The student housing sector ended a stellar 2024 leasing season, according to the October national student housing report from Yardi Matrix. Preleasing and rent growth both were close to last year’s historic levels and more than half of Yardi 200 schools achieved at least 95 percent occupancy. Another positive for the sector is that Yardi anticipates sales activity in the sector will pick up going into Q4 2024 and 2025.

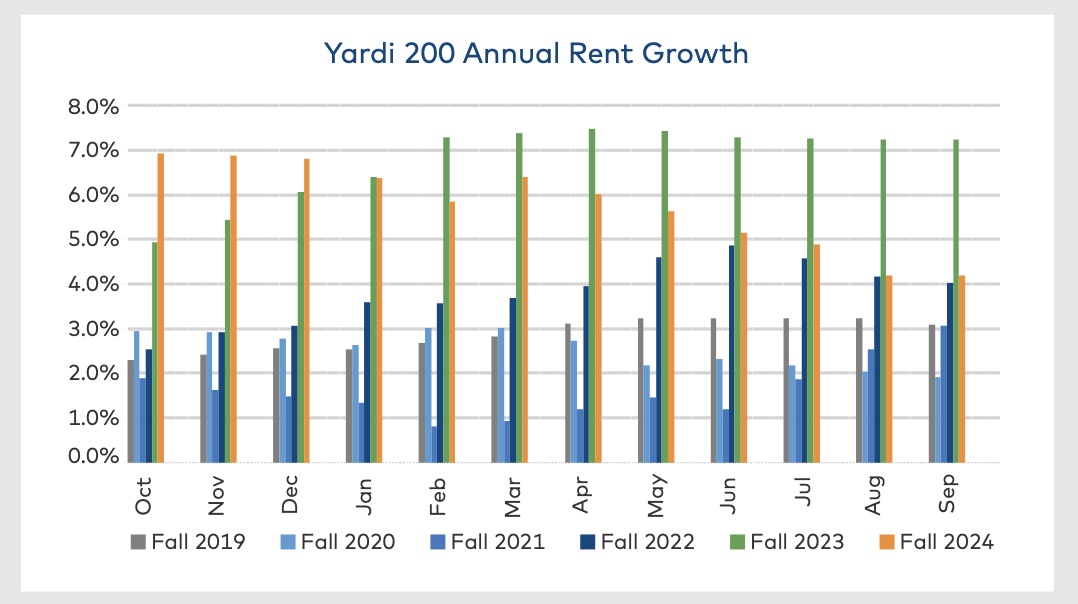

According to Yardi Matrix data, rent growth slowed by September to 4.2 percent in the sector, which averaged 5.8 percent rent growth over the last 12 months, lower by comparison with 6.8 percent rent growth in 2022-23, but more than the trailing 12-month average of 2.6 percent from 2019 to 2022, and more than the multifamily sector’s roughly flat rents. Yardi expects these trends to continue into the 2024-2025 leasing season.

During the last few months of the leasing season, average advertised rents per bed fell from $901 in May to $896 in September, but 72 percent of the beds among the Yardi 200 were already preleased by April, meaning overall rent growth for the 2024-2025 season was likely more than 6 percent, said the report.

Thirty-two schools averaged more than 10 percent rent growth, while 22 schools averaged rent declines during the season. Many markets that registered the biggest rent growth hikes in September also registered strong enrollment increases over the past several years, as well as fast lease ups in the 2023-2024 season.

A number of schools with the weakest rent growth over the past year are in urban markets where student housing supply could be competing with a weaker multifamily market.

