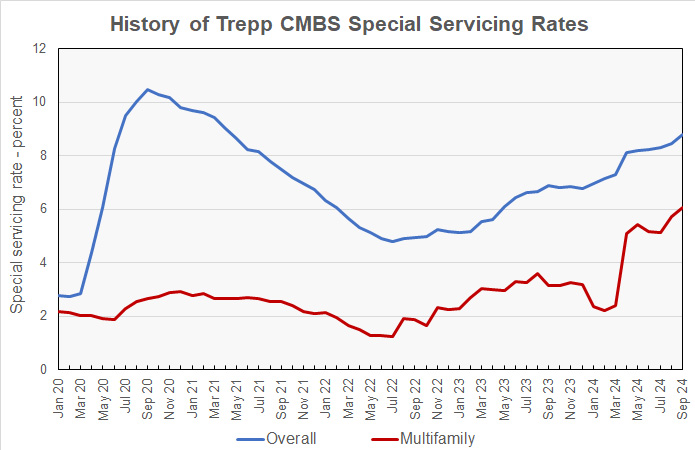

Trepp reported that special servicing rate for multifamily commercial mortgage-backed securities (CMBS) loans continued to move higher in September, rising another 36 basis points. The overall CMBS special servicing rate on commercial property also continued to rise, as rates on all the property types tracked by Trepp moved higher.

Multifamily CMBS special servicing rates jump higher

The special servicing rates on CMBS loans on multifamily property rose for the second month in a row in September. The September rate increase put the special servicing rate back on the upward trajectory it had followed between July 2022 and July 2023. According to Trepp, the 6.07 percent multifamily special servicing rate is its highest level in nearly 9 years.

The report found that overall CMBS special servicing rate rose to 8.79 percent, up from 8.46 percent the month before. This rate has been trending higher since July 2022 and has risen for 9 straight months.

The special servicing rate on CMBS loans on industrial properties is again by far the lowest of any commercial property type covered. However, it moved 11 basis points higher this month, reaching 0.50 percent. The rate on lodging properties climbed 42 basis points to 7.84 percent. The special servicing rate on office properties once again had the largest gain for the month, jumping another 67 basis points to 12.58 percent. The rate for retail properties also rose significantly this month, climbing 30 basis points higher to 11.22 percent.

The history of the overall and multifamily CMBS special servicing rates as reported by Trepp since January 2020 is illustrated in the chart, below.

The full Trepp special servicing rate report can be found here.

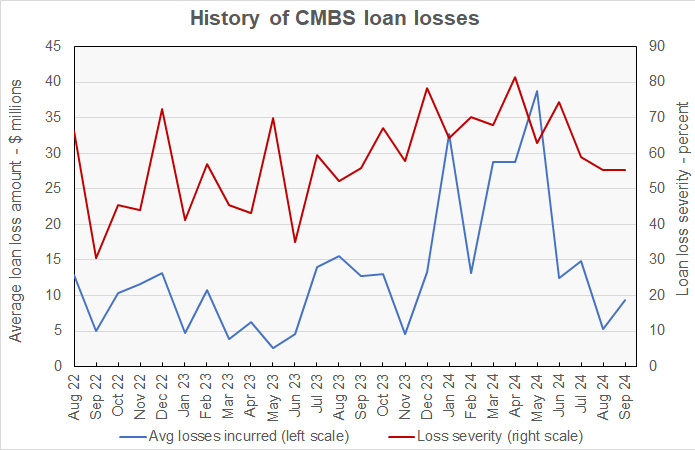

Loan loss severity nearly unchanged

Trepp also recently reported on the volume and severity of loan losses on CMBS loans which were resolved in September. However, it does not break down this data by the type of property covered by the loans. The history of this data since August 2022 is shown in the next chart, which shows the average loss incurred per resolved loan along with the average percentage of a resolved loan’s value that was lost during resolution.

The chart shows that the severity of CMBS loan losses was nearly unchanged in September at 55.26 percent, although the average loss per loan rose to $9.3 million. The number of loans resolving in the September rose from 9 to 15. The total dollar value of the loans that resolved rebounded to $139.5 million, slightly less than the monthly average of $169.2 million over the last 12 months.

Since monthly loan loss data can be volatile, Trepp also reports on the 12-month trailing average loss severity. This figure reached 65.97 percent this month, up from 65.29 percent last month. A year ago, it was 52.71 percent. The September loan loss severity report can be found here.