The Mortgage Bankers Association (MBA) reported that delinquency rates rose in Q2 for commercial and multifamily mortgages issued by 4 of the 5 classes of lenders they track.

Distress definitions differ

The MBA report is issued quarterly, with the latest version providing data through Q2 2025. It covers commercial property lending by Fannie Mae and Freddie Mac as individual entities and also by issuers of commercial mortgage-backed securities (CMBS), life insurance companies, and banks and thrifts as classes of lenders. The report does not separate out reporting on loans on multifamily properties from other commercial property types.

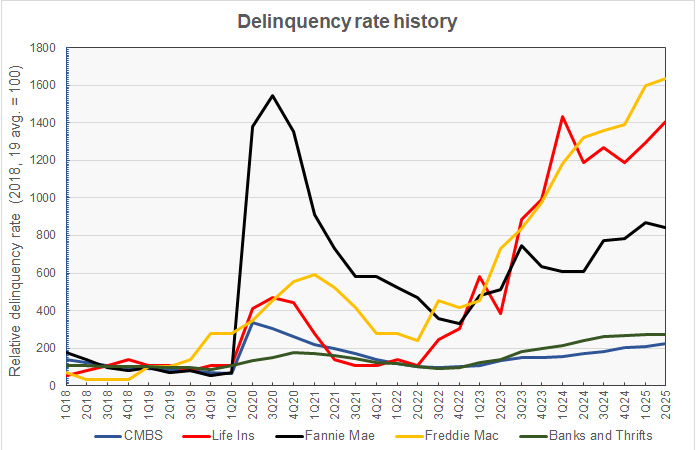

MBA notes that the standards that these various classes of lenders use in assessing whether to report a loan as delinquent vary widely. Therefore, the absolute delinquency rates reported by the different lenders are not directly comparable. Because of this, the first chart, below, shows the relative delinquency rate history for the classes of lenders covered in the MBA report. The data displayed is normalized so that the average quarterly delinquency rate for each of the lender classes for the period between Q1 2018 and Q4 2019 is set to a value of 100.

The chart shows that the portion of loans that were classified as delinquent surged during the pandemic but then abated as Emergency Rental Assistance funds were made available. However, delinquency rates have been rising since late 2022.

Delinquency rates for commercial and multifamily mortgages from banks and thrifts and those backed by Freddie Mac are at their highest levels since the pandemic. Delinquency rates on commercial mortgages issued by life insurers are nearly so. However, rates on mortgages backed by Fannie Mae or bundled as CMBS are well below the levels they reached during the pandemic shutdowns.

Rates on the rise

By the numbers, the reported delinquency rates in Q2 2025 were 6.36 percent for CBMS, up from 5.91 percent the prior quarter. Rates were 0.51 percent for life insurance companies, up from 0.47 percent in Q1. Delinquency rates were 0.61 percent for Fannie Mae, down from 0.63 percent the prior quarter. Fannie Mae was the only class of lender to see delinquency rates fall during Q2, if only marginally. Rates were 0.47 percent for Freddie Mac, up from 0.46 percent. In Q2, rates were 1.29 percent for banks and thrifts, up from 1.28 percent.

Note that the CMBS delinquency rates compares for a rate of 7.29 percent overall, and 6.86 percent for multifamily mortgages, reported by Trepp for August 2025.

The full MBA report includes definitions of how each class of lender defines a delinquent commercial mortgage. It can be found here.