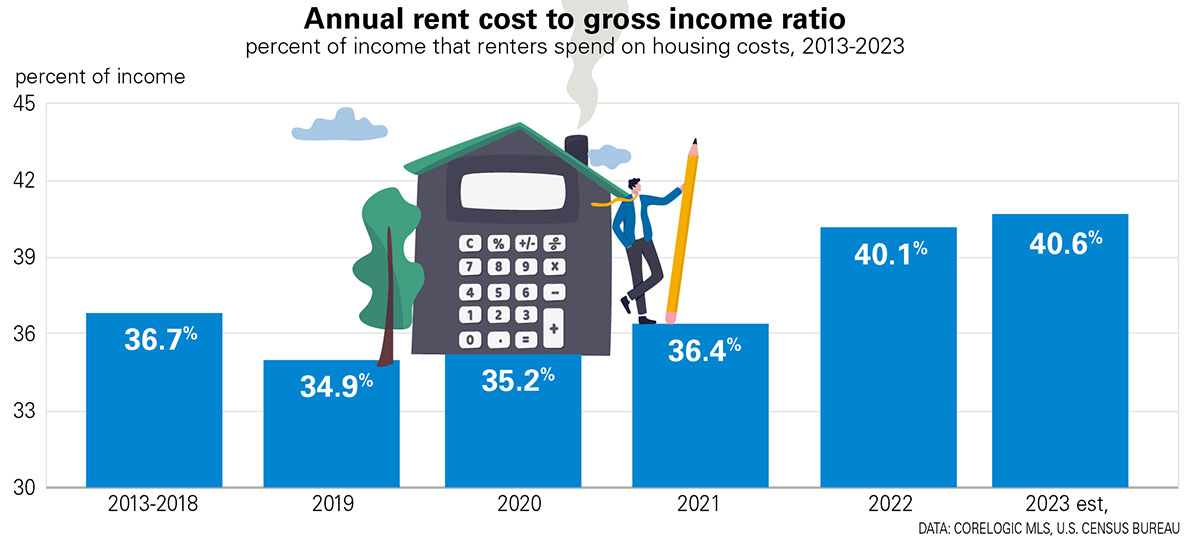

Rapid inflation is hitting low-to-moderate income renter households the hardest. For the first time in decades, the rent-to-income ratio has reached 40 percent at the height of U.S. inflation, marking one of the least-affordable rental markets ever.

The estimated rent-to-income ratio for the rest of 2023 should continue to hover around 40 percent, with low-to-moderate-income renters bearing the brunt of high inflation.

Nearly 70 percent of renter households have a gross family income that is less than the U.S. median.

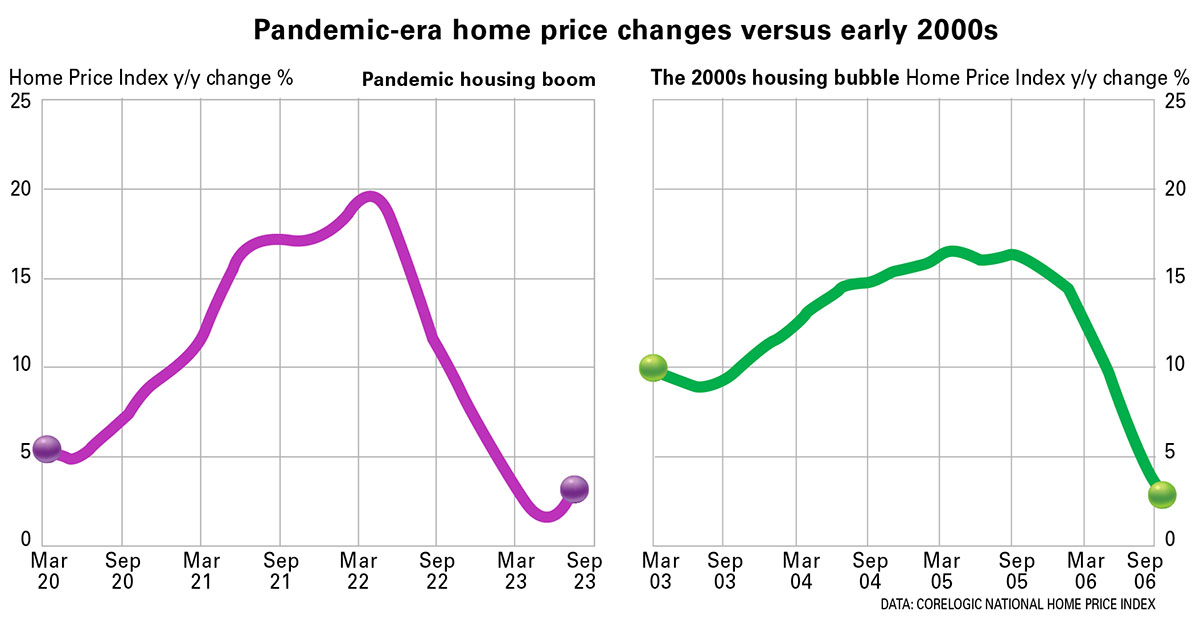

In the three years following the onset of the pandemic, rental costs have become more expensive than ever for millions of households. This is especially true for low-to-moderate-income households, which make up nearly 70 percent of renters. Skyrocketing home prices during the pandemic housing boom, which made the 2000s housing bubble seem more restrained and disciplined, has priced millions of renters out of homeownership. Rents have skyrocketed in tandem with home prices since early 2020. Wedged between rapid home price and consumer price inflation, the rental market has also seen its fair share of inflation.

