The 2024 apartment market forecasts are in and despite twists, turns and uncertainties, multifamily fundamentals are strong.

In December, the Apartment List Research Team released its Seven Predictions for the 2024 Rental market and Origin Investments published its Top 10 2024 Predictions of Multifamily Real Estate. Both suggest that the apartment market is bolstered by underlying strong fundamentals, despite lingering uncertainties and continuing recession fears.

The crystal balls

The overarching questions heading into the new year are how rent growth and property valuations will hold up in light of the supply/demand equation and the state of the nation’s economy.

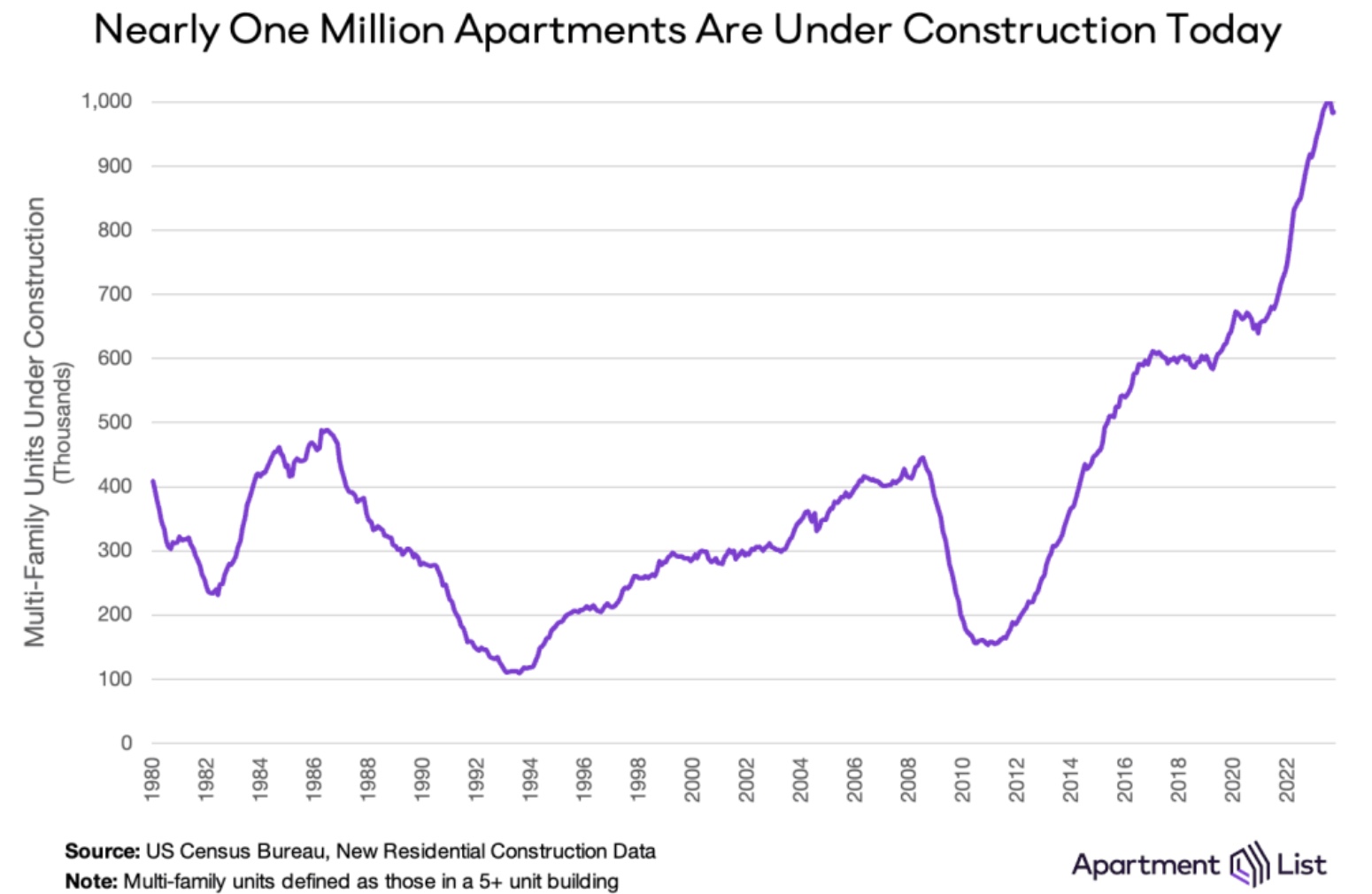

According to Apartment List, the number of new multifamily apartment units under construction hit one million for the first time ever in 2023 and both reports expect 2024 will see the most apartment units delivered in decades.

But the supply surge won’t be indefinite. Origin Investments predicts new starts will screech to a halt because of the lack of available multifamily funding and a “potential rise in defaults on expiring debt, among other uncertainties.” This is in line with Yardi Matrix analysis.

