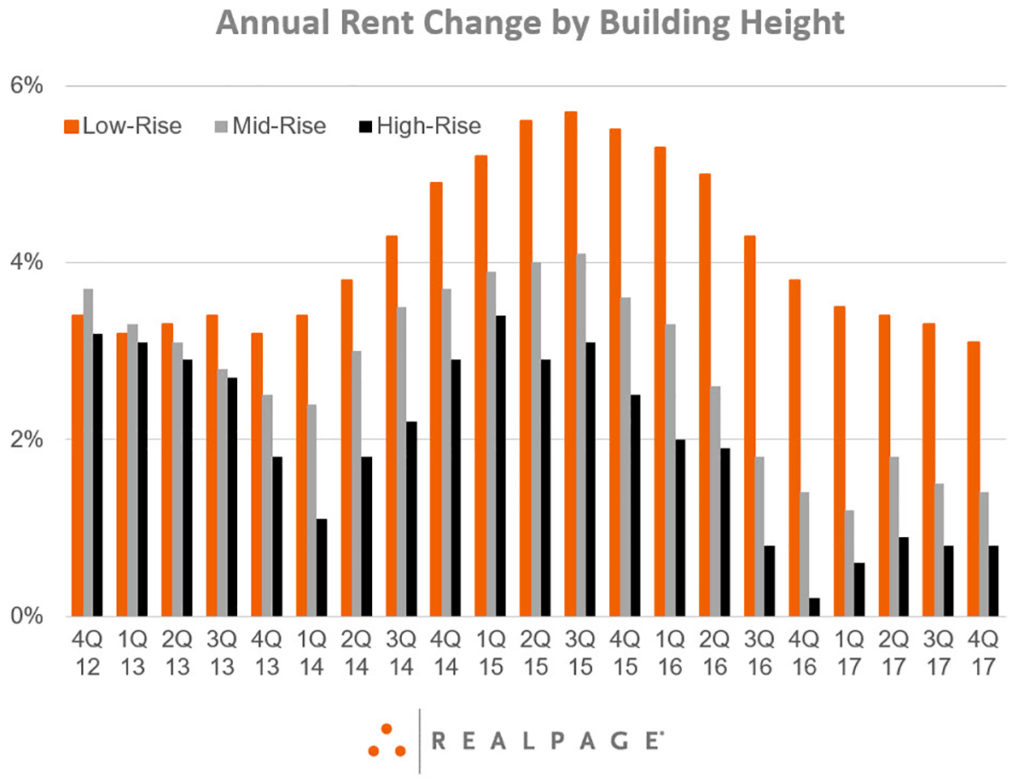

Rents in low-rise garden apartments continue to rise faster than pricing in taller residential structures. Garden apartments, defined as properties of one to three stories, register 3.1 percent rent growth for 2017, versus 1.4 percent rent increases in mid-rise developments of four to six stories and just 0.8 percent rent bumps in high-rise product of seven or more stories.

The past year’s performance echoes the stronger rent inflation posted in garden apartment properties from 2013 through 2016. The last time rent growth proved comparable across various building heights was 2012, before new apartments began to come on stream in such large volumes in the current economic cycle.

Indeed, that new supply volume is one of the key influences on variation in rent growth by building height. Nearly all of this cycle’s new supply consists of mid-rise and high-rise properties. In most metros, it is very tough to get a lower-density new development to pencil out financially in the urban core or a closer-in suburb. Thus, garden construction is occurring only at the far fringes of the metropolitan area, if at all.

Even with a much stronger rent growth pace registering in garden units, the mostly older low-rise properties still produce notably lower total rents. The nation’s typical monthly price for a garden apartment is $1,175, versus $1,635 for a mid-rise unit and $1,986 for a high-rise apartment.

The 95.2 percent occupancy rate for garden properties runs a little stronger than the rates in higher-density projects, but the difference is slight. Mid-rise communities are 94.7 percent full, and high-rise developments log occupancy of 94.4 percent.

Author: Greg Willett