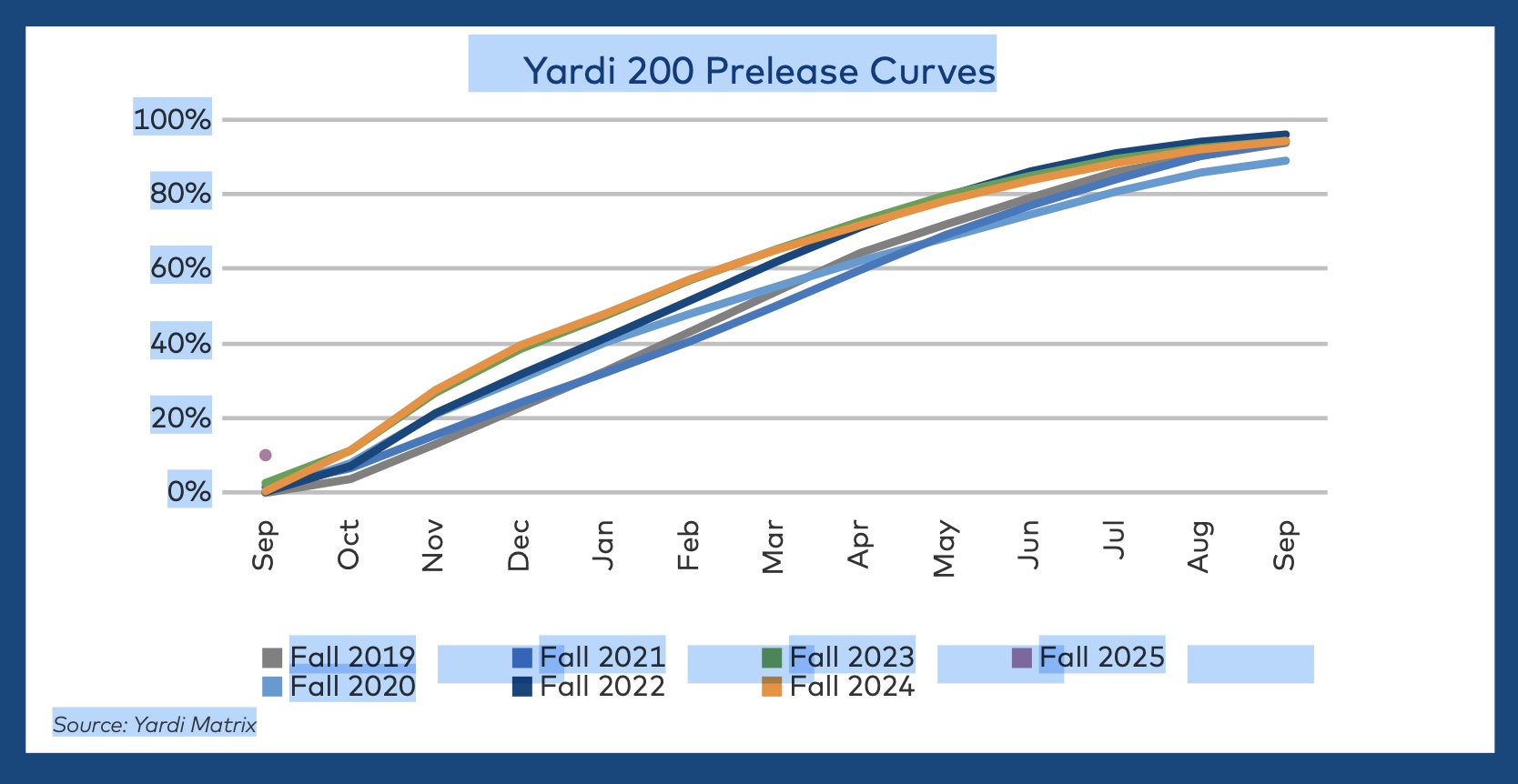

Surveyed preleasing for the Yardi 200 schools reached 92.9 percent in August 2024, 20 basis points ahead of August 2023, when many markets saw the return of student tenants.

During the first five months of the 2023-2024 preleasing season, preleasing was strong, only to slow in winter and spring. Occupancy reached 94.5 percent in September 2024, 10 basis points lower than September 2023, while preleasing for fall 2025 reached 10.2 percent in September based on limited data, with four schools more than 25 percent preleased in the first months of leasing.

