The latest CoStar report on the changes in the prices of commercial property in the United States said that the equal-weighted quarterly index of multifamily property prices rose 13.3 percent over the last 12 month. However, the index fell 1.0 percent in Q1, its first decline after a series of gains which began in Q1 2019.

Perhaps surprisingly, the fastest appreciating property type both for the quarter and for the year was hospitality. The equal-weighted CCRSI for hospitality properties rose 10.5 percent in Q1 2022 and was 21.3 percent higher than its level in Q1 2021. The equal-weighted CCRSI for industrial property, the recent price growth leader, rose only 0.3 percent in Q1 2022 and was 14.0 percent higher than its level in Q1 2021.

Defining the index

The CoStar report focuses on a relative measure of property prices called the CoStar Commercial Repeat Sales Index (CCRSI). This index is computed based on the resale of properties whose earlier sales prices and sales dates are known. The index represents the relative change in the price of property over time rather than its absolute price. In March 2022, there were 1,940 sales pairs for all of the property types tracked by CoStar. Since CoStar does not break out the number of transactions by property type, we do not know how many of those transactions were for multifamily properties.

CoStar reports the CCRSI data in a variety of ways. Some indexes are calculated monthly while some are only calculated quarterly. Index calculations may be equally weighted over all transactions or may be weighted by value to emphasize the sales of major properties. CoStar’s report, and this summary of it, look at different indexes, which may affect the results reported. For example, a monthly index may show more extreme price movements than a quarterly index, which effectively averages the sales price data over three months.

Multifamily outpaces other commercial property types

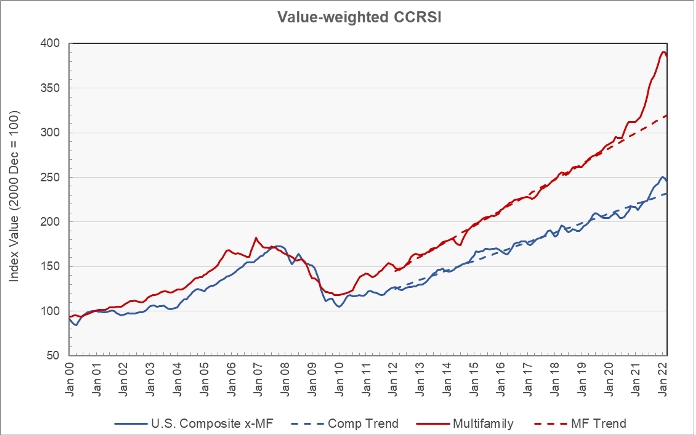

The first chart shows how monthly value-weighted multifamily property price indexes have changed since January 2000 relative to the composite price index of the other primary commercial property types CoStar tracks. The data is normalized so that both indexes are set to a value of 100 in December 2000. The change in the value of each index since then shows how the relative price of that property type has changed. The chart also contains trendlines for the price indexes of the two classes of commercial property based on their relatively steady growth between January 2012 and January 2020.

The chart shows that multifamily property price gains have generally outperformed the price gains of other commercial property types considered as a single asset class. Recently, the price gains of both of these property types have exceeded their long-term averages. The surge in multifamily property prices began soon after the pandemic struck in early 2020. The rise in prices for other commercial property lagged somewhat, possibly because of the profoundly negative impact of the pandemic on office and hospitality asset classes.

The chart also shows that the value-weighted multifamily property price index and the index for other commercial property are both down from their recent highs. The multifamily property price index is down 1.2 percent from its high in January 2022 while the other commercial property price index is down 2.2 percent from its recent high, also in January 2022.

