Fannie Mae’s December economic and housing forecast predicts that single-family and multifamily starts will fall in 2024, but not as far as they predicted last month.

Multifamily starts will have milder downturn

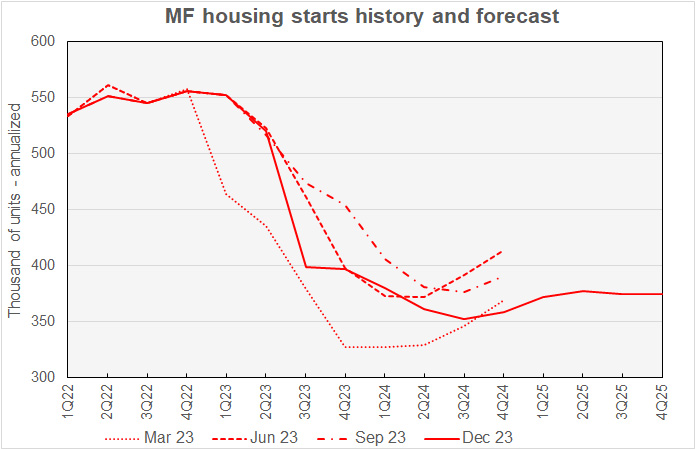

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. Fannie Mae considers any building containing more than one dwelling unit to be “multifamily”, including both condominiums and rental housing units.

The latest forecast revises the quarterly multifamily starts numbers to project that starts will fall more sharply than anticipated in last month’s projections in Q4 2023 and Q1 2024, but that starts will fall by less than previously projected in subsequent quarters. The Q4 2023 starts estimate was revised lower by 13,000 units while the Q1 2024 starts estimate was revised lower by 9,000 units. However, the starts forecast for Q3 2024, again projected to be the low point in this cycle, was revised higher by 15,000 units.

Compared to last month’s forecast, the predicted number of multifamily starts for 2023 was revised lower by 3,000 units to 467,000 units. The predicted number of multifamily starts for 2024 was revised higher by 6,000 units to 363,000 units. The forecast for multifamily starts in 2025 was revised higher by 3,000 units to 372,000 units.

Low point in single-family starts also revised higher

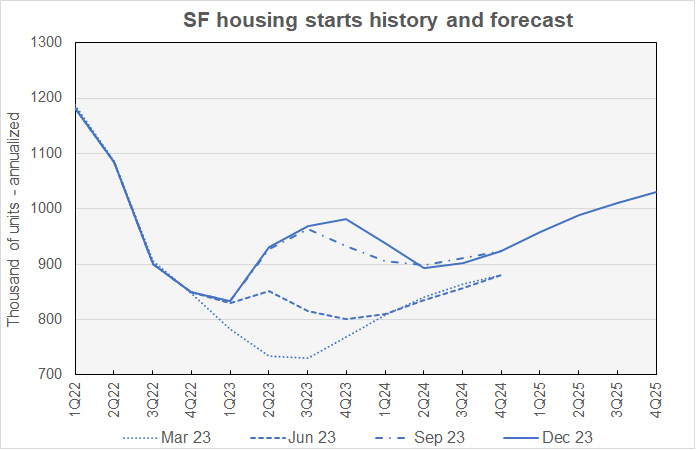

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts.

Compared to last month’s forecast, Fannie Mae’s forecasters raised their single-family starts forecasts for every quarter of their forecast horizon. They continue to expect a pullback from the recent rise in single-family starts, but they now expect that starts won’t begin to fall until Q1 2024, one quarter later than in last month’s forecast. They also revised their forecast for Q1 2024 higher by 73,000 annualized units. Q2 2024 is still expected to be the low point for starts, but projected annualized starts for that quarter were revised higher by 39,000 units to 893,000 units.

Fannie Mae now expects single-family starts to be 928,000 units in 2023, up 12,000 units from the level forecast last month. Fannie Mae now expects single-family starts to be 914,000 units in 2024, up 40,000 units from the level forecast last month. Single-family starts in 2025 are forecast to be 997,000 units, up 32,000 units from the level forecast last month.

2024 expected to be a down year for GDP growth

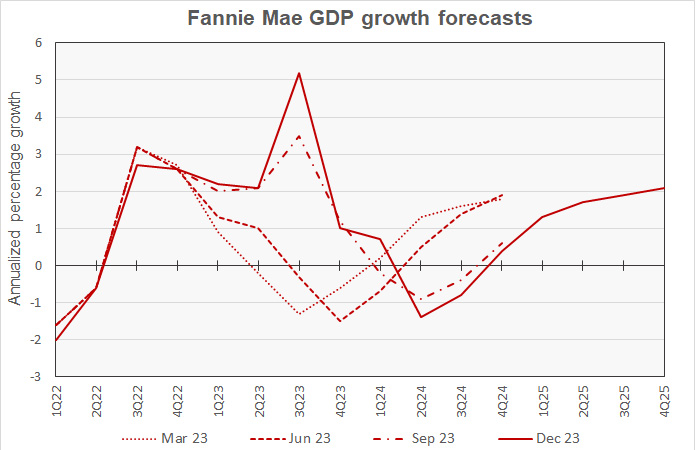

The next chart, below, shows Fannie Mae’s current forecast for Gross Domestic Product (GDP) growth, along with other recent forecasts.

