Student housing rents are softening in several key markets, Yardi Matrix reports, as a supply surge continues to reshape leasing dynamics for Fall 2025.

As the 2025–26 academic year approaches, student housing preleasing is outpacing recent years, but operators are pulling back on rent increases as they race to fill beds amid a significant supply surge. The cooling rent growth trend was already apparent in Yardi’s April report.

According to Yardi Matrix’s Student Housing National Report for July, preleasing in its 200 tracked markets hit 85.3 percent in June, up from 83.7 percent a year ago. Fifty markets are already above 90 percent preleased, including ten at full capacity.

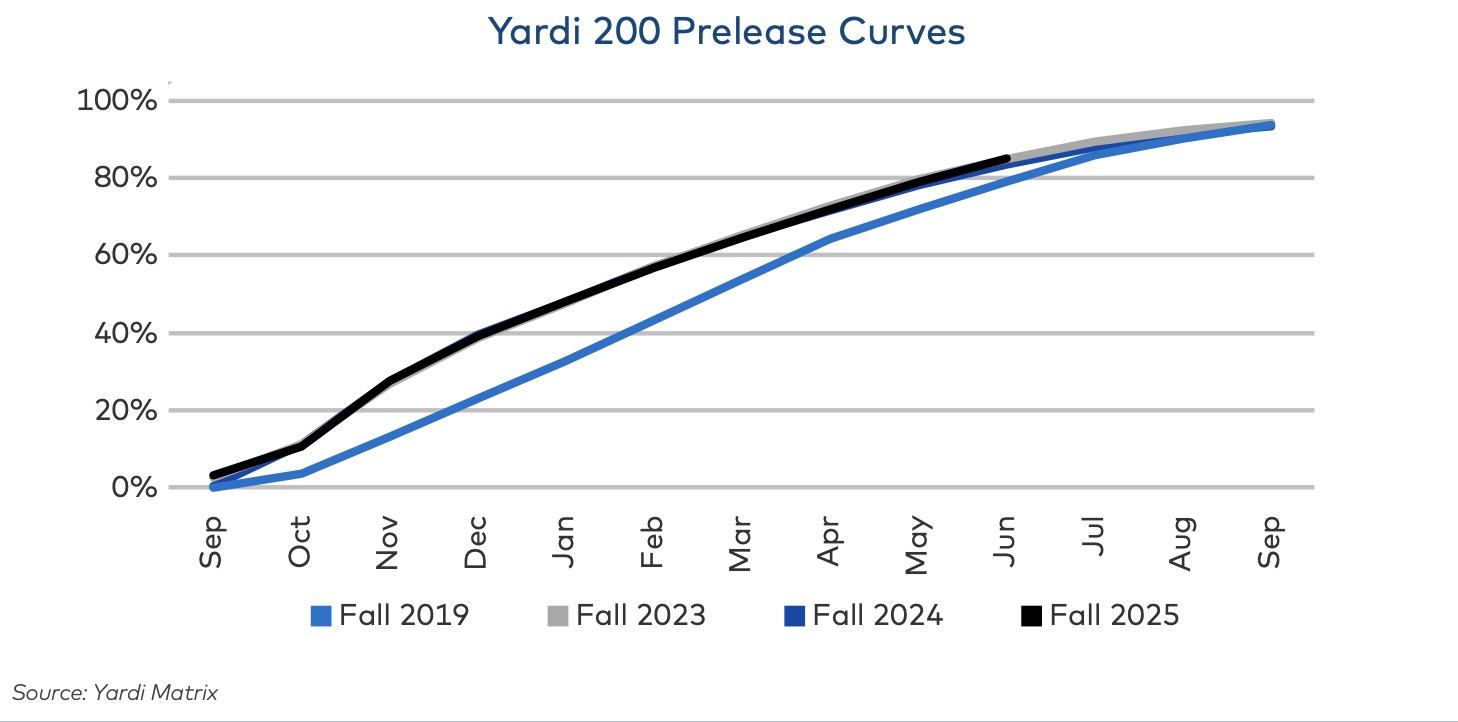

The chart belows shows preleasing progress for Fall 2025 continues to outpace recent years, reflecting rising college enrollment alongside growing supply pressures.

This year’s strong preleasing is partially driven by an expected increase in college enrollment following a 2025 peak in high school graduates. However, besides the supply surge in many key markets, broader headwinds affecting rent also loom: federal education funding cuts, tighter student loan programs and anticipated drops in international enrollment.

