JLL Capital Markets announced that it closed the sale of Sophia Square Apartments, a 281-unit, Class A, garden-style apartment community located in southern Miami-Dade county.

JLL marketed the property on behalf of the seller, Grand Peaks Properties. Brookline Investment Group acquired the asset.

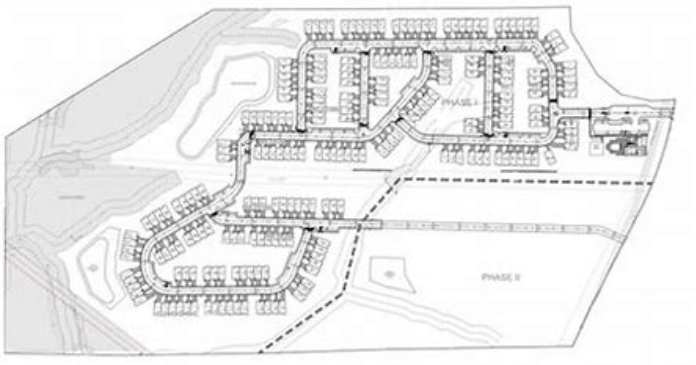

Completed in 2019, this newly built, institutional-quality asset features one-, two- and three-bedroom floorplans with an average size of 872 square feet. Unit amenities include granite countertops in kitchen and baths, stainless-steel appliances, modern cabinetry, nine-foot ceilings, in-unit washers and dryers, vinyl plank flooring and private balconies or patios. Community amenities include gated entrance, a fitness center, a resort-inspired swimming pool, a multi-purpose clubroom, a children’s play area and a dog park.

Located at 13710 SW 256th Street, Sophia Square, benefits from its immediate accessibility to US-1 and Florida’s Turnpike, placing it less than 30 minutes from Kendall, Doral, Dadeland and Coral Gables. It is also within walking distance to the soon-to-be-built Bus Express Rapid Transit corridor that will operate on US-1. The property is proximate to an array of area amenities, including Homestead Bayfront Park, Homestead Speedway and The Falls mall, as well as top-rated schools, major employers and health facilities.

The JLL Capital Markets Investment Advisory team representing the seller was led by Managing Director Maurice Habif, Director Simon Banke and Director Ted Taylor. This JLL team has sold nearly $300M of multifamily assets for Grand Peaks this year.

JLL Capital Markets is a full-service global provider of capital solutions for real estate investors and occupiers. The firm’s in-depth local market and global investor knowledge delivers the best-in-class solutions for clients — whether investment sales and advisory, debt advisory, equity advisory or a recapitalization. The firm has more than 3,000 Capital Markets specialists worldwide with offices in nearly 50 countries.