Congress passed a $900 billion pandemic relief package that would finally deliver long-sought cash to businesses and individuals and resources to vaccinate a nation confronting a frightening surge in COVID-19 cases and deaths.

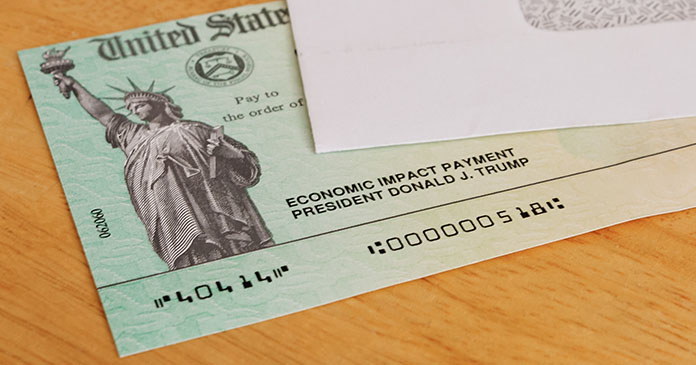

Lawmakers tacked on a $1.4 trillion catchall spending bill and thousands of pages of other end-of-session business in a massive bundle of bipartisan legislation as Capitol Hill prepared to close the books on the year. The bill approved Monday night, December 21, went to President Donald Trump for his signature, which was expected in the coming days.

Response from NMHC and NAA

National Multifamily Housing Council (NMHC) President Doug Bibby and National Apartment Association (NAA) President and CEO Bob Pinnegar issued the following statement on the passage of a roughly $900 billion COVID relief package.

“NMHC and NAA congratulate Congressional leaders in both parties on the passage of a COVID relief package that will provide desperately needed support to millions of Americans who call an apartment home. We look forward to President Trump signing it into law.

“For the better part of a year, NMHC and NAA have been at the forefront of calling on policymakers to pass legislation which includes rental assistance as well as a number of other key priorities. While there remains much work to do in the coming weeks and months, this effort is clearly a step in the right direction and will come as welcome news for so many households facing financial distress. Importantly, this package includes:

- $25 billion in dedicated rental assistance

- $600 in direct stimulus checks

- $300 per week in enhanced unemployment benefits through March. Expiring unemployment programs for gig workers and long-term unemployed were also extended

- $284 billion for a second forgivable Paycheck Protection Program (PPP) loan

“We are heartened that the legislation includes such critical resources that will allow those impacted by COVID and resulting economic distress to meet their financial obligations, including rent. Unfortunately, it also extends the current CDC eviction moratorium until January 31, 2021. Eviction moratoriums fail to address a renter’s underlying financial distress and do not address housing instability. The resources provided in this package, as well as future support that will need to be extended in 2021, are essential to addressing apartment residents’ financial challenges—not interminable moratoriums.

“NMHC and NAA will continue to work with policymakers on future legislation to ensure that residents and housing providers have the support necessary to allow for a sustainable and equitable recovery. As part of that recovery, targeted and limited liability protections for apartment firms will be a critical component of future COVID packages.”

Statement from NAHB Chairman Chuck Fowke

Chuck Fowke, chairman of the National Association of

Home Builders (NAHB) and a custom home builder from Tampa, Fla., issued the following statement after Congress passed a $900 billion economic relief package:

“NAHB commends congressional leaders for working together to craft a bipartisan rescue package that will provide much-needed relief for American families and businesses that continue to suffer economic hardship stemming from the COVID-19 pandemic. The legislation contains several provisions championed by NAHB. These include simplified Paycheck Protection Program loan forgiveness rules for small businesses, dedicated rental assistance to help renters and landlords, and improvements to the Low-Income Housing Tax Credit that will spur the production of thousands of new affordable rental units. This relief bill will help housing continue to lead the economy forward.”

Response from the National Rental Home Council

The National Rental Home Council issued the following statement on passage of the Emergency Coronavirus Relief Act:

“The National Rental Home Council applauds lawmakers for offering $900 billion in COVID relief, including $25 billion in assistance to the renters and landlords struggling to weather COVID.

“The rental assistance announced today will help families stay in their homes, while giving rental home property owners the resources they need to meet the costs of ownership.

“Since many single-family homeowners own just one property, their margins are already thin. Without rental income, they can’t afford to pay property taxes, maintenance, and service fees on their properties.

“America’s mom-and-pop landlords, who own all but 0.2 percent of America’s single-family units, also rely on their rental home investments to finance their retirement, their kids’ college tuition, and other major expenses.

“Today’s package also benefits renters, since single-family rental homes account for over half of all rental housing in the United States. And monthly home rental rates remain lower than the monthly mortgage payment for an entry-level home.

“We thank Congress for offering assistance that puts money in the pockets of renters and landlords. Direct payments allow families to pay their rent and allow landlords to continue providing safe and affordable housing to their communities.”