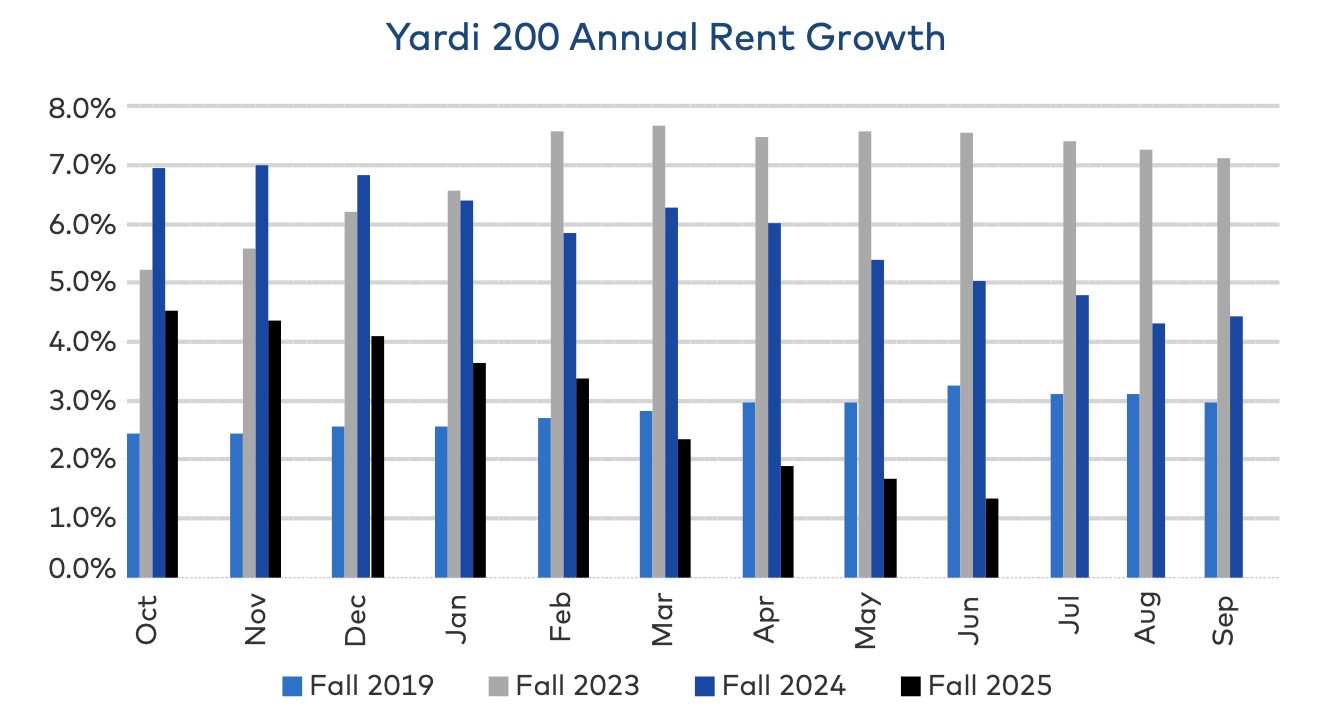

Average asking rent per bed fell for the third month in a row, landing at $909 in June—just 1.3 percent above year-ago levels, and the slowest annual increase since April 2021. Operators are increasingly offering lower rates or incentives to stay competitive, especially in oversupplied markets.

The chart above reflects the sharp slowdown in average student housing rent growth in June 2025 as markets face a notable supply surge of new product.

For example, Arizona State University saw rents fall 10.2 percent year-over-year amid flat enrollment and a flood of new multifamily and student housing projects. Tennessee, Cal–Berkeley, Georgia Tech and Michigan also saw rents decline by five percent or more, largely due to increased inventory.

In contrast, markets with rising enrollment and constrained supply are holding pricing power. At Ole Miss, rents surged 21.1 percent year-over-year—the largest increase nationally—driven by a 25 percent enrollment jump since 2021 and only one new off-campus development during that period. Mizzou posted 10.9 percent rent growth with no new supply added since 2017. Virginia Tech saw rents rise nine percent after enrolling 700 additional students and only 254 new beds delivered in recent years. In these markets, landlords have been able to push rents while maintaining near-total occupancy.

Meanwhile, the supply surge is particularly notable in markets like Knoxville, Tallahassee and Tempe, where developers are racing to complete projects before demand plateaus. While overall college enrollment is expected to rise this year, risks remain, suggests Yardi. Cuts to federal higher education funding, shrinking student loan programs, and a likely drop in international enrollment could dampen demand in select markets, particularly at private institutions or in states with declining demographic trends.

Transaction activity has also slowed. Just 50 student housing properties have sold so far in 2025—fewer than this time last year—but the total number of beds sold is higher. The average price per bed has climbed to nearly $94,000, far above the $73,500 average from 2020–2024, driven largely by rent gains over that period.

Whether this supply surge leads to sustained rent pressure or is absorbed by strong preleasing remains a key question heading into the new academic year. Yardi Matrix continues to expand its coverage, tracking more than one million beds across 1,500 universities. More than 19,000 beds are under construction and over 50,000 are in planning or early stages—factors likely to keep competitive pressure elevated through 2026.

Yardi Matirx’s full report is available here.