The latest version of the Census Bureau’s Pulse Survey shows that a large and increasing portion of renters are behind on their rent payments.

Taking our pulse

The Pulse Survey is an experimental program that the Census Bureau has been running to assess how the population of the country is reacting to the fallout from COVID-19. Early on during the pandemic, Census surveyed the US population weekly. Lately, Census has been releasing survey results every two weeks. The current survey, designated Week 21, collected data from December 9 through December 21.

The survey asks a variety of questions about how the respondent is coping financially, including questions about paying for housing. A difficulty in using the survey is that the results are presented based on the number of adults responding in a certain way, not on the number of households. Different households could have different numbers of adult members. When looking at housing, a view from the perspective of households would have made more sense.

One of the questions that the Pulse Survey asks of renters is whether they are current on their rent. While some say that they occupy their housing without paying rent and some did not report whether they are current on their payments, the majority of respondents answered the question Yes or No. The portion of respondents who pay rent saying that they are not current has grown over time.

The week 13 Pulse Survey taken in the last week of August – 15.3 percent were behind on their rent payments.

The week 16 Pulse Survey taken in early October – 16.2 percent were behind on their rent paymentst.

The week 21 Pulse Survey taken in mid-December – 19.2 percent were behind on their rent payments.

For reference, the NMHC rent tracker showed that 89.8 percent of renters at 11.5 million professionally managed apartments had made at least a partial rent payment for December by the 20th of the month. Of course, making a partial payment does not mean that the renter is current. Also, the units covered by the rent tracker represent only about 29 percent of the approximately 40 million occupied rental housing units in the United States. Many of the rental units not covered by the rent tracker are multifamily properties owned by smaller operators, and many more are single family rentals.

Looking ahead

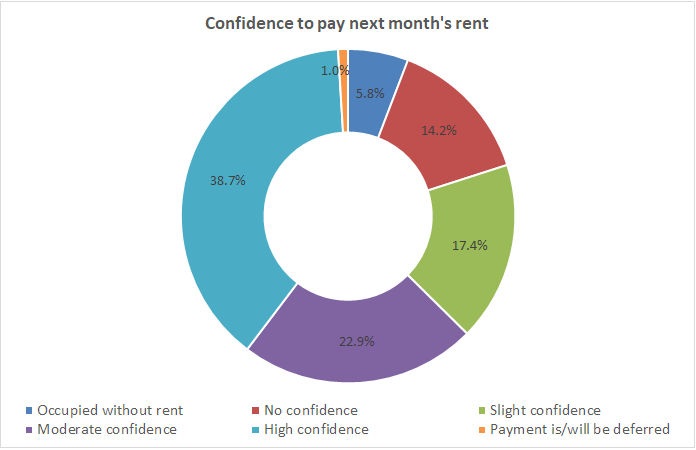

The Pulse Survey asked renters how confident they are that they will be able to make the next month’s rent payment. Their responses are summarized in the following chart.

The chart shows that 31.6 percent of renters have either slight or no confidence that they will be able to make the next month’s rent payment. Fully 67.4 percent of renters have moderate to high confidence that they will be able to make next month’s rent payment, or they do not have to pay rent. Only 1 percent of renters will have their rent payment deferred.

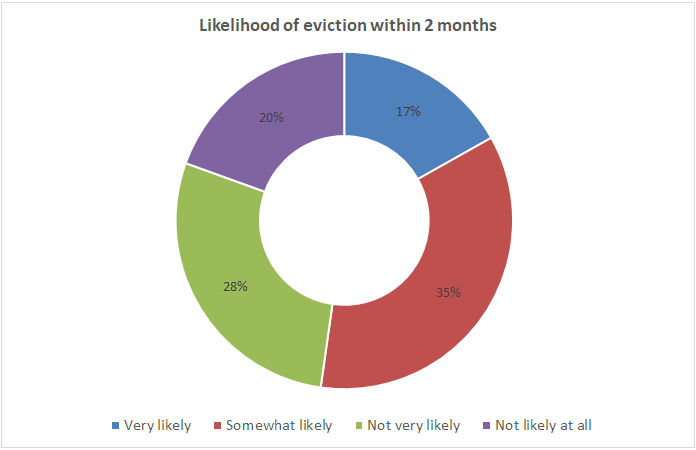

The final chart shows the expectations of those who are currently behind on their rent as to whether they will be evicted within the next 2 months.

Slightly over half of rent payers who are not current on their rent think that it is somewhat likely or very likely that they will be evicted within the next 2 months. Taking into account the “renters” who occupy their residences without having to pay rent, the portion of renters who think that it is at least somewhat likely that they will be evicted is about 9 percent of all renters. This would represent about 3.6 million households.

The latest survey was taken before the passage of the latest COVID relief bill by Congress. It the aid it promises is rolled out quickly expectations may improve in the next Pulse Survey.