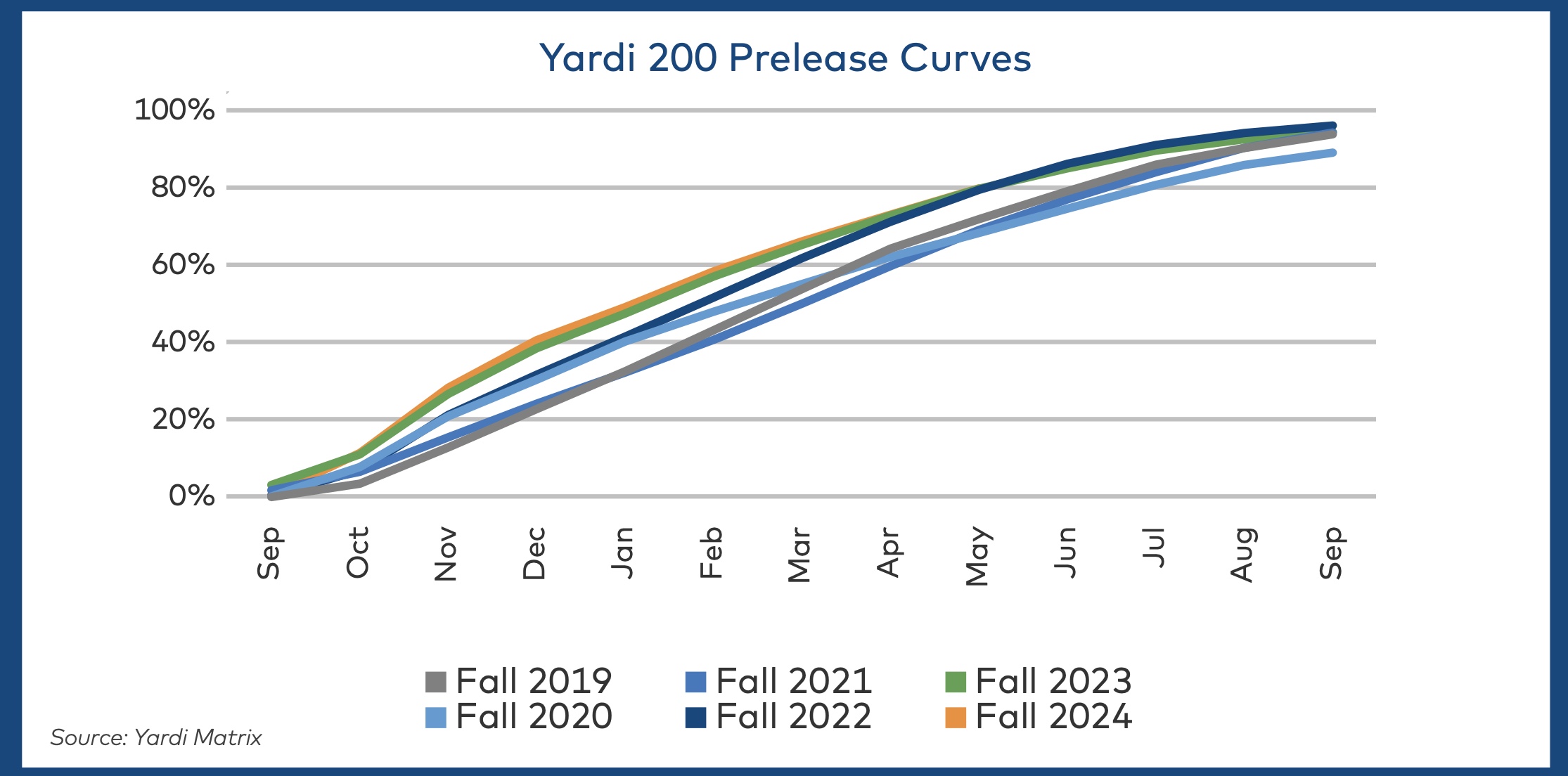

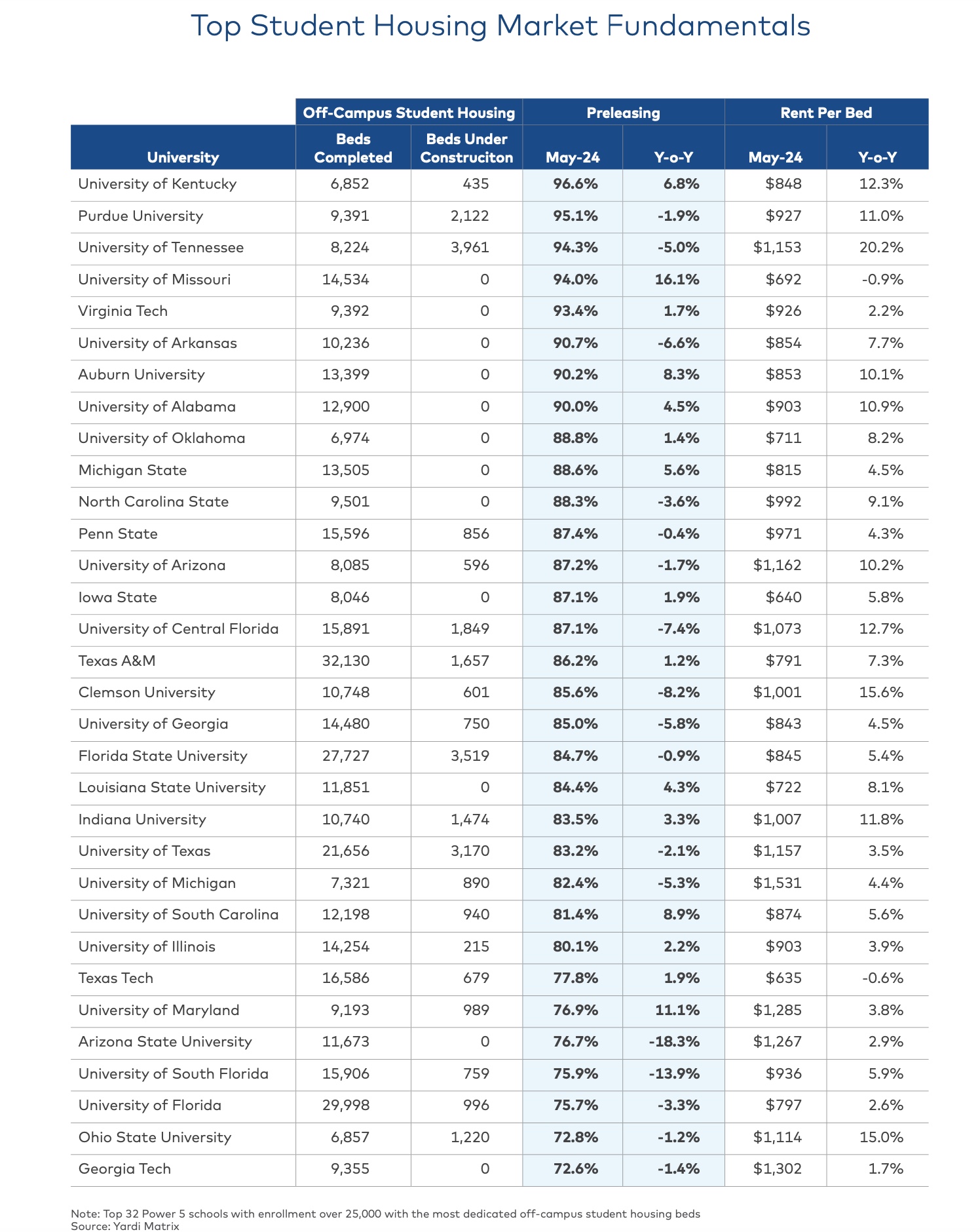

Yardi Matrix released its June 2024 student housing report on the 12th. According to the report, preleasing at Yardi 200 schools continued its upward momentum in May, reaching 80 percent, up from 73.5 percent in April, driven by strong enrollment and limited new supply. May’s preleasing rate is 10 basis points (bps) above last year’s during the same month, according to the latest Yardi Matrix National Student Housing Report.

