Apartment landlords are offering unprecedented concessions as competition heats up across a cooling rental market. With new supply still flooding many metros and renter demand showing signs of fatigue, giveaways such as free rent or parking have become commonplace. In some cities, these concessions are nearly expected.

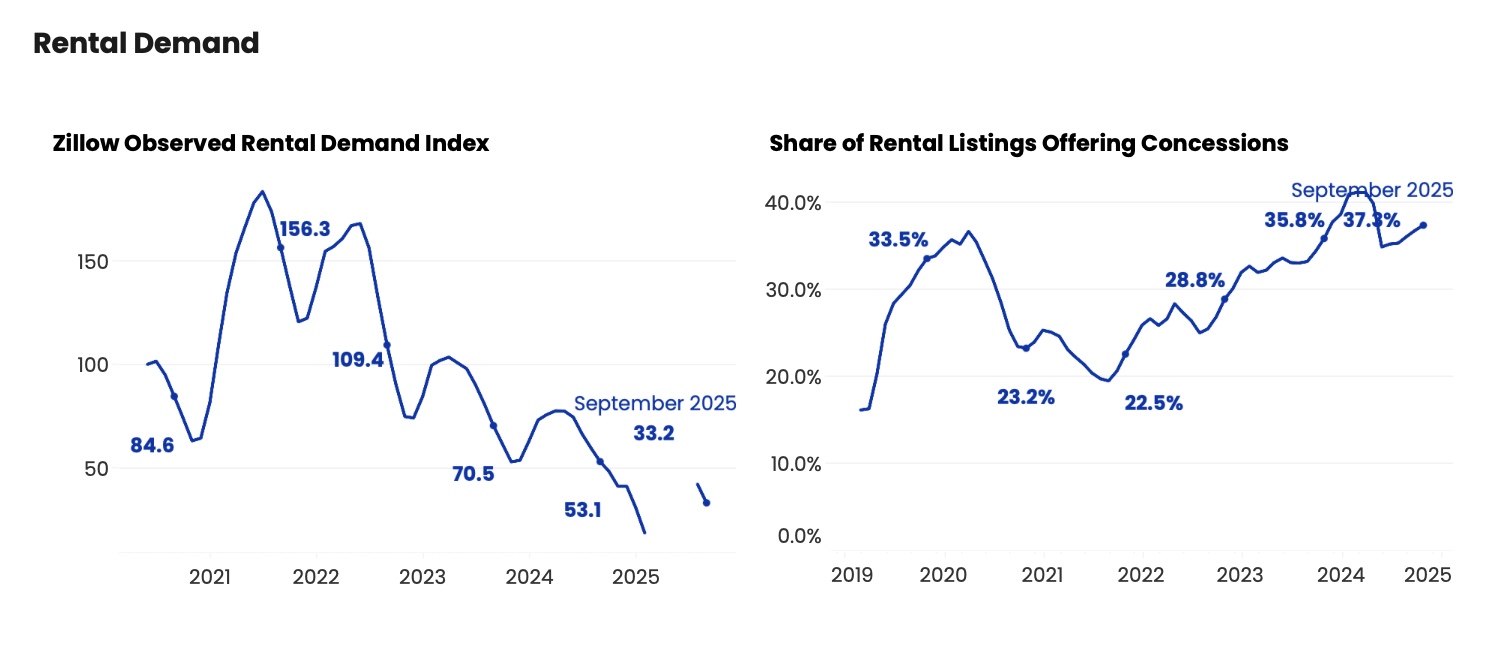

Zillow’s latest report shows that 37.3 percent of active listings included some type of concession, setting a new record. National multifamily rent growth slowed to 1.7 percent year over year, the second-lowest since 2021. Meanwhile, single-family rents rose just 3.2 percent, the smallest annual increase since 2016. The typical renter household now spends 28.4 percent of median income on housing, down from 28.8 percent a year earlier. This marks the best affordability reading in four years.

Markets with the heaviest construction are seeing the steepest rent declines, including Austin (-4.7%), Denver (-3.4%), and San Antonio (-2.3%). In contrast, metros with tighter supply and strong demand, including Chicago (6%), San Francisco (5.6%), and New York (5.3%), continue to post gains. Zillow noted that Sunbelt and Mountain West regions are under the most downward pressure, while slower-construction areas have held steady.

Zillow’s chart below illustrates a decline in renter demand alongside a rising share of listings offering concessions.

RealPage Q3 2025 data confirms similar trends. U.S. apartments absorbed roughly 637,100 market-rate units in the year ending Q3. This is above the decade average but sharply below the 784,900 units absorbed in the prior 12 months. Effective asking rents fell 0.3 percent to $1,880, the first summer rent decline since 2009. RealPage reported nearly 22 percent of apartments were offering concessions as of the 3rd quarter, averaging 6.2 percent of rent value, compared to 14 percent in August.

