The Urban Land Institute (ULI) recently released its biannual economic forecast. It has a more positive outlook for the economy and for the multifamily housing industry than did their last forecast of 6 months ago.

The report combined the individual forecasts of 42 economists and analysts into a consensus economic forecast for the US economy and real estate markets over the next three years. This summary focuses primarily on parts of the report concerning multifamily housing.

Looking at the economy

The ULI report points out that the US economy’s real GDP contracted 3.5 percent in 2020 as employment fell by 9.4 million jobs. For 2021, the report forecasts real GDP growth of 6.5 percent but employment growth of only 5.5 million jobs. This would leave the economy 2.8 percent larger than in 2019, but with 3.9 million fewer workers, about 2.6 percent of the number of those employed at the end of 2019.

The report forecasts real GDP growth of 3.9 percent in 2022 and 2.5 percent in 2023. Employment is expected to grow by 3.0 million in 2022 and by 2.1 million in 2023, when it will finally surpass the total employment level in 2019.

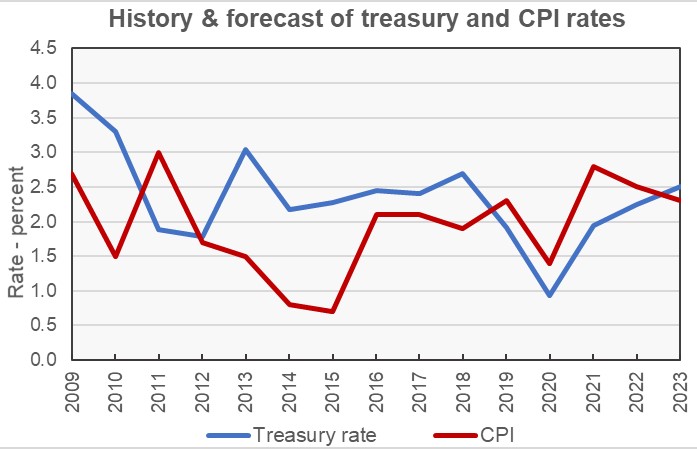

Inflation as measured by the consumer price index (CPI) in 2020 was 1.4 percent, below the recent average of 2 percent. In 2020, the ten-year treasury rate dropped below 1 percent, well under the 20-year average of 3.07 percent and the recent 5 year average of 2.3 percent.

For 2021, the CPI is expected to rise by 2.8 percent, up significantly from the forecast of 2.0 percent in the ULI economic forecast of 6 months ago. Inflation is expected to decline to 2.5 percent in 2022 and to 2.3 percent in 2023.

The ten-year treasury rate is now expected to be 1.95 percent in 2021, up from 1.0 percent forecast 6 months ago. It is forecast to rise to 2.25 percent in 2022 and to 2.5 percent in 2023.

The history and forecasts for the CPI and ten-year treasury rate are shown in the first chart, below.

Focusing on apartments

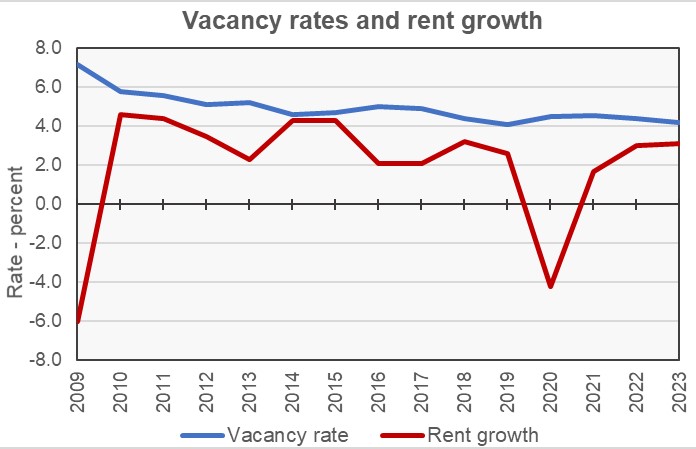

Apartment vacancy rates, which had been as high as 7.2 percent in 2009, fell as low as 4.1 percent in 2009. Vacancies rose to 4.5 percent in 2020 and ULI forecasts them to rise marginally to 4.55 percent in 2021. This is down from a vacancy rate of 5.1 percent forecast for 2021 in the last economic forecast 6 months ago. Vacancy rates are now expected to be 4.38 percent in 2022 and 4.18 percent in 2023.

ULI reported that apartment rents dropped by 4.2 percent in 2020. ULI now projects that apartment rents will rise 1.7 percent in 2021 and 3.0 percent in 2022. These rates are up from projections of rent growth of 0.1 percent for 2021 and 2.5 percent for 2022 in the economic forecast of 6 months ago.

The history and forecasts for vacancy rates and for rent growth rates are shown in the next chart, below.

While the ULI forecast predicted strong single-family housing construction in the next three years with starts rising to 1,200,000 units by 2023, the report did not contain a forecast for multifamily housing construction.

The business of apartments

The report included a projection for total annual returns on apartments as defined by the National Council of Real Estate Investment Fiduciaries (NCREIF). These returns have a 20-year average of 8.7 percent but had declined to 5.5 percent in 2019 before falling to only 1.8 percent in 2020. ULI projects that total annual returns will rise to 5.6 percent in 2021, 6.7 percent in 2022, before declining slightly to 6.5 percent in 2023.

The ULI forecast also has projections for commercial real estate cap rates, transaction volumes and property price changes. However, these projections are for commercial property as a whole and apartments are not broken out as a separate asset class. In brief, the forecast is for cap rates and property prices increases to remain close to the levels they were at in 2019, 4.5 percent and 5 percent, respectively. Transaction volumes are expected to recover steadily from the drop they took in 2020, but they will not have quite returned to the peak they reached in 2019 by 2023.

The full economic forecast also covers other commercial property types and the single-family housing market. It is available to ULI members at uli.org. The next ULI consensus forecast is scheduled to be released in October.