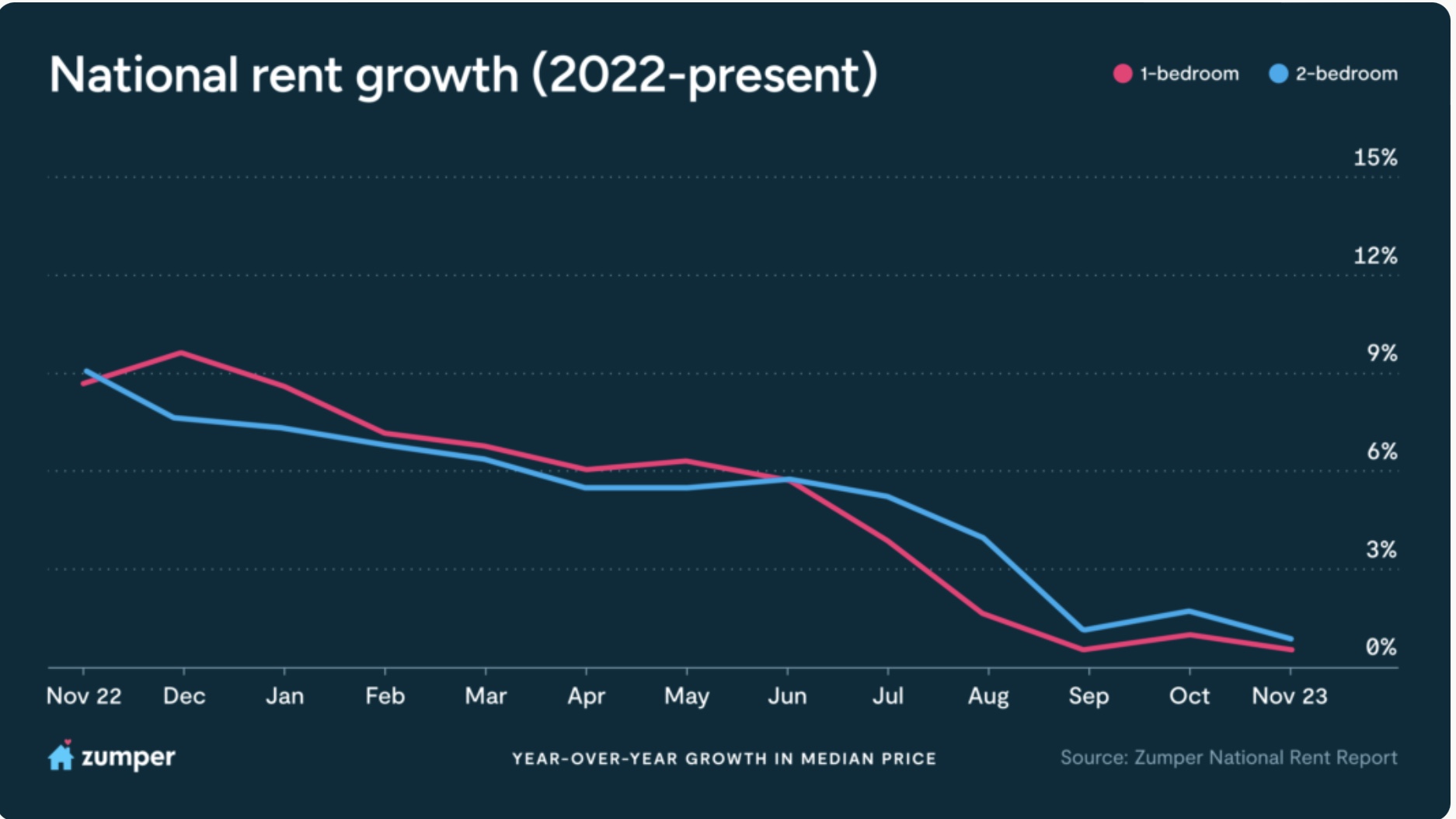

Zumper, one of the nation’s largest rental platforms, declared a renters’ market in its most recent National Rent Report. Easing inflation, slowing migration and a record number of new apartment deliveries are affording renters more options, less competition and softer rents in many markets.

Heading into 2024, renters are facing a much less stressful situation than a year ago, although rents also declined year-over-year last December.

Rents in half the cities on Zumper’s top 100 list were down in November compared to last year. This is reflected in Zumper’s National Rent Index, where national medians for both one- and two-bedroom rental homes are down for the second month in a row and the year-over-year growth rates for both are at their lowest points since December 2020.

The continued softening is due in part to pandemic-era price hikes finally normalizing in many markets, especially across the Sun Belt, where Zumper is seeing the steepest rates of decline.

“We’re seeing most major markets settle into their new resting heart rates,” said Zumper CEO Anthemos Georgiades.

More support for a renters’ market is that nearly 10,000 buildings on Zumper’s platform are offering rent specials at a time when home ownership is 52 percent more expensive than renting nationwide – the widest gap on record.

