Waterton, a national real estate investor and operator, today announced it acquired an 18-building, 280-unit garden apartment community located in the Denver suburb of Thornton, Colorado.

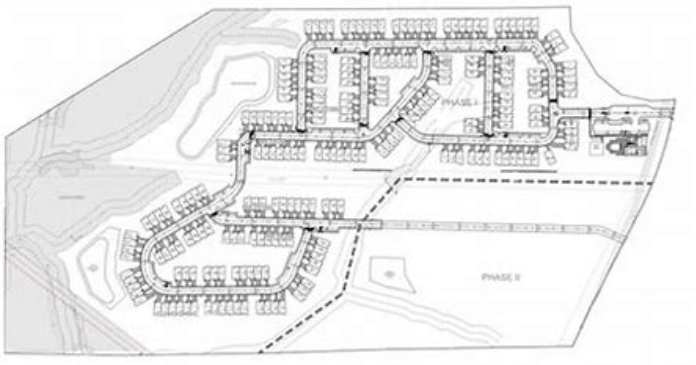

The property, located just north of Denver in close proximity to both the downtown Denver and Boulder job centers, consists of two phases, including 10 two-story buildings completed in 2016 and eight recently completed three-story buildings.

The community is immediately adjacent to the new Thornton Station of the Regional Transportation District’s North Metro Line, scheduled to open by 2020, providing access to commuter trains offering a 20-minute commute to downtown Denver. The Ridge at Thornton is just east of the intersection of Highway 44 and I-25, in close proximity to north Denver’s premier retail corridor.

“With the recent completion of Phase II, we are excited about closing on the Ridge and completing the lease-up. There is little new product in the Thornton submarket and there are no nearby communities located on top of a future light rail station. That competitive advantage will be a game changer for the community,” said Peter Kuzma, Vice President of Acquisitions, who led the transaction. The addition of new amenities and the opening of the new rail station is expected to increase demand resulting in premium stabilized rents.

“The Thornton submarket enjoys healthy supply/demand fundamentals and is well-positioned to experience growth as the corridor continues to add jobs and infrastructure,” said Mr. Kuzma. “The combination of the market’s affordability and the recent improvements to transit infrastructure will not only lead to household growth, but also an increase in employment opportunities for residents.”

About Waterton

Waterton is a real estate investor and operator with a focus on U.S. multifamily and hospitality properties. Founded in 1995, Waterton executes value-add strategies and manages a national portfolio of multifamily and hospitality properties on behalf of institutional investors, family offices and financial institutions. Waterton is privately held and is headquartered in Chicago with regional teams throughout the United States. As of June 30, 2018, Waterton’s portfolio includes approximately $4.3 billion in real estate assets.