As we enter the New Year, analysts are peering into their crystal balls to predict how multifamily will thrive in 2025.

Yardi Matrix sees the multifamily market poised for modest growth, driven by the Northeast and Midwest markets, expecting economic growth and the industry’s stable fundamentals to increase rents by 1.5 percent in 2025.

Most analysts predict another year of heavy apartment deliveries in 2025, except CoStar Group, which calls for rapidly falling supply to push meaningful rent growth in the second half of 2025 and 2026.

Matrix calls for another big year of supply in 2025 with dwindling starts stifling deliveries in 2026 and 2027. Supply growth is unevenly distributed with 12 to 15 high-growth markets accounting for the lion’s share of deliveries.

Analysts at Gray Capital expect many of the markets with the most supply this year will be supply leaders again in 2025, with some cities on course to deliver even more new supply than they did in 2024. According to RealPage, the nation’s largest apartment markets – New York and Los Angeles – are set to see big jumps in apartment delivery volumes in 2025.

“Some folks have been saying 2024 was the peak and we are going to see the backside of that mountain on a graph start to emerge. But we think 2025 will see delivery of about half a million units, not far off from the 2024 pace,” said RealPage chief economist Carl Whittaker. The good news is that he also expects demand to remain consistent and match supply levels.

Demand was the biggest surprise of 2024, said Whittaker. “We saw more than 600,000 units absorbed on net, meaning there are 600,000 additional occupied apartment units today versus one year ago. That is a lot of demand and absorption, considering most pundits saw slowing job growth as a threat entering 2024,” he said.

Tailwinds in 2025

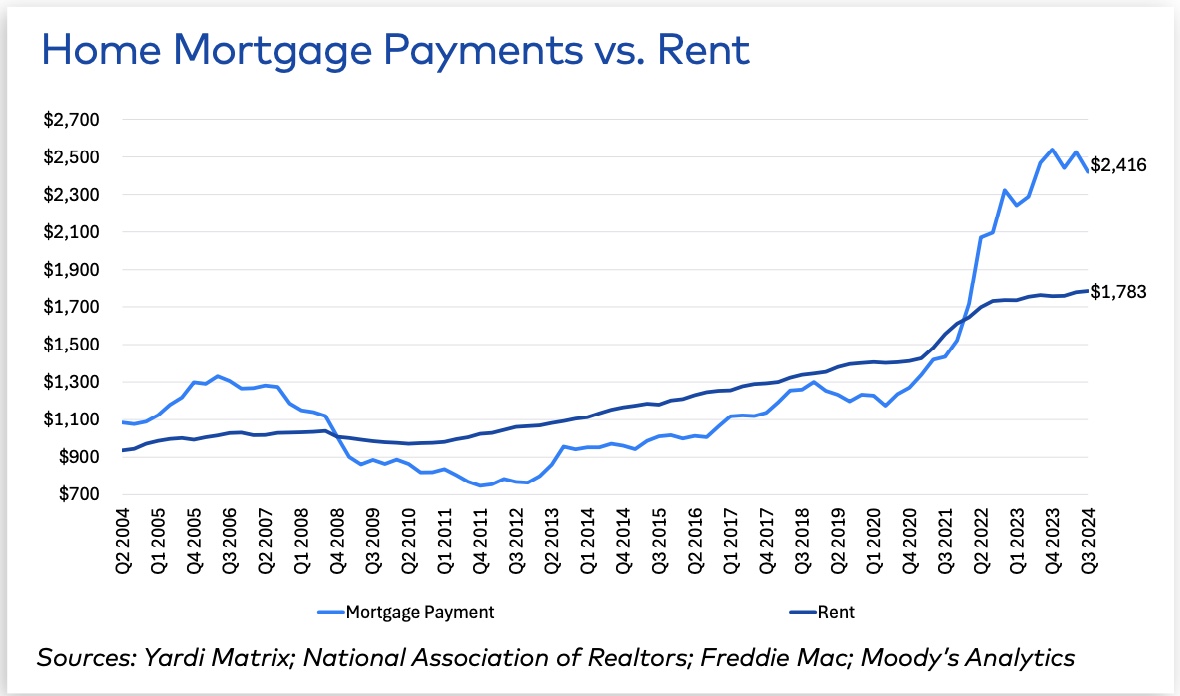

Weak buying power and the high cost of homeownership continue to keep potential homebuyers in rentals longer. The 30-year mortgage rates reached 7.4 percent in October 2023 and were in the 6.5 percent range in December 2024, making homeownership unattainable for many, said Matrix.

Gray Capital notes that the premium for homeownership versus renting continues to underscore the importance of rental housing and the strength of apartment fundamentals.

“These unambiguous signs of high housing demand help to explain the historic levels of apartment absorption that will bring a more balanced multifamily market as the current supply wave recedes,” said Gray Capital.

The chart below shows the correlation between household growth and apartment absorption.

Last year was the year of retention, said RealPage’s Whittaker. With high supply forecasted again this year, he thinks operators will again need to focus on retention to mitigate marketing costs and rising turnover costs, as concessions offered on some of last year’s leases burn off in 2025.

Renters in high-supply markets like the Sunbelt will continue to find concessions and rent relief in the new year, while rents in lower-supply metro areas are forecast to grow at a pace similar to the 2010s decade, he said.

Investment returns

A wave of loan maturities in 2025 could be a significant catalyst for investment activity, said Gray Capital analysts, as banks become less likely to kick their impaired mortgages further down the road.

Along with research from the New York Federal Reserve that suggests “extend and pretend” loan workouts are less appropriate in 2025 than during the pandemic, forecasts for the federal funds rate and 10-year treasury yields point to a continued elevated interest rate environment that will put more pressure on borrowers facing maturities.

RealPage’s Whittaker predicts some investment activity could return this year. “While the appetite for investing existed over the past couple of years, the economics didn’t make sense, whether it be interest rate pressures or how the market would absorb a 50-year supply wave,” he said, adding, “Now that we have some knowns on that side of the equation, I think more capital will start flowing back into the space.”

But analysts agree that capital markets activity will depend on the direction of interest rates. While a favorable capital markets environment should spur investment, with agency and FHA lenders increasing their caps and loosening lending standards, multifamily cap rates may not compress if interest rates remain elevated, said Gray Capital.

And Matrix noted, “The rapid increase of rates in 2022 created uncertainty in pricing, stalling multifamily sales and leaving many properties underwater on mortgages. We expected increased trading activity in 2024, but rate cuts likely won’t be fast or deep enough for a strong rebound in 2025.”

Creeping inflation in 2025 also could impact construction and property performance, but inflation has been cooling over the past few months.

Most analysts think President Donald Trump’s return to the White House could stimulate the economy through deregulation and lower taxes, but his tariff and immigration policies could be inflationary.

(Edited for publication in 2024)