Moody’s Analytics associate director and economist Nick Villa gazes into his crystal ball to determine which markets will see the highest apartment rent growth in 2025.

He leans on Moody’s Q3 2024 Preliminary Trend Announcement, released October 1, and data as of October 21, to explore the regions and metros that are poised to experience the most growth in effective rents per unit next year.

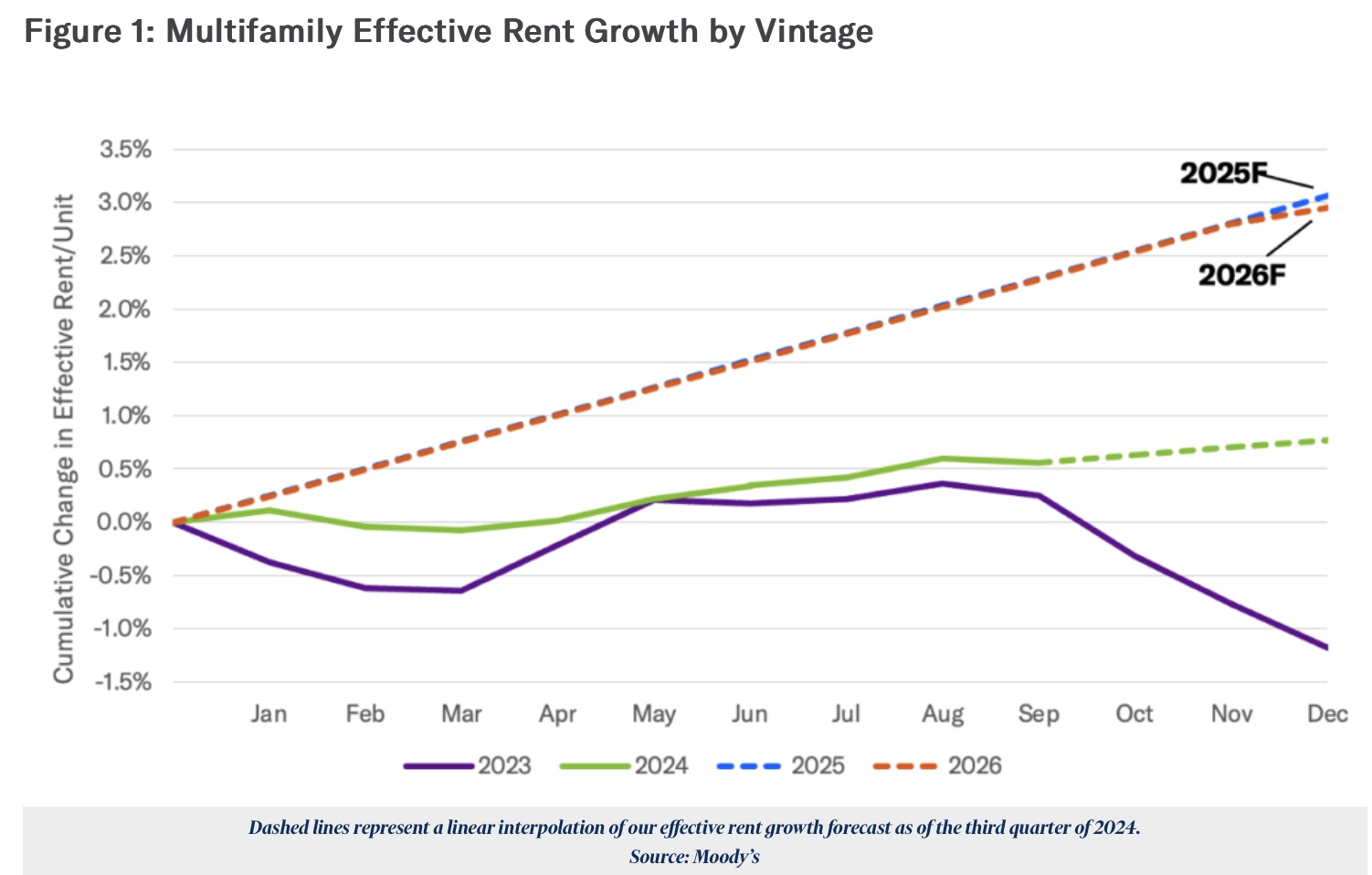

The largest wave of supply since the 1970s is finally peaking this year, while permits and construction starts are slowing. Given the divergence between starts and completions, Moody’s analysts expect supply pressures will taper off over the next 12 to 18 months, leading to an acceleration in national rent growth of around three percent annually in 2025 and 2026. See chart below.

