2024 could be the year of the distressed deal

Investors are finally starting to take advantage of distress in the multifamily sector, even though the huge wave of distress pundits predicted last year failed to materialize.

In February, multifamily distress hit its highest level...

The sticky combination of heat and high humidity

Extreme weather alerts in a community communications program is an operational baseline. Extreme weather warnings can help residents understand their risk and protect themselves, which is especially important for small children and older adults,...

Aging boomers rekindle senior housing market

Senior housing has been one of the biggest disappointments for commercial real estate investors. Now thanks to millions of aging baby boomers, that may be about to change.

The oldest boomers turn 80 in less...

Bozzuto acquires Gables property

Over the last decade and a half, it has made much more sense for Bozzuto to build rather than buy apartments. However, as it has become harder to pencil out new projects, the Greenbelt,...

New metrics make Midwest investment attractive

Recently, the Midwest has shown surprising growth and economic resilience, making this region an attractive candidate for multifamily development, investment and general interest.

Often considered the slowest growing region in the U.S., the Midwest has...

The state of affordable housing

Housing affordability has emerged as a key issue in this year’s U.S. presidential election. Both Democrat Kamala Harris and Republican Donald Trump have talked about what they would do to increase the supply of...

Investors circle overleveraged apartments

Rescue capital is available for apartment borrowers that need it, but relatively few owners of over-leveraged apartment properties are willing to pay the price—so far.

High interest rates have stranded the owners of over-leveraged apartment...

Rents fall behind inflation

Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (September 2021:...

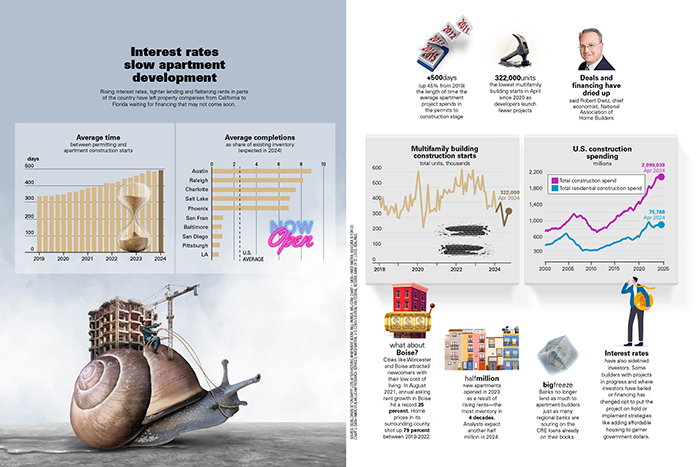

INFOGRAPHIC: Interest rates slow apartment development

Rising interest rates, tighter lending and flattening rents in parts of the country have left property companies from California to Florida waiting for financing that may not come soon.

+500 days (up 45% from 2019)...

The incredible disappearing Starwood CRE investor

The $10 billion fund from Starwood Capital Group has been trying to preserve its available cash and credit by limiting investor redemptions. In the first quarter, the fund was hit with $1.3 billion in...

Increasing apartment supply is slowing new lease-up velocity

Increasing apartment supply is slowing new lease-up velocity, said Madera Residential head of investment strategy and research Jay Parsons. Leasing velocity for newly built apartments is at its slowest pace in recent...

Class B apartments lead occupancy increases

Apartment occupancy has increased across all three asset classes lead by Class B, despite a 50-year-high wave of new apartment deliveries, according to RealPage Analytics. Seven consecutive quarters of record new apartment...

Empty apartments finally start to fill

The biggest apartment construction boom in four decades flooded the market with new supply over the past two years. Apartment owners had to contend with a surge in empty units.

That is starting to change.

The...

California to turn unused school land into millions of housing units

In an effort to address a lack of housing that officials say has contributed to a shrinking teaching workforce, the California Department of Education is planning on converting undeveloped school lots into affordable housing.

State...

1.1 million apartments occupied since 2020

National apartment occupancy hit a 10-year low at the end of 2023, while demand reached its highest point since Q2 2022 and continues to be strong. The number of occupied apartments in...