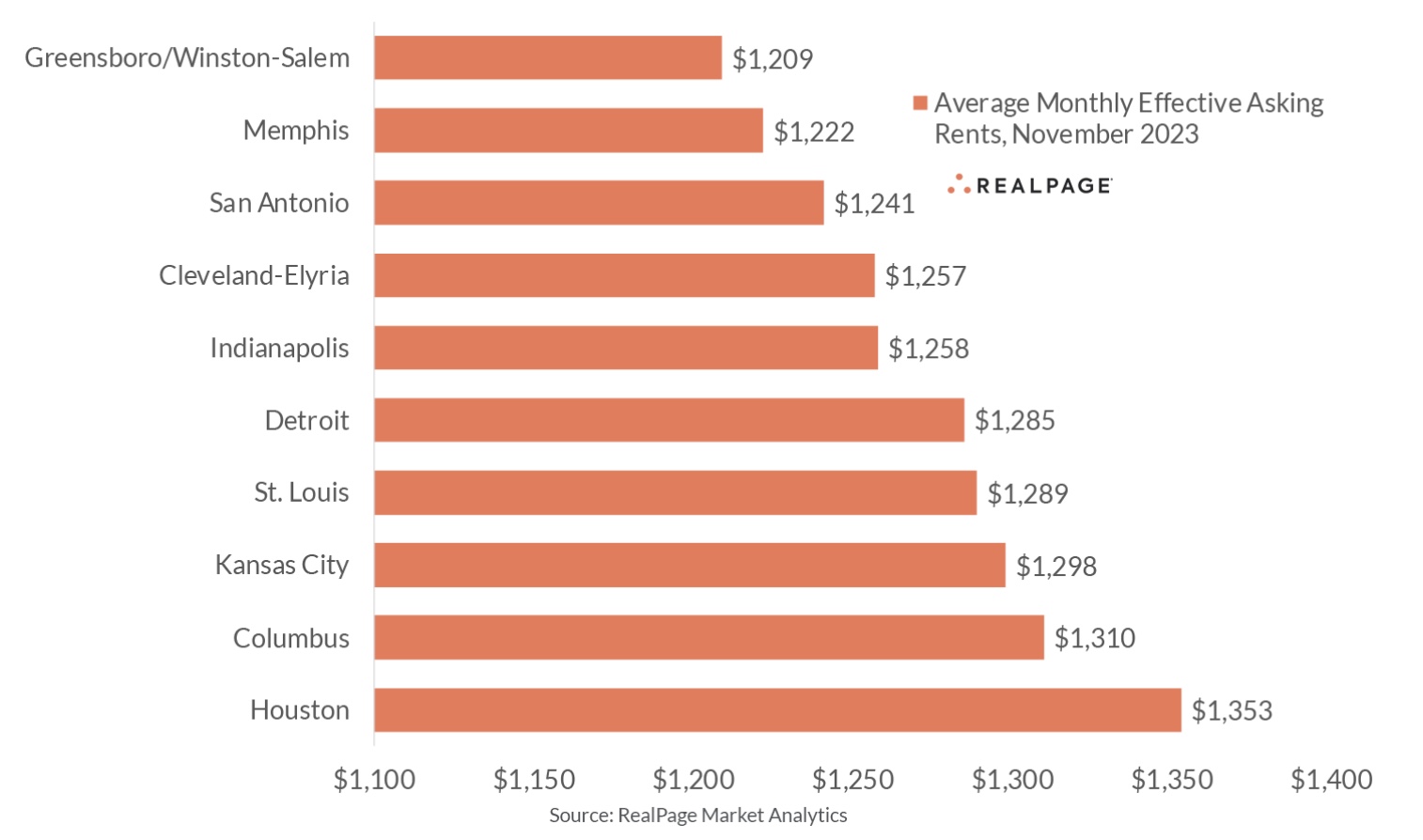

RealPage names nation’s most affordable markets

According to RealPage Market Analytics, apartments are more affordable in the South and Midwest. Of the nation’s 50 largest markets, six of the most affordable are in the Midwest and four are in the South.

The South takes the top three slots on RealPage’s most affordable list, with Greensboro/Salem coming in as number one with average effective asking rents of $1,209 in November, nearly $600 a month less than the national average of $1,805.

While monthly rents in Memphis average $1,222 and $1,241 in San Antonio, both of those South regional markets rank among the nation’s weakest in terms of occupancy performance. The lowest occupancy reading is 91.2 percent in San Antonio, followed by 92.1 percent in Memphis and 92.6 percent in Greensboro/Winston-Salem.

Midwest markets constituted a big slice of the most affordable rents list. These range from $1,257 in Cleveland to $1,310 in Columbus. Houston rounds out the nation’s 10 most affordable markets with average monthly rents of $1,353 in November.

Meanwhile, the country’s highest rents can be found in New York, where monthly asking rents average $4,501. New York also boasts the nation’s highest occupancy rate of 97 percent.