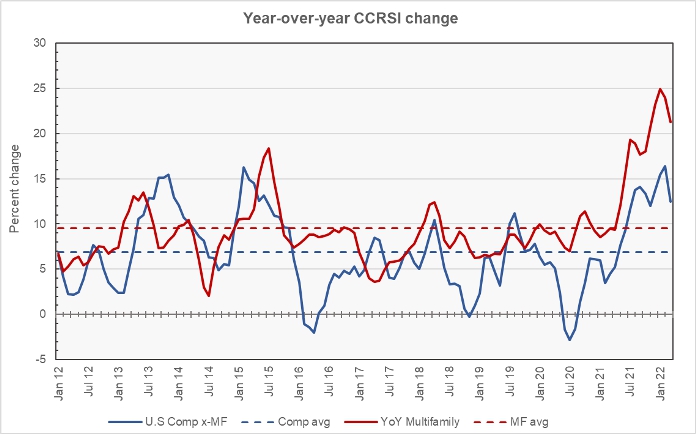

The second chart focuses on the price trends of these two value-weighted indexes since the start of 2012 by looking at them in terms of year-over-year price growth. The chart also includes lines representing the average rate of price change for each asset group over the time period illustrated in the chart.

The chart shows the rapid rise in the monthly value-weighted multifamily property price index since May 2021. The year-over-year rise in the index peaked at 25 percent in January, but fell to 21.3 percent in March. This result is in line with the 22.4 percent year-over-year price gain reported earlier by Real Capital Analytics.

The lines representing the average rates of price appreciation for the two indexes show that the average rate of growth in multifamily property prices has been 9.5 percent, while the average rate of growth of commercial property other than multifamily has been 6.9 percent over the 9+ year time span represented.

Regional differences matter

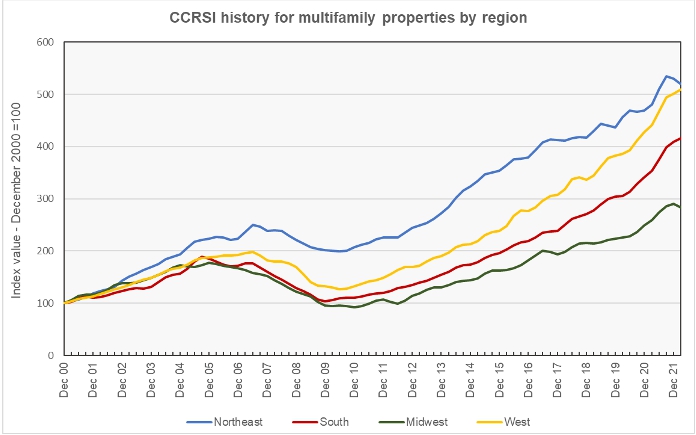

CoStar’s quarterly reports include information on the change in the equal-weighted CCRSI by region. The long-term history of these indexes is shown in the next chart, below.

The chart shows that the year-over-year rates of increase in the price indexes for all regions peaked in Q3 2021. While multifamily property prices have continued to rise in the South and West regions, albeit at a slower rate, prices have fallen in real terms in the Northeast region since Q4 2021 and in the Midwest region in Q1 2022.

Using CoStar’s equal-weighted quarterly indexes and comparing to year-earlier levels, prices in Q1 2022 were up by 17.7 percent in the South, 15.5 percent in the West, 9.4 percent in the Midwest and 8.3 percent in the Northeast.

Q1 land rush

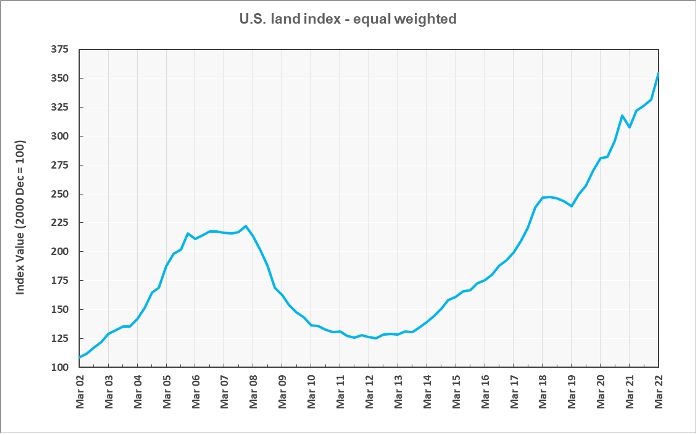

The final chart, below, shows the history of the equal-weighted price index for land. In Q1, the price index for land was up 6.8 percent from the previous quarter and up 15.3 percent from the level of Q1 2021.

The full report has additional information about transaction volumes, including “distressed” transactions. However, that data is not broken out by property type. The full report can be found here.