The strength of the U.S. Economy in Q3 2023 was a surprise to most forecasters, including those from Fannie Mae. This is evident in the wide range of forecasts for that quarter illustrated in the above chart. An early indication that growth for that quarter would exceed estimates came from the Atlanta Fed’s GDP Now model. As of December 14, the GDP Now model was indicating GDP growth of 2.6 percent in Q4 2023. However, Fannie Mae’s forecasters are currently calling for GDP growth of only 1.0 percent in Q4.

While there is speculation that the Fed may be able to pull off a soft landing for the economy, Fannie Mae’s forecasters continue to believe that it will experience a recession. As in last month’s forecast, they expect the downturn to occur in Q2 and Q3 2024. The economy is forecast to shrink 1.4 percent in Q2 and somewhat less in Q3, before returning to growth in Q4.

The full year forecast for GDP growth for 2023 was left unchanged at 2.6 percent. The full year GDP forecast for 2024 was revised upward by 0.1 percentage point to -0.3 percent. The GDP growth forecast for 2025 was also revised upward by 0.1 percentage point to 1.7 percent.

Inflation forecasted to revive in 2025

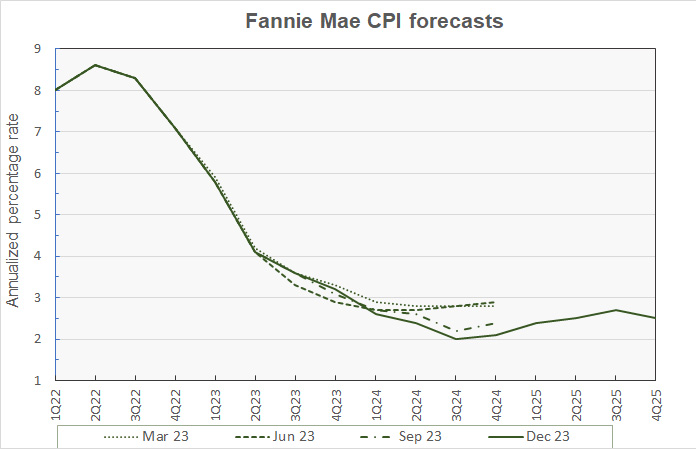

The next chart, below, shows Fannie Mae’s current forecast for the Consumer Price Index (CPI), along with three other recent forecasts.

Fannie Mae’s quarterly inflation forecasts were again only tweaked slightly this month, with no quarterly revision of more than 0.1 percentage point. The forecast calls for CPI inflation to fall to 2.0 percent in Q3 2024 as the economy enters a recession. The forecast then calls for CPI inflation to rise to 2.7 percent in Q3 2025 as growth returns.

Looking at whole-year forecasts, the forecast for year-over-year CPI growth in Q4 2023 was raised 0.1 percentage point to 3.2 percent. The Q4 2024 year-over-year inflation forecast was left unchanged at 2.1 percent. The Q4 2025 year-over-year CPI inflation forecast was lowered 0.1 percentage point to 2.5 percent.

Higher employment predicted

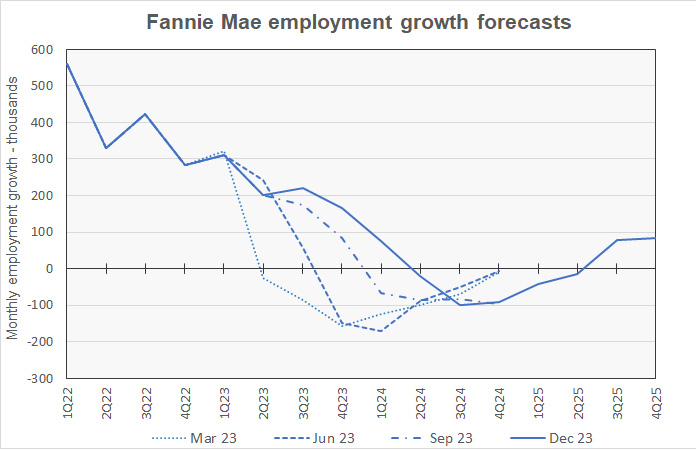

The next chart, below, shows Fannie Mae’s current forecast for employment growth along with two earlier forecasts. Employment growth is our preferred employment metric since job gains, along with productivity gains, drive economic growth. By contrast, the unemployment rate depends on employment but also on the labor force participation rate. Either rising employment or falling labor force participation can drive the unemployment rate lower, but only the former would contribute to economic growth.

The revisions to Fannie Mae’s forecast for job growth are consistent with a slightly later economic downturn. Employment growth is still expected to turn negative in Q2 2024, but positive employment growth is not expected to return until Q3 2025, one quarter later than was forecast last month.

Compared to last month’s forecast, the expected full year forecast for employment growth in 2023 was revised upward from a gain of 2.6 million jobs to a gain of 2.7 million jobs. The employment growth forecast for 2024 was revised from a loss of 900,000 jobs to a loss of 400,000 jobs. The employment growth forecast for 2025 was revised from a gain of 500,000 jobs to a gain of 300,000 jobs.

The Fannie Mae forecast can be found here. There are links on that page to the detailed forecasts and to the monthly commentary.