JLL Capital Markets announced that it has closed the $32.125M construction financing for the development of The Virginia, a 198-unit market-rate multihousing project located in Seguin, Texas.

JLL represented the borrower, Periscope Capital Investment and Verdot Capital, to secure the 15-year, floating-rate loan through a regional bank.

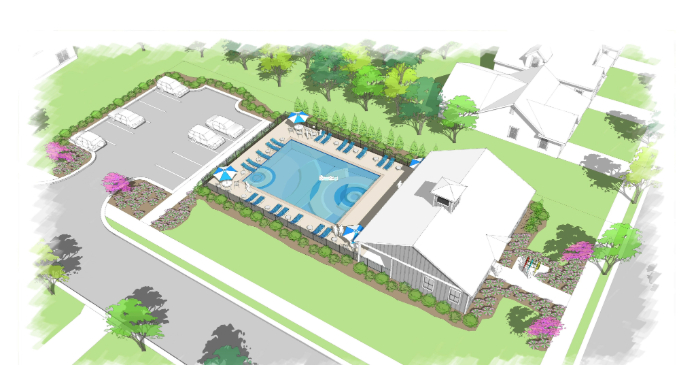

With an anticipated completion in 2024, the three-story project will offer one-, two- and three-bedroom units, averaging 892 square feet. Community amenities will include a best-in-class fitness center, sauna, yoga room and swimming pool, as well as a a recreational patio, a business center, barbeque areas, dog parks and more. A second phase of this project will be delivered in 2025, which will bring the total market-rate units to 424.

Located at 3501 N. Austin St., The Virginia is located thirty minutes east of San Antonio and about an hour south of Austin. The site also features direct access to Interstate 10, which is a direct transportation artery into Downtown San Antonio. Seguin serves as the retail hub for three major counties, Guadalupe, Gonzales and Wilson, and the site provides convenient access to downtown Seguin, which houses the bulk of the retail options. Nearby attractions include ZDT’s Amusement Park, The Seguin-Guadalupe Heritage Museum, Walnut Springs Park and Max Starcke Park and Golf Course.

The JLL Capital Markets Debt Advisory team was led by Director Alanna Ellis, Managing Director Jeff Lepley and Associate Alex Sheaffer.

JLL Capital Markets is a full-service global provider of capital solutions for real estate investors and occupiers. The firm’s in-depth local market and global investor knowledge delivers the best-in-class solutions for clients—whether investment sales and advisory, debt advisory, equity advisory or a recapitalization. The firm has more than 3,000 Capital Markets specialists worldwide with offices in nearly 50 countries.