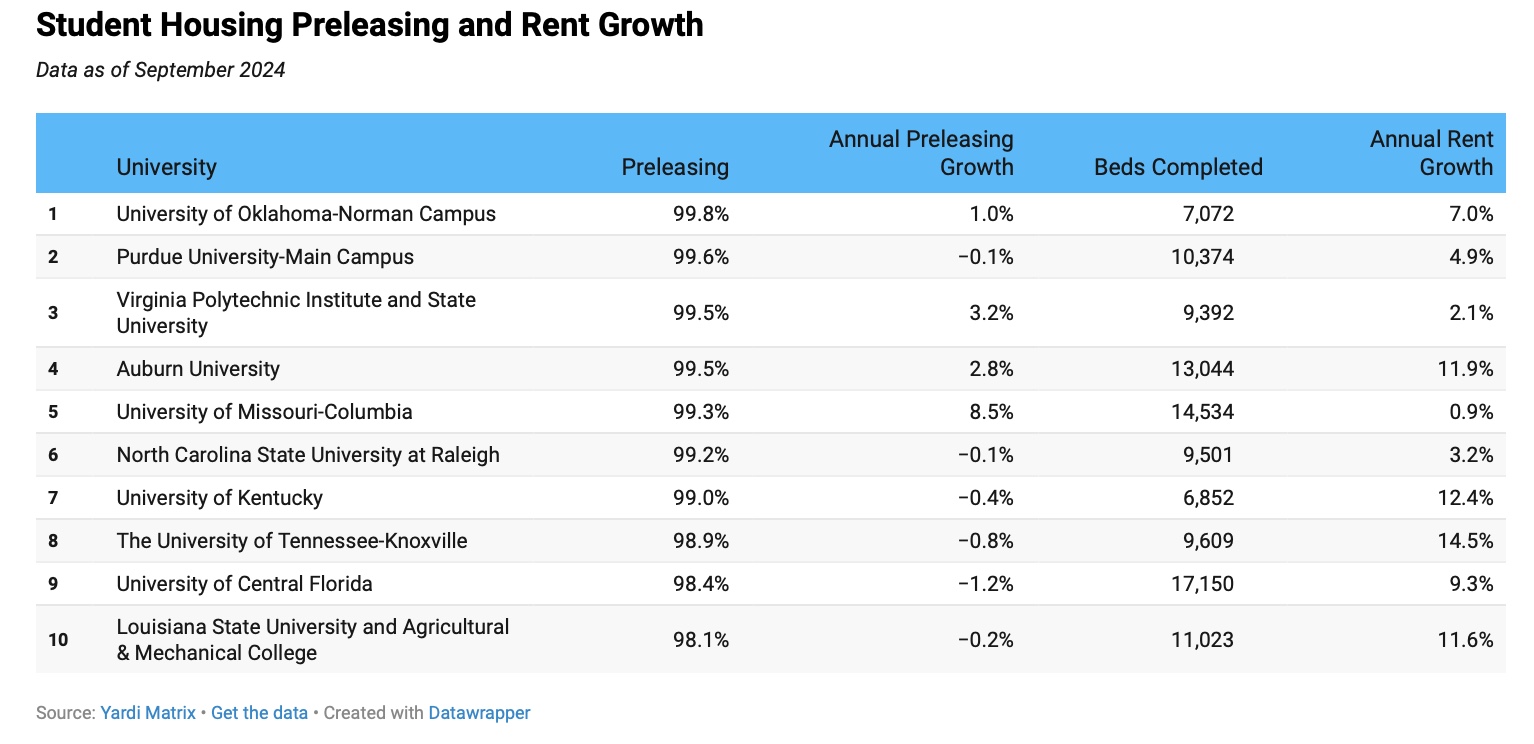

By September, 50 schools had reached 99 percent occupancy. Most of these lacked new supply deliveries in 2024 and have experienced some recent enrollment growth. Meanwhile, 21 schools ended the season with less than 85 percent occupancy. Most of these had a significant number of bed deliveries in 2024 and most markets saw a decline in enrollment last year.

Occupancy improved by five percent or more in 23 Yardi university markets, most of which benefited from a pause in new deliveries this year after struggling to absorb new supply last year. Thirty-three schools, many with new supply deliveries that challenged the markets, fell behind last year’s occupancy level by five percent or more.

The chart below shows the top ten Yardi schools with the highest percentage of beds preleased as of September and the corresponding rent growth.

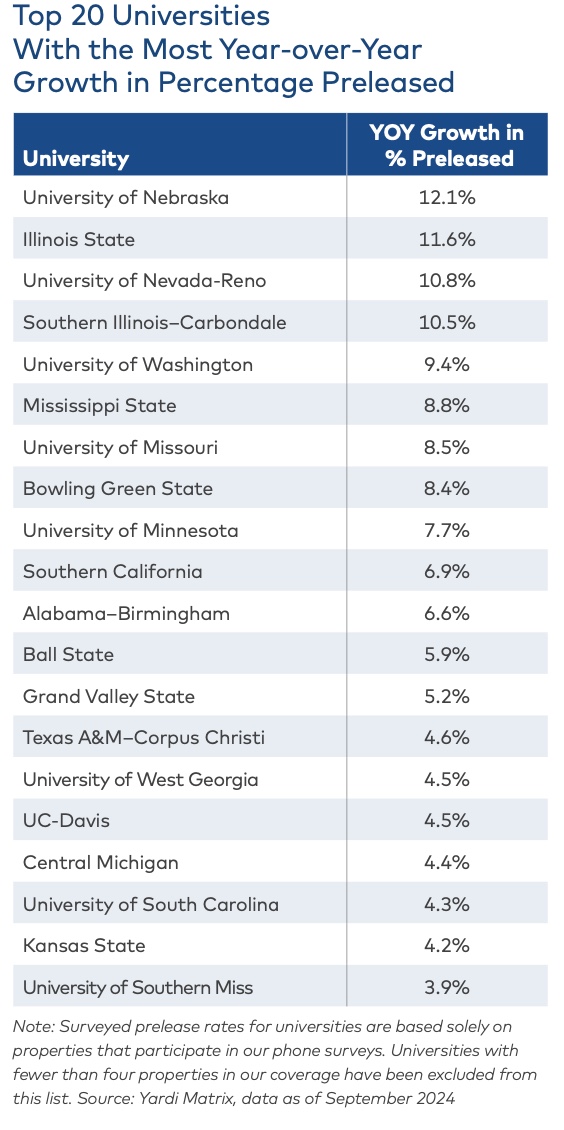

In the next chart are the top 20 schools with the most growth year-over-year in percentage preleased.

Yardi Matrix expects Yardi 200 schools will see 41,432 beds delivered in 2024, representing a five percent decrease from 2023.

Yardi Matrix expects Yardi 200 schools will see 41,432 beds delivered in 2024, representing a five percent decrease from 2023.

Investments in the sector have increased in the past few months, with around 39,000 beds sold year-to-date as of September, representing a 10 percent decrease since the same period in 2023 and eight precent below the average for 2017-2019.

The complete report is available here.