Fannie Mae’s March economic and housing forecasts shift the timing of the expected recession to later in 2023 than predicted in recent forecasts. This change in outlook ripples through their forecasts for other economic metrics. It delays the expected recovery in single-family housing starts. It also results in slightly lower predicted multifamily starts in each quarter until the second half of 2024.

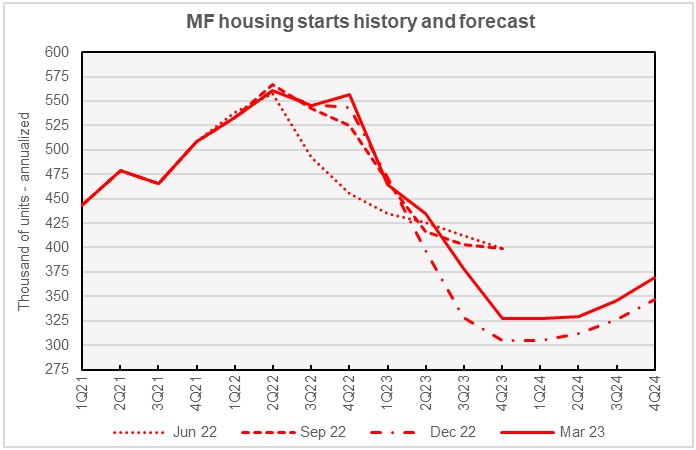

Multifamily starts forecast lower for 2023

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. Fannie Mae considers any building containing more than one dwelling unit to be “multifamily”, including both condominiums and rental housing units.

The chart shows that than Fannie Mae’s forecasters have had to make adjustments for the unexpected strength of the post-COVID building boom. However, since early 2022, they have also become more pessimistic about the expected depth of the decline in multifamily construction with the economic slowdown anticipated to come in 2023. The December 2022 forecast illustrated in the chart called for the lowest total number of multifamily starts over the next two years of any of Fannie Mae’s forecasts. While the March forecast predicts a higher total of unit starts than did the December forecast, it predicts a slightly lower starts total than did the February forecast.

Compared to last month’s forecast, the March forecast calls for more multifamily starts in Q4 2022 but fewer starts in each subsequent quarter through Q3 2024. Fannie Mae now expects multifamily starts (2+ units per building) for 2022 to come in at 545,000 units, unchanged from the level forecast last month. The forecast for multifamily starts in 2023 is now 401,000 units, down 15,000 units from the level forecast last month, and the forecast for 2024 is 343,000 units, down 1,000 units from last month’s forecast.

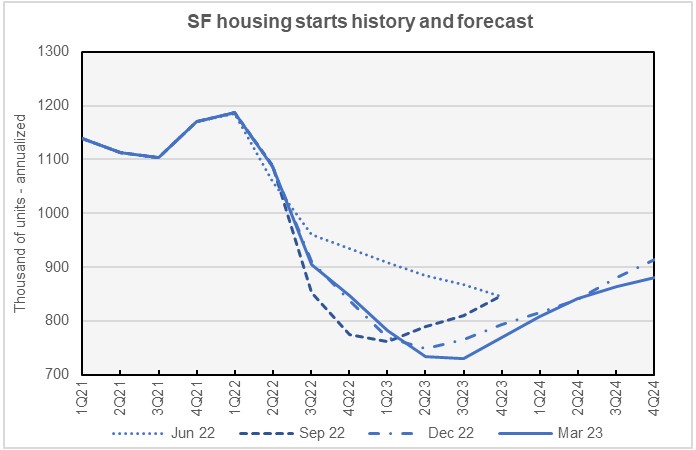

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts.

Compared to last month’s forecast, Fannie Mae’s forecasters raised their predicted numbers for single-family starts in Q1 2023 but lowered them for every other quarter of the forecast period. They now expect the low point in single-family housing starts to occur in Q3 2023 and for starts to trend upward after that time.

Fannie Mae now expects single-family starts to be 1,008,000 units in 2022, unchanged from the level forecast last month. Fannie Mae lowered their forecast for single-family starts in 2023 by 10,000 units to a level of 754,000 units. Fannie Mae’s lowered their forecast for single-family starts in 2024 by 28,000 units to a level of 848,000 units.

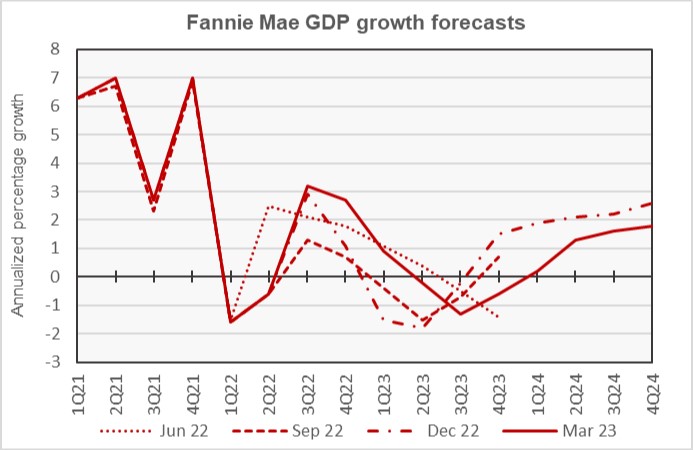

GDP falls later

The next chart, below, shows Fannie Mae’s current forecast for Gross Domestic Product (GDP) growth, along with three other recent forecasts.