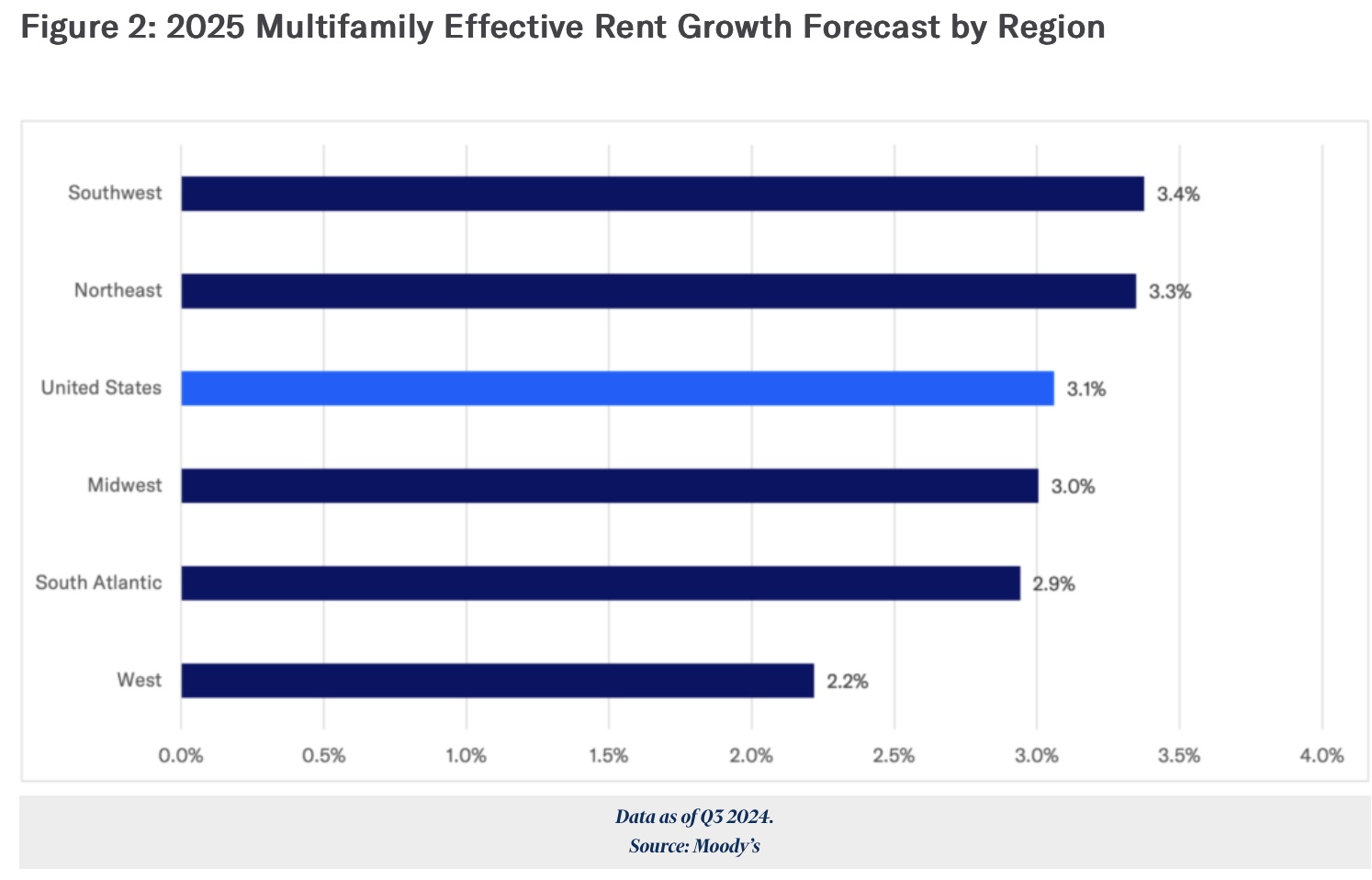

The next chart looks at the effective rent growth forecast by five U.S. regions.

The Southeast region is stacking up to see the greatest rent increases next year at around 3.4 percent, while the West is forecast at the other end of the spectrum with 2.2 percent growth.