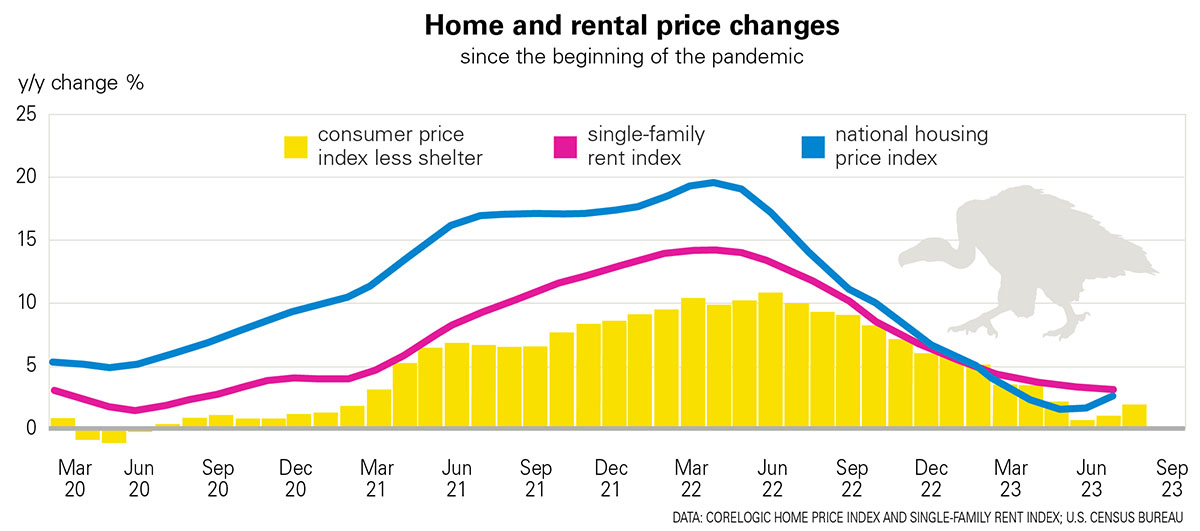

Rents have skyrocketed in tandem with home prices since early 2020. Wedged between rapid home price and consumer price inflation, the rental market has also seen its fair share of inflation.

For the 14-month period between August 2021 and September 2022, the single-family rental market recorded double-digit, year-over-year growth that reached nearly 15 percent at its peak.

But unlike millions of homeowners who have had the opportunity to refinance into low-rate mortgages or cash in on their all-time-high housing wealth, there has been no such relief for U.S. tenants, as low interest rates and the resulting inflation have only fueled fast rental cost hikes.

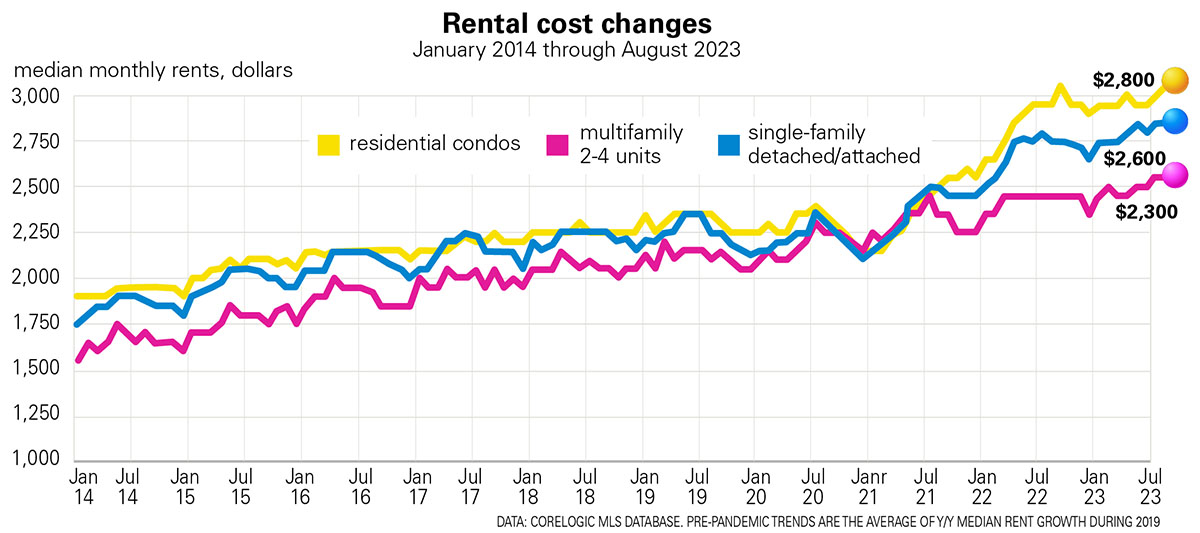

Just how expensive have rental costs become for typical Americans? Despite slowing after the Federal Reserve’s interest rate increases, single-family rents continue to reach new highs.