Fannie Mae’s forecasters first predicted that a recession would occur in late 2023 as part of their April 2022 forecast. Subsequent forecasts moved the date for the start of the downturn earlier. The October 2022 forecast predicted negative GDP growth for Q4 2022. More recent forecasts have been moving the start date of the downturn later. The March forecast calls for negative GDP growth to only begin in 2Q 2023, with marginally negative GDP growth of -0.2 percent predicted for that quarter. Each subsequent quarter’s GDP growth was also revised lower in the latest forecast.

The full year forecast for GDP growth in 2022 is now for growth of 0.9 percent, down from a forecast 1.0 percent growth last month. The full year GDP forecast for 2023 was revised downward by 0.2 percentage points to -0.7 percent. The full year forecast for 2024 was revised downward by 0.6 percentage points to 1.2 percent.

Higher inflation forecast

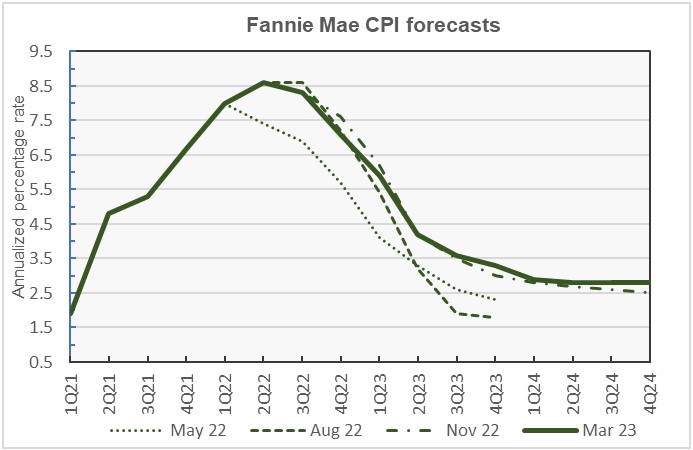

The next chart, below, shows Fannie Mae’s current forecast for the Consumer Price Index (CPI), along with three other recent forecasts.

Compared to last month’s forecast, Fannie Mae is predicting higher inflation in every quarter of 2023. It predicts slightly lower inflation in Q1 and Q2 2024 than did last month’s forecast but higher inflation in the last two quarters of that year.

The February forecast for year-over-year CPI growth in Q4 2022 was left unchanged at 7.1 percent. The year-over-year CPI forecast for Q4 2023 was revised upward from 3.0 percent to 3.3 percent, while that for Q4 2024 was revised upward by 0.3 percentage points to 2.8 percent.

Unemployment rate rises more slowly

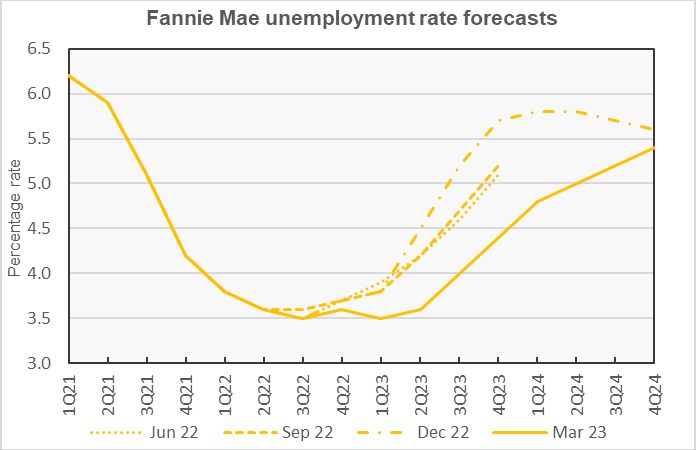

The next chart, below, shows Fannie Mae’s current forecast for the unemployment rate, along with three other recent forecasts.

Fannie Mae is predicting that job losses will begin in Q2 2023 but will rise more gradually than was foreseen in last month’s forecast. However, job losses are expected to persist through the end of 2024, fully 6 months later than what was foreseen in last month’s forecast.

The full year forecast for the unemployment rate in 2022 was left unchanged at 3.6 percent. The full-year unemployment rate forecast for 2023 was revised downward from 4.2 percent to 3.9 percent. The unemployment rate forecast for 2024 was revised downward from 5.3 percent to 5.1 percent.

Commentary looks at senior housing

The Multifamily Economic and Market Commentary for March reviewed the recent history and current performance of the market for senior housing. Much of the data it presented was derived from NIC Map Vision reports. It described how occupancy in senior housing declined during the pandemic but has been recovering recently. However, despite rising 2.8 percentage points during 2022, occupancy remains well below pre-pandemic levels.

The period of declining occupancy from late 2021 through early 2022 was matched by declining rates of rent growth. The recent growth in occupancy has been accompanied by a rise in rent growth, with rent growth rates of nearly 5 percent in late 2022, well above rates seen in the years before the pandemic.

In 2022, total absorption of assisted living and independent living senior housing was a little over 8600 units. At the same time, nearly 11,000 new units were delivered and nearly 36,000 units were under construction. The report did not list how many units were removed from the market.

Senior housing property sales volume for 2022 was less than half of its level in 2021. However, sales volume in Q4 2022 was less than 10 percent of that in Q4 2021 so the sales slowdown may be accelerating. Cap rates, which had been around 6 percent in 2020, jumped to around 8 percent in 2022.

Headwinds cited for the senior housing market included rising operating expenses and higher financing costs. They also included the reluctance of senior to sell their homes in today’s uncertain real estate market, limiting the supply of new senior housing residents. However, the coming wave of baby boomers approaching their 80’s was cited as a long term positive.

The Fannie Mae forecast can be found here. There are links on that page to the detailed forecasts and to the commentary.