JLL Capital Markets announced that it has closed the sale of The Union at Lyndhurst (The Union), a 328-unit, Class A, mid-rise multihousing community in Lyndhurst, New Jersey.

JLL marketed the property on behalf of the seller, Mesirow Institutional Real Estate Direct Investments, which offers a series of risk-balanced, multifamily value-added investing opportunities to a growing base of large domestic and international institutional investors. Pacific Urban Investors acquired the asset.

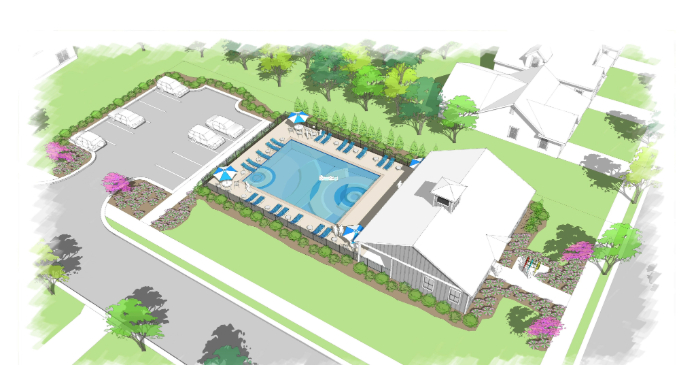

The Union comprises studio, one- and two-bedroom units averaging 1,007 square feet. Units offer stainless steel appliances, central heat/AC, nine-foot ceilings, in-unit washer and dryers and patio/balcony. The community features four separate courtyards, a dog park, fitness center, heated outdoor pool and complimentary shuttle to bus and train station.

Situated at 1301 Wall Street West, The Union is located in the Meadowlands region just off of the intersection of Route 17 and Route 3, less than seven miles from the Lincoln Tunnel entrance for direct access into Midtown Manhattan. The property benefits from convenient access across Northern New Jersey due to its proximity to the New Jersey Turnpike (I-95), the Garden State Parkway, and Interstates 80 and 280. The area offers an abundance of outdoor activities, restaurants, shops, and entertainment, including Richard W. Dekorte Park, American Dream, Medieval Times and The Meadowlands Sports Complex.

The JLL Capital Markets Investment Sales Advisory team representing the seller was led by Jose Cruz, Michael Oliver, JB Bruno, Kevin O’Hearn and Steve Simonelli.

“We had great interest on Union at Lyndhurst given its location and quality,” said Cruz. “Investors liked the access to NYC specifically as well as the lack of multifamily rentals in the immediate area. The demand from the institutional investor universe for high-quality multi-housing in the New York area is accelerating going into the year end.”

“The long-term fundamentals of the U.S. residential apartment sector remain attractive as a result of secular shifts in the economy,” said Alasdair Cripps, Chief Executive Officer of Mesirow Institutional Real Estate Direct Investments. “We are pleased with the performance of The Union property within our portfolio since its acquisition in August 2015. Mesirow Institutional Real Estate Direct Investments remains opportunistic as both an acquirer and seller of high-quality multihousing rental units across the U.S.”

JLL Capital Markets is a full-service global provider of capital solutions for real estate investors and occupiers. The firm’s in-depth local market and global investor knowledge delivers the best-in-class solutions for clients — whether investment and sales advisory, debt advisory, equity advisory or a recapitalization. The firm has more than 3,000 Capital Markets specialists worldwide with offices in nearly 50 countries.