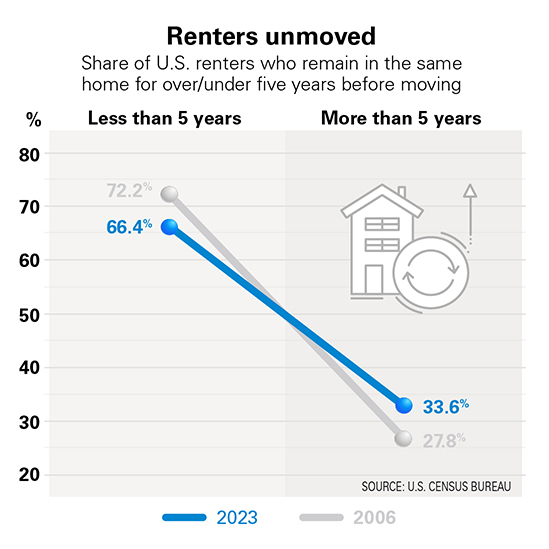

Over a third of U.S. renters have lived in the same home for at least five years—up from 28.4 percent a decade ago according to a new report from Redfin. Economic fundamentals are likely a strong contributor to the ebb in move outs.

In June 2022, consumer sentiment was at the lowest level recorded since 1966. The record-breaking University of Michigan Consumer Sentiment Index came in even lower than that during the Great Recession of 2008.

The Index collects consumer attitudes on inflation, interest rates, work and wages, housing and household finances.

Important to note, since COVID lockdowns (Jan. 2020) consumer sentiment trend lines have shifted, becoming more heavily weighted toward housing, household income, the federal funds effective rate, personal savings and household expenditures (excluding food and energy).

Important to note, since COVID lockdowns (Jan. 2020) consumer sentiment trend lines have shifted, becoming more heavily weighted toward housing, household income, the federal funds effective rate, personal savings and household expenditures (excluding food and energy).

“The critical shortage of housing in the U.S. market is really having lasting effects on housing overall,” said Matthew Walsh, assistant director and economist at Moody’s Analytics. A big component of that shortage is also the fact that, after the Great Recession… very few starter homes or low-cost units were built, making things even worse for first-time homebuyers, he said.

People who are renting but want to buy are stuck. People who live in starter homes and want to move to bigger homes are stuck. The conditions have frustrated the American promise of upward mobility.

“Most Americans view their life cycle as: They go to college, find a good job, then after having a job for several years, trying to buy a house,” said Lawrence Yun, chief economist at the National Association of Realtors. “That kind of normal sequence of improving their life has been now cut off because even if one has a good job, even if one has a good credit score, it’s very difficult to become homeowners. This shock factor is greatly influencing people’s sentiment about the broader economy.”

