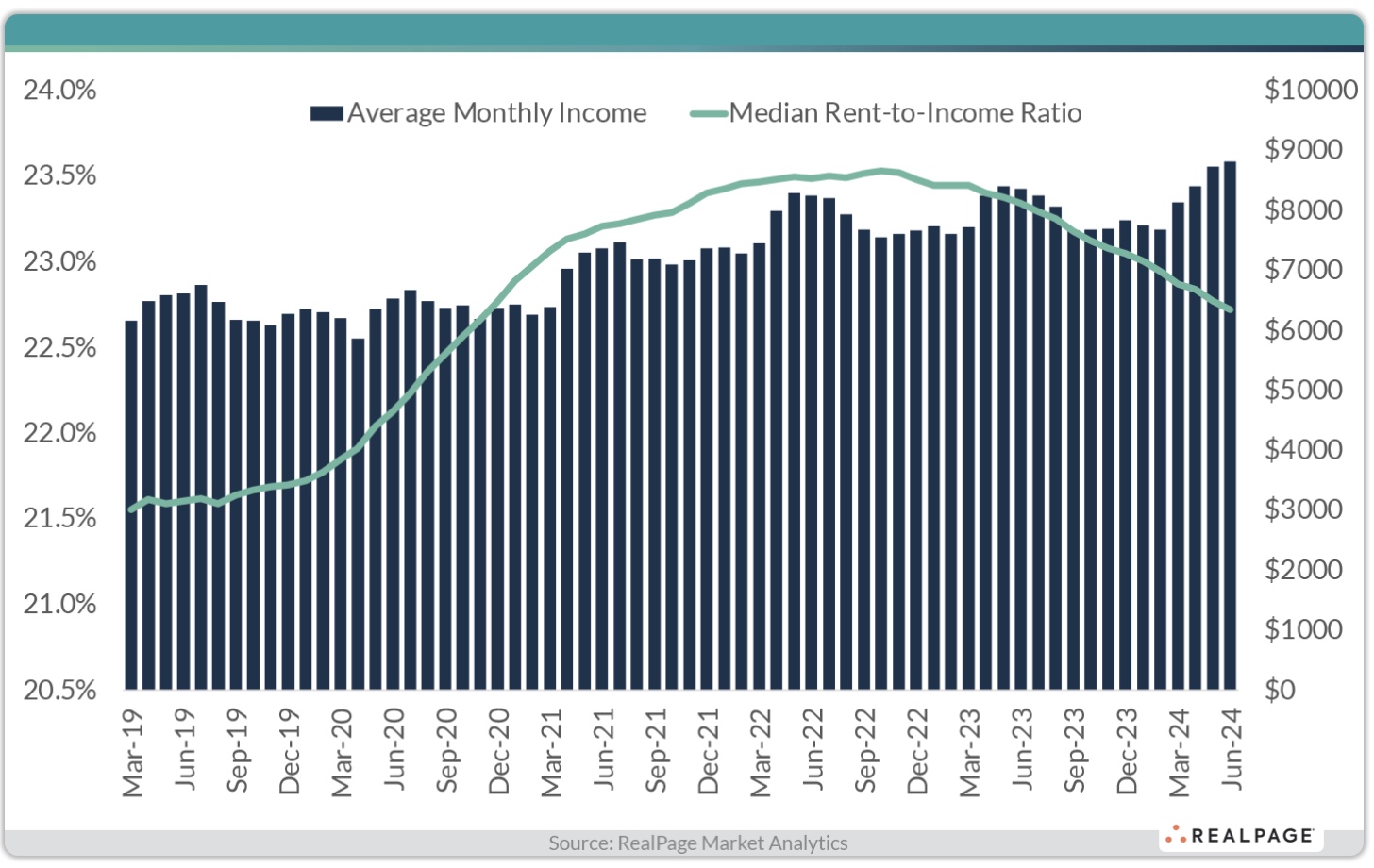

Those numbers, Parsons writes, have changed relatively little in recent years, even when rents surged during 2021 and 2022, thanks to surging incomes among new renter households.

Invitation Homes reported average renter household incomes of $158,000 and rent-to-income ratios of 18 percent, the lowest reported by institutions. Many apartment REITs also report renter household incomes in the six-figures, said Parsons.

Additional corroboration comes from RealPage, which reports on a broader set of U.S. renters living in professionally managed, market-rate apartments, revealing a median rent-to-income ratio of 22 percent, trending downward after peaking near 24 percent in late 2021. RealPage also shows that incomes among new lease signers, including dual-income roommates, are right around $100,000.

By comparison, analysis of Census data shows renter incomes for the overall population well below $60,000.

By comparison, analysis of Census data shows renter incomes for the overall population well below $60,000.

Parsons thinks the discrepancy may result from the professionally managed market catering to mid- and higher-income renters.

According to Harvard Joint Center for Housing Studies’ analysis of Census data over the last decade, three quarters of all new U.S. renter households have had incomes topping $75,000. This is the demographic served by most REITs, “private equity” and other institutional capital, said Parsons.

He also notes that Census data paints a misleading picture of true rent by including utilities. And, unlike Census, housing providers can only track income for new lease signers.

The takeaway, Parsons notes, is that a very real affordability crisis exists among lower-income renter households, exacerbated by a severe deficit of supply. But few of these renter households live in professionally managed, market-rate apartments or single-family rentals, now or even prior to COVID.

“Lower income renters are far more likely to be rent burdened and have far fewer options for places to live. They’re also more likely to double up with other households to share the cost of rent and utilities.

“We need a lot more housing, especially for lower-income households. And we need to keep the spotlight there, because misdirected angst toward higher-income renters is a disservice to low-income renters in far greater need,” he said.