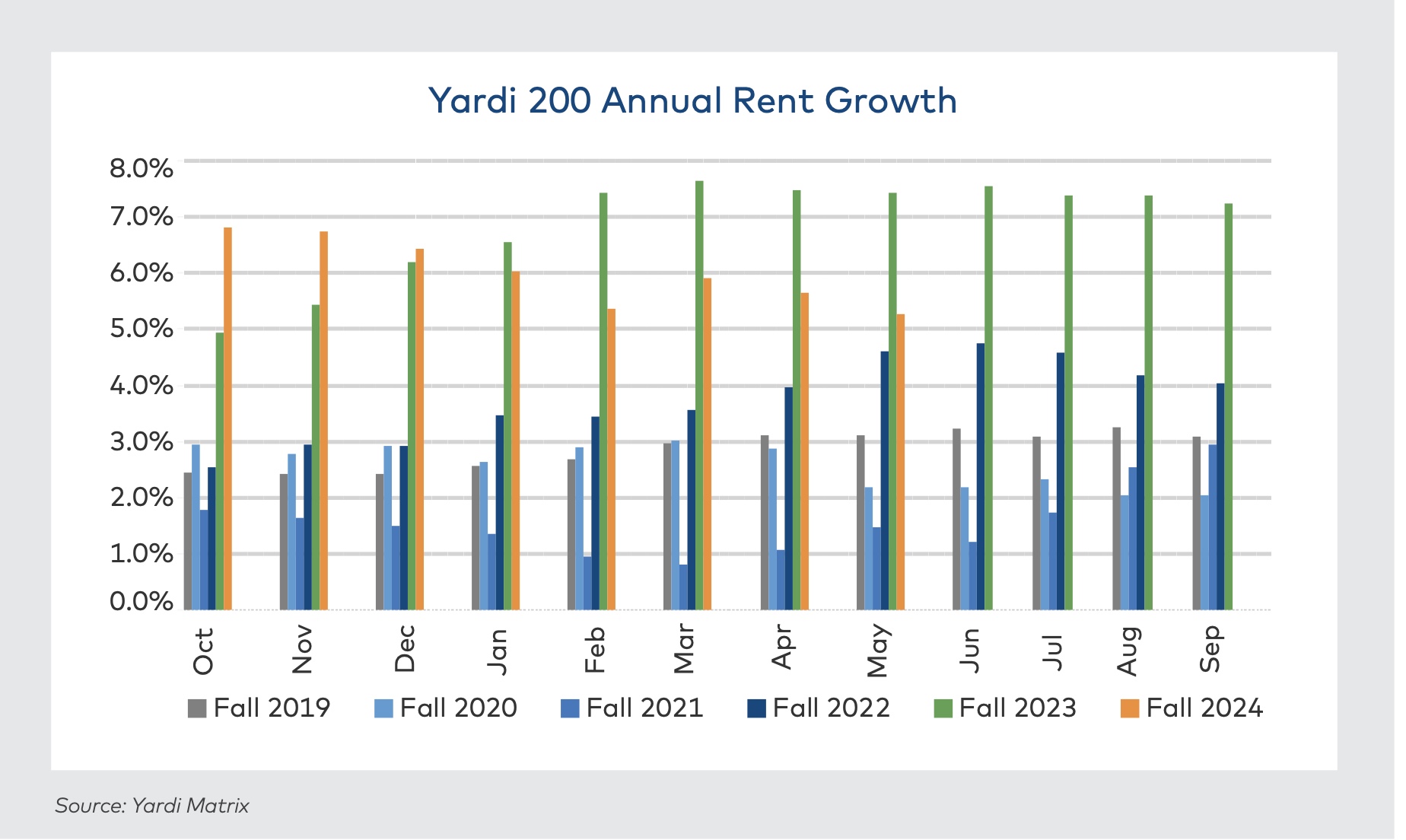

Average published asking rent reached $897 per bed in May, 5.3 percent higher year-over-year, marking an all-time high for the student housing sector under Yardi’s purview But growth rates are slowing both year-over-year and month-over-month and are at the lowest they’ve been this leasing season, said Matrix analysts.

Rent growth of 5.3 percent in May moderated from April’s 5.7 percent and 6.8 percent earlier in season. Rent growth throughout the leasing season has averaged six percent, having benefitted from rising enrollments and new supply. Compare this with annual multifamily rent growth, which was 0.6 percent so far this year.

Universities with the lowest rent growth are in major metros where beds are competeing with weaker multifamily marlets, said analysts.

Performance in the student housing sector is mixed, with some markets struggling to fill beds and others doing well, said Yardi. Last month, 41 markets recorded rent growth in the double-digits, while 34 saw rent declines or remain flat year-over-year.

Five schools including Ole Miss are completely preleased for the upcoming school year, while 34 have about 10 percent more beds to fill. The schools with the highest preleasing rates also saw increases in advertised rents.

But operators are concerned that issues with Free Application of Federal Student Aid filings could impact freshman enrollment this year, since nearly 10 percent fewer members of the 2024 high school senior class completed the forms compared with last year.

Yardi’s student housing data base includes more than 2,000 universities and colleges nationwide, including the top 200 investment grade universities across all major collegiate conferences. Known as the “Yardi 200,” it includes all Power 5 conferences as well as Carnegie R1 and R2 universities.

Meanwhile, Yardi projects 45,495 new beds will deliver this year at the schools it covers, up from 37,576 in 2023 and close to the peak years of 2013 and 2014. Analysts expect supply will return to the long-term average of around 36,400 annual beds delivered over the next five years.

The lion’s share of supply this year will deliver at the University of Wisconsin-Madison, Florida International, the University of Texas-Austin, ASU-Downtown and UC-Davis, all with more than 2,000 beds expected to deliver.

In the current high interest rate environment, student housing properties are selling at a slower pace than last year, but the price per bed is higher. Average sales are $87,500 per bed supported by strong preleasing and rent growth, compared to an average of $80,000 from 2017 through 2023.

Yardi’s complete report is available here.