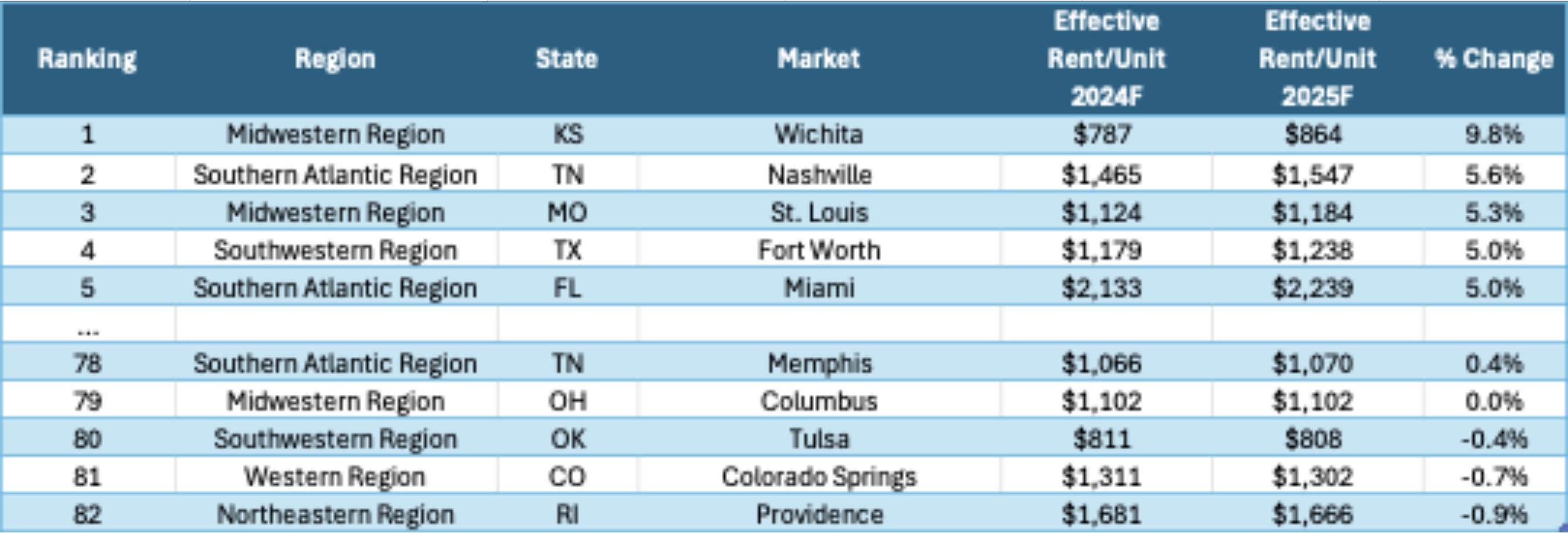

On a metro level among Moody’s top 82 primary markets, Witchita, Kansas, is projected to see nearly 10 percent (9.8 percent) rent growth next year after ranking the third lowest effective rent level at approximately $816 in this year’s third quarter.

Based on it being the seventh smallest market based on inventory size, it’s less surprising Witchita took the top spot for rent growth, said Villa. He adds additional context by pointing out that 75 of Moody’s top 82 markets had effective rents of at least $1,000 per unit in the same quarter.

Witchita also ranks favorably from a rent-to-income ratio perspective when compared to other Tier 1 markets, with only Oklahoma City reporting a lower ratio as of Q2 2024.

“Even with forecasted rent growth of nearly 10% in 2025 and hypothetically if we also assume flat wage growth, the ratio would still remain below 16 percent and continue to fall within the least rent-constrained area of the distribution,” wrote Villa.

The fifth spot for highest rent growth next year goes to Miami, which saw the highest effective rent per unit of $2,133 in Q3 2024. The metro is expected to see a five percent increase in rents next year.

If Miami meets this forecast, “effective rents would be approximately 42 percent higher than year-end 2019 versus our roughly 24 percent estimate at the national level,” said Villa.

Moody’s projects rents will decline in only three markets next year, and none of them by more than one percent. The table below ranks the top and bottom five metros for effective rent growth in 2025 and highlights current rents as of Q3 2024.

Providence, Rhode Island, where average effective rents per unit were $1,681 in Q3, ranked last at -0.9 percent.

Meanwhile, Tulsa, Oklahoma, posted the second-lowest effective rent per unit of $811 in the same quarter and is expected to see negative rent growth of -0.4 percent next year.