Berkadia arranges financing for acquisition of Frontal Trust’s single-family rental portfolio in Miami-Dade County

Berkadia announces it has arranged a $17.15 million loan for the acquisition of 125 condos and single-family homes located within Miami-Dade County, Florida. The majority of the assets are located in Homestead and include...

American Landmark acquires new luxury apartments in San Antonio, Texas

American Landmark Apartments, one of the fastest-growing multifamily owner-operators in the country, announces it has acquired Palmette Pointe Apartments, a 328-unit apartment community located in the northwest section of San Antonio, Texas, in the...

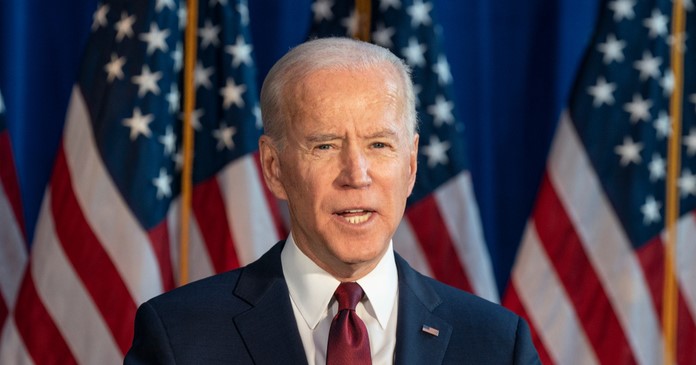

Reconciliation framework includes $150 billion for housing

President Biden released a framework for a reconciliation bill that would implement his legislative priorities. No text for actual legislation was provided, so the framework is only the general outline of a plan at...

Lynd Living acquires value-add apartment community in Austin, Texas for $46.6 million

Lynd Living, a Texas-based multifamily investor, developer and operator, has acquired its fourth property in Austin, Texas in the past 20 months. On October 28, Lynd Living, in partnership with an institutional buyer, closed...

Stepp Commercial completes $3.95 million acquisition of a 16-unit apartment property in Downey, California

Stepp Commercial, a leading multifamily brokerage firm in the Los Angeles market, has completed the $3.95 million acquisition of a 16-unit apartment property located at 11502 to 11506 Adco Avenue in Downey, Calif. Stepp Commercial’s...

PCCP, LLC provides $40 million senior loan to Carmel Partners for the acquisition of...

PCCP, LLC announced it has provided a $40 million senior loan to an affiliate of Carmel Partners for the acquisition of One38 Apartments, a 101-unit apartment community located adjacent to the San Jose Convention...

October apartment market conditions show strong improvement

Apartment market conditions showed continued improvement in the National Multifamily Housing Council’s Quarterly Survey of Apartment Market Conditions for October 2021. The Market Tightness (82), Sales Volume (79), and Equity Financing (65) indexes came...

WPD Management hires Dan Nagle as Director of Business Development

WPD Management, a property management company operating throughout the south side of Chicago, has hired Dan Nagle as Director of Business Development. Nagle is the first person to hold this position at the company...

Middleburg Communities announces $63.8 million sale of Mosby at Riverlights in Wilmington, North Carolina

Middleburg Communities, a Vienna, Virginia-based real estate investment, development and management firm announces the $63.8 million sale of Mosby at Riverlights, a 250-unit Class A apartment community at 4027 Watercraft Ferry Avenue in Wilmington,...

CBRE arranges sale of 331-unit Seven Springs community in Burlington, Massachusetts

CBRE announced that it has arranged the sale of Seven Springs, a 331-unit luxury, garden-style apartment community located at 1 Seven Springs Lane in Burlington, Massachusetts. CBRE Capital Markets’ multihousing experts Simon Butler, Biria St....

Trepp assesses CRE loan health

A new report from Trepp takes a look at the state of commercial real estate (CRE) lending in Q3 2021. While the report covers lending for all commercial property types, this article focuses on...

Interra Realty brokers $5.2 million sale of mixed-use building in Chicago’s Southport corridor

Interra Realty, a Chicago-based commercial real estate investment services firm, announced it negotiated the $5.2 million sale of 3546 N. Southport Ave., a mixed-use property with 21 apartments and two commercial spaces in the...

Cushman & Wakefield arranges $30.3 million loan on behalf of Gindi Equities

Cushman & Wakefield announced that the commercial real estate services firm has arranged a $30.3 million acquisition loan on behalf of Gindi Equities for Chapel View, a 224-unit apartment community located in Chapel Hill,...

The Multifamily Group brokers 350 units in Lubbock, Texas

The Multifamily Group (TMG), a Dallas-based commercial real estate brokerage firm, announced this week that it had facilitated the sale of a portfolio of assets in Lubbock, Texas. Jon Krebbs represented the seller, and...

Institutional Property Advisors closes $59.5 million San Diego County multifamily asset sale

Institutional Property Advisors (IPA), a division of Marcus & Millichap, announced the sale of Sycamore Hills Village, 155-unit multifamily asset in Vista, California. The property sold for $59.5 million, or $383,870 per unit. “The acquisition...