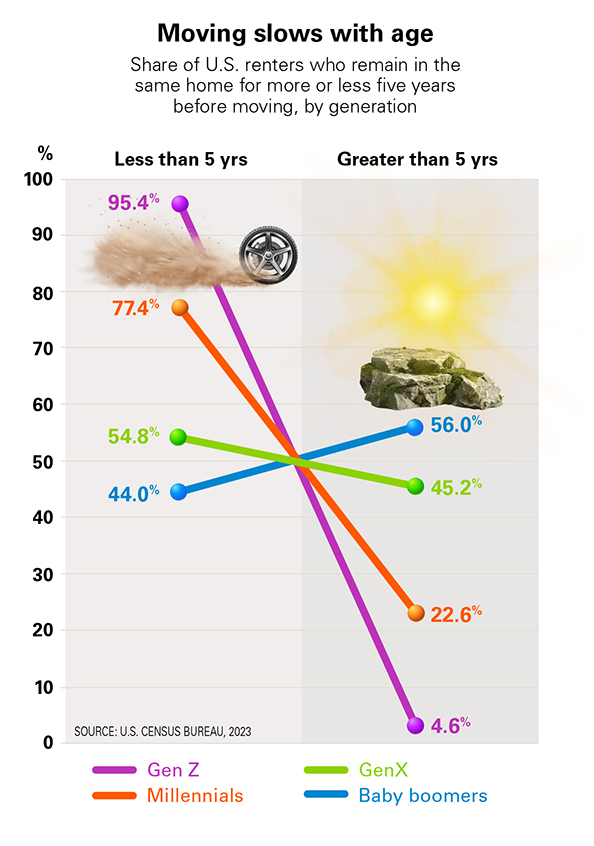

While the majority of renters move within five years—25.6 percent moving within 12 months and 40.8 percent moving between 1 to 4 years—economic conditions have meant many stay put for longer. The high cost of moving and paying rental brokers in cities like New York, has also discouraged renters from moving regularly.

Nearly one in six of renters had lived in the same property between 5 and 9 years in 2023, compared to 14.4 percent in 2006. Nearly the same number (16.6 percent) stayed in the same home for 10+ years, compared to 13.9 percent a decade earlier.

“Rents spiked during the pandemic but have stayed relatively flat over the past two years as home prices and mortgage rates continued to climb. That has encouraged renters to stay in the same home, where they are less likely to face major rent increases, said Redfin Senior Economist Sheharyar Bokhari. “The recent construction boom has also led to a record number of new apartments hitting the market, keeping rents down and setting 2025 up as a renter’s market where more Americans will choose to rent, or remain renters.”

Expenditures impacts move rates

Expenditures impacts move rates

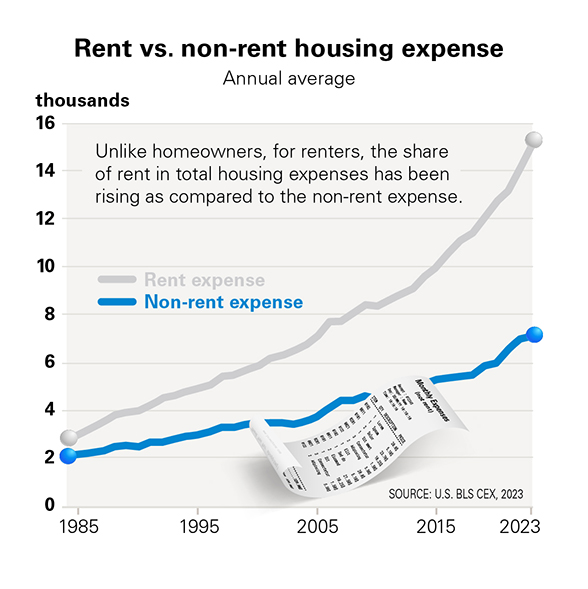

Unlike homeowners, who mostly have a fixed-rate mortgage and are shielded from rising interest rates and house prices, renters do not have the same advantage and must deal with rising rent costs. For renters, the share of average annual expenditures spent on rent rose from 18 to 26 percent between 1984 to 2023. As opposed to homeowners, this steady increase in rent means that renters are having to cut back on their spending elsewhere.

These cuts are likely to be seen in more discretionary categories rather than in the necessities. Food away from home has increased slightly from its low in 2020 but is not back to its pre-pandemic level. Aside from food, there’s also a downward trend in renters’ expenditures on apparel and services.

Another area is transportation. Spend on transportation has declined more for renters than for homeowners. This could be due to homeowners moving away from city centers to suburbs to buy a home, therefore spending more on transportation in order to commute to work. Renters, however, are more likely to live closer to work and can spend less on transportation as a percentage of their total expenses.

Unlike homeowners, for renters, the share of rent in total housing expenses has been rising as compared to the non-rent expense. Non-rental housing expenses, like the non-mortgage expenses, includes utilities, household operations, furnishings, housekeeping supplies, etc.

Homeowners can lock into lower mortgage rates and shield themselves from the rising interest rates and house prices. Renters do not have the same advantage and must deal with rising rent costs. Rising rents mean reducing spending on other expenses, including moving.