“Sluggish new lease activity appears to be the primary driver behind a weaker-than-expected third quarter,” said Carl Whitaker, RealPage’s chief economist. “This sluggishness looks to be a reflection of broader macroeconomic headwinds as the nation has seen job growth quickly slow in the past few months.”

Jay Parsons, rental housing economist and economic advisor to JPI, explained, “There IS a lot of demand … but it’s being spread out among an ever larger number of competing new properties. High supply means units are sitting vacant longer. Leasing traffic is down. Conversion is tough. Concessions are abundant. And that’s why rent growth is non-existent, or down, across most U.S. markets.”

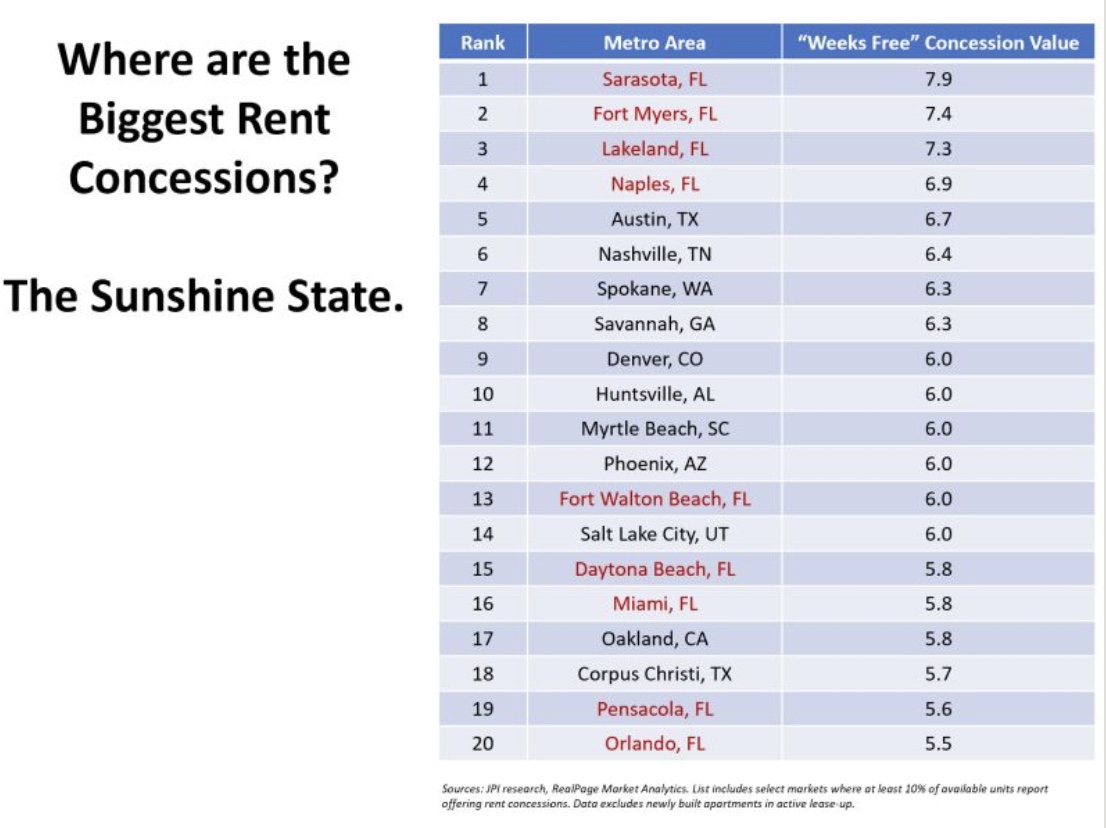

In September, Parsons drew on JPI research to highlight that stabilized apartments nationwide are offering an average of five weeks of free rent — the highest level since the Great Financial Crisis. Florida dominates the top markets, with Sarasota averaging nearly eight weeks, and Fort Myers, Lakeland, and Naples around seven. High-supply markets such as Austin, Nashville, Denver, Phoenix, and Salt Lake City also see concessions of six or more weeks. Parsons said these incentives reflect competition rather than weak macro demand. He cautions that heavy reliance on concessions can complicate lease renewals.

Landlords increasingly prefer to offer short-term perks rather than lower monthly rents, Zillow noted. Concessions typically follow seasonal patterns, peaking in winter or early spring, and are likely to continue rising.

As elevated supply continues to ripple through the market and leasing seasonality slows into winter, property managers may need to go beyond concessions. “Concession chasers are a real thing,” Parsons said. “It’s a tough environment even for the very best property managers.”