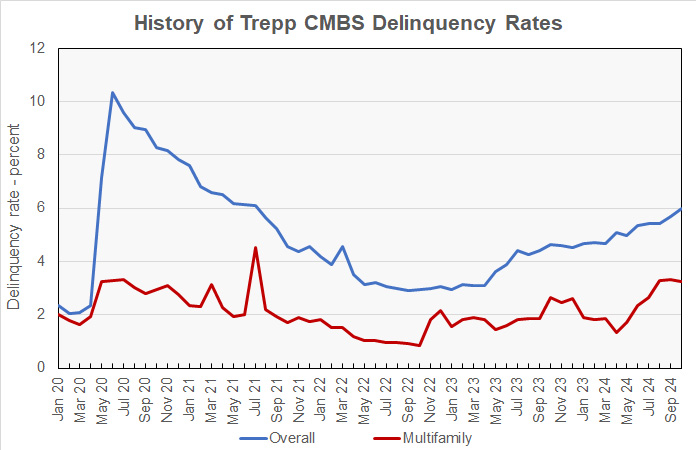

Trepp reported that delinquency rate for multifamily commercial mortgage-backed securities (CMBS) loans fell in October, breaking a string of 5 consecutive monthly increases. However, the overall CMBS delinquency rate continued to rise, climbing 28 basis points in the month.

Overall CBMS delinquency rate moves higher

For delinquencies, Trepp focuses on loans that are 30 or more days delinquent. The current CMBS delinquency report provides data through October 2024. While it only looks at CMBS loans, it breaks out results by the type of property covered by the loans.

The delinquency rate for loans on multifamily property was 3.33 percent, down 9 basis points from last month’s reading. The rate had been only 1.33 percent in April. One year ago, the delinquency rate for CMBS loans for multifamily property was 2.64 percent.

Trepp found that the overall delinquency rate of CMBS loans in October was 5.98 percent. This is up from last month’s level of 5.70 percent. It is also up from its level of 4.63 percent one year ago.

The report noted that loans that are past their maturity date but are still current on their interest payments are not counted as being delinquent. However, if they were included, the overall delinquency rate on CMBS loans would rise to 7.73 percent from the level reported above.

The history of the overall and multifamily CMBS delinquency rates as reported by Trepp since January 2020 is illustrated in the chart, below.

Office loans drive the increase

The other property types whose CMBS loan delinquencies were examined by Trepp were industrial, lodging, office and retail.

While the overall commercial property CMBS delinquency rate rose for the month, the increase was driven entirely by an increase in delinquencies on office loans. The delinquency rates for loans on the other property types were either unchanged or down for the month.

The delinquency rates on CMBS loans on office properties rose significantly this month, climbing 101 basis points to 9.37 percent. However, much of the rise is attributed to one large loan becoming delinquent. The delinquency rate for industrial property was unchanged this month, remaining at 0.32 percent. The delinquency rate on retail property fell 25 basis points to 6.82 percent. The delinquency rate on lodging properties fell 14 basis points to 6.09 percent.

The full Trepp delinquency report can be found here.