A key takeaway from Apartment List’s report is that the rental surge of the pandemic years has cooled in the wake of easing demand and rising supply, resulting in more than two-thirds of the nation’s 100 largest cities now logging negative year-over-year rent growth.

But both reports agree that rent growth will rise slightly out of negative territory in 2024, yet remain in the low single digits, amid the massive supply surge. “Even in the most bullish scenario, it’s unlikely that demand will be strong enough to outstrip all the new supply that we know is coming,” said Apartment List.

Origin Investments writes that negative rent growth will “head back to the historic norm, generally within a two- to four-percent range by Q3 and Q4 2024, bringing rent growth to 2022 levels.”

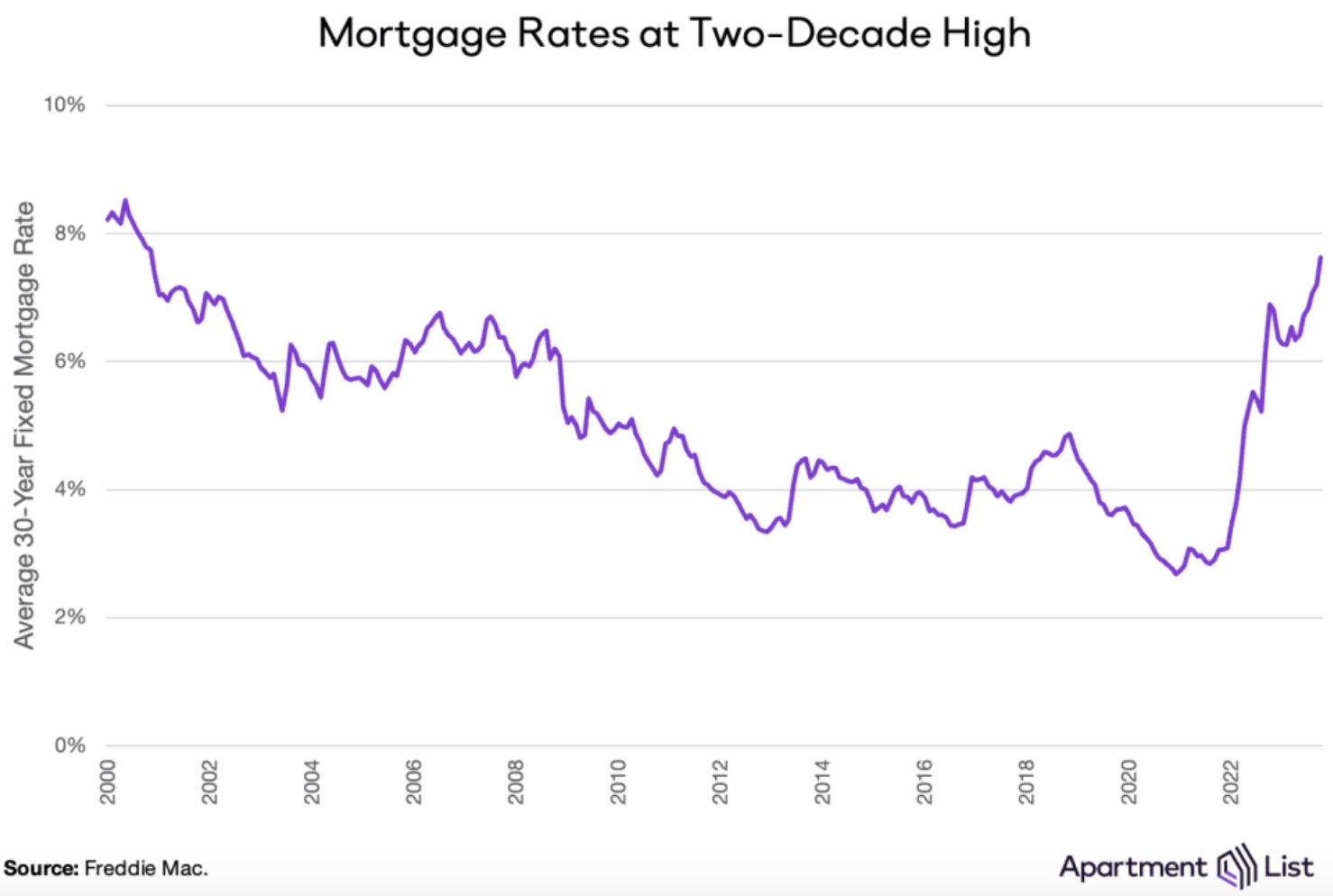

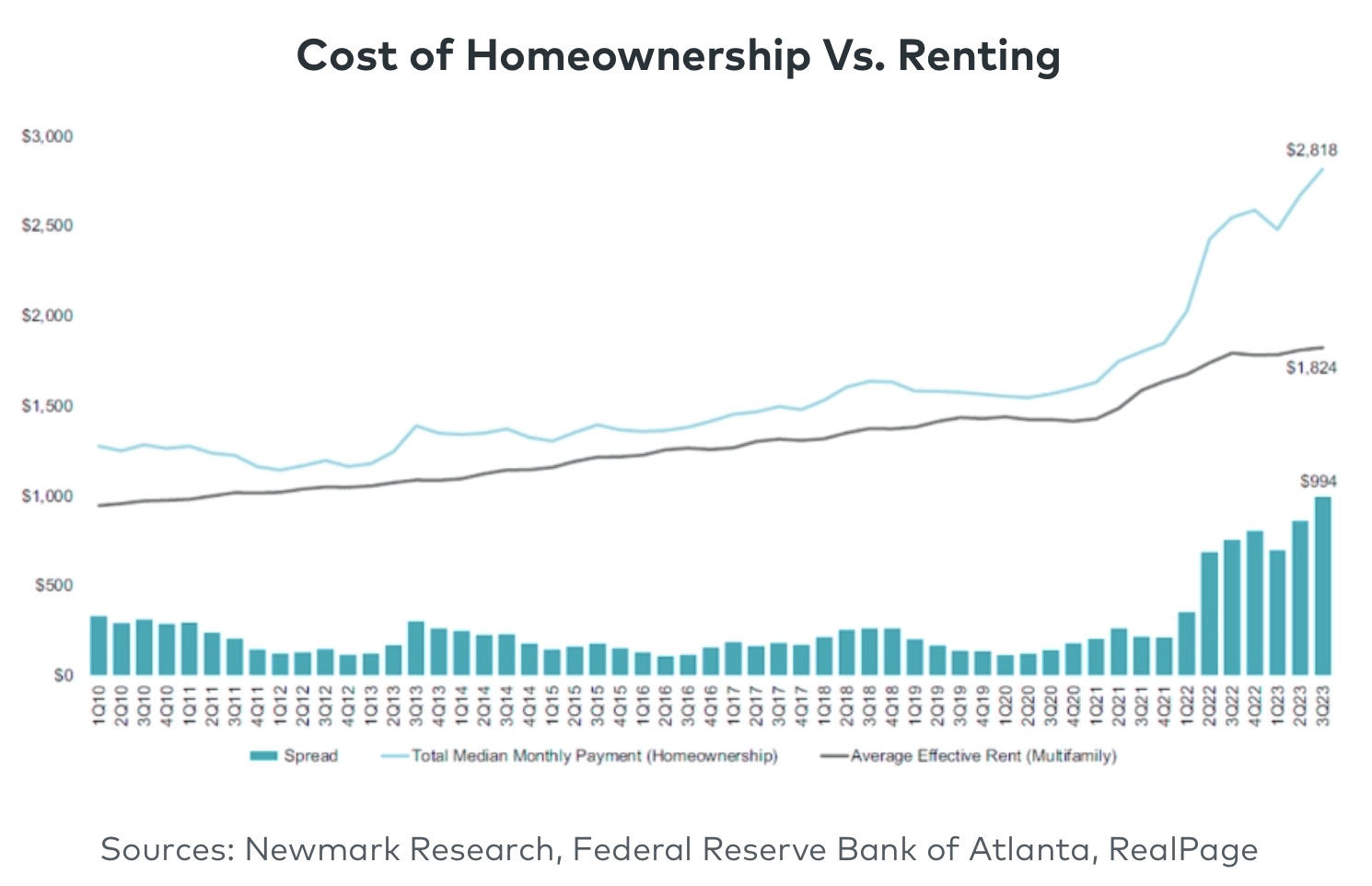

Although demand won’t boom next year, says Apartment List, systemic barriers to homeownership will help create more long-term renters. The combination of record-high prices and spiking mortgage rates has caused home sales to grind to a standstill, since very few buyers can afford to buy, and current owners locked into low rates don’t want to sell.

Origin Investments notes that “This is the worst time possible to buy a home; the price discrepancy between buying and renting is at its most extreme since 1996.”

Meanwhile, concensus expectations are that mortgage rates will ease modestly next year, but not enough to significantly alter the prevailing dynamic of the for-sale market, says Apartment List.

Further forecasts

Hybrid work arrangements will become the new normal for office jobs, even though in 2023 workers began migrating back to the office. The pendulum will never swing back to pre-pandemic norms, says Apartment List. This will drive demand for rentals that provide spaces and amenities that enable a flexible renter workforce to blend work and home life.

Insurance rates, which repriced up dramatically in 2022, due to increased frequency of weather-related disasters and associated costs, will remain high, writes Origin Investments. “Despite owners often getting less for their money, these rates are here to stay and will impact owners who haven’t broadened their margins to account for rising costs.”

Last year, generative AI went mainstream and began to change the way property managers operate and communicate with renters. Apartment List thinks 2024 will see a new wave of AI-powered tools specifically for renters.

Origin Investments’ CO-CEO David Sherer remains bullish on the multifamily market. “We are seeing generational opportunities in senior debt and preferred equity, both of which provide protection in the capital structure and the potential for 10- to 15-percent returns. The world is uncertain, but it remains a mistake to stay out of the investment market, and this will continue to be true in 2024,” he said.