As of August 2023, the median asking rent for U.S. single-family detached or attached housing units was $2,600, up by 4 percent year over year. August’s median asking rent for condominiums was $2,800, up by 3.7 percent on an annual basis.

The median asking rent for small, two-to-four-unit residential apartments was $2,300, up by 4.5 percent year over year.

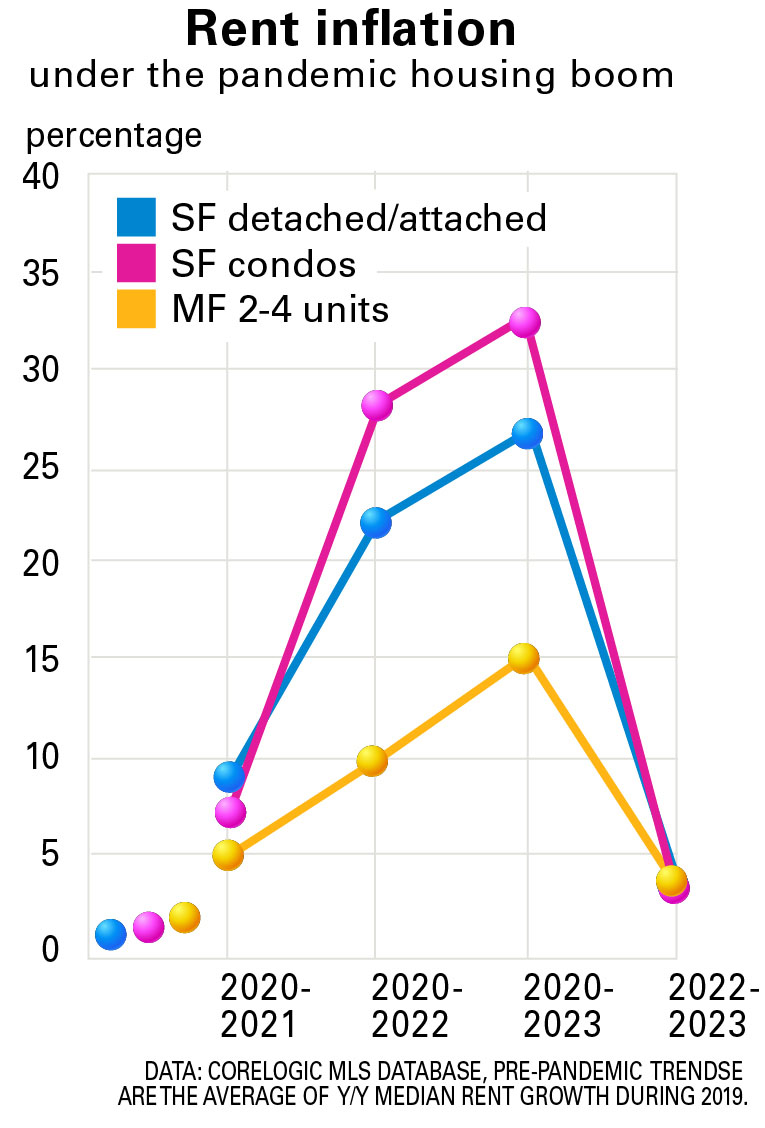

Likely driven by limited supply, rental costs for condominiums grew the fastest during the three-year pandemic housing boom, followed by single-family detached or attached properties.

Since 2020, the median asking rent for condos jumped by 33.3 percent to average 11 percent per year. For single-family detached/attached properties, median asking rents were 28.6 percent higher than in August 2020. The staggering rent growth during COVID-19 stands in a stark contrast to pre-pandemic trends, when gains were flat and sluggish.

Rent growth for small, two-to-four-unit residential apartments has not been as rapid but nevertheless picked up amid rapid inflation, averaging 5 percent per year over the last three years and largely in line with reported rent growth for multifamily apartments.

In fact, before the pandemic, rental cost growth for small residential apartments outpaced that of larger condos or single-family detached/attached rentals.

The shift to remote work and the resulting demand for larger living spaces farther away from city centers is likely driving this market movement.

As a percentage of household income, rent affordability is not only at the lowest point it has been in decades but has also experienced significant deterioration due to rapid inflation and stagnant wage growth, coming in the wake of rapid home price appreciation and housing-wealth increases.

At the height of U.S. inflation in 2022, a household that rented a median-priced, single-family home and earned an income near the U.S. median spent about 40 percent of its gross family income on annual rent payments.

At the height of U.S. inflation in 2022, a household that rented a median-priced, single-family home and earned an income near the U.S. median spent about 40 percent of its gross family income on annual rent payments.

The estimated rent-to-income ratio for 2023 should continue to mark the worst rent affordability for millions of households, while low-to-moderate income renters will continue to bear the brunt of high inflation.

Excerpt Neirin Gray Desai, DailyMail.com