Class B apartments lead occupancy increases

Apartment occupancy has increased across all three asset classes lead by Class B, despite a 50-year-high wave of new apartment deliveries, according to RealPage Analytics. Seven consecutive quarters of record new apartment...

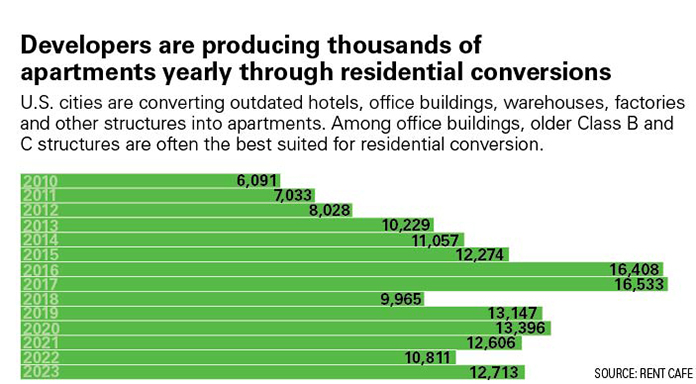

Office to apartments

download pdf

Hybrid work is likely here to stay. This shift isn’t just changing lifestyles—it’s also affecting commercial spaces. Office vacancy rates post-COVID shot up almost overnight, and they remain near 20 percent nationwide, the...

Apartment market fundamentals stabilized in July, reports RealPage

According to data from RealPage Analytics, apartment fundamentals stabilized in July. Rent growth and occupancy remained relatively steady during the month. National occupancy was 94.2 percent for the third straight month, which...

California to turn unused school land into millions of housing units

In an effort to address a lack of housing that officials say has contributed to a shrinking teaching workforce, the California Department of Education is planning on converting undeveloped school lots into affordable housing.

State...

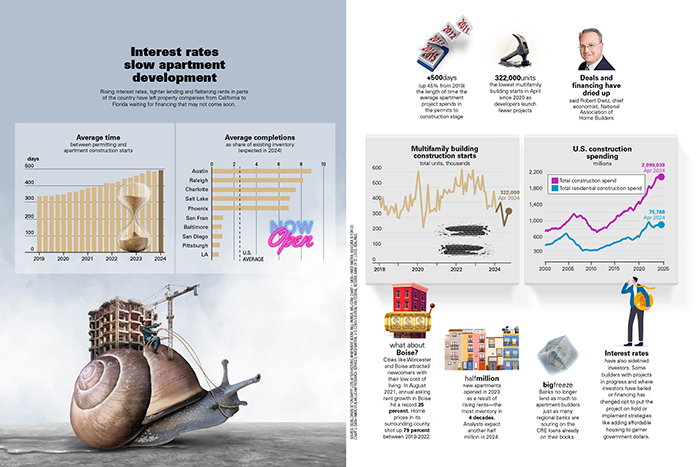

INFOGRAPHIC: Interest rates slow apartment development

Rising interest rates, tighter lending and flattening rents in parts of the country have left property companies from California to Florida waiting for financing that may not come soon.

+500 days (up 45% from 2019)...

The housing theory of childless cat ladies

Would a YIMBY building boom rejuvenate urban family life or produce sterile, megacity hellscapes?

Housing Boom = Baby Bust?

America’s low birth rate is in the news again, thanks largely to Vice Presidential candidate Sen. J.D....

Increasing apartment supply is slowing new lease-up velocity

Increasing apartment supply is slowing new lease-up velocity, said Madera Residential head of investment strategy and research Jay Parsons. Leasing velocity for newly built apartments is at its slowest pace in recent...

Yardi Matrix looks at student housing trends for Fall 2024

According to the Yardi Matrix Fall 2024 student housing report and webinar, the strong getting stronger is an emerging theme among the Yardi 200. Yardi tracks the performance of 1.15 million student...

Student housing sector ends stellar 2024 leasing season

The student housing sector ended a stellar 2024 leasing season, according to the October national student housing report from Yardi Matrix. Preleasing and rent growth both were close to last year’s historic...

Multifamily core and value-add metrics outperform expectations

Much news about multifamily has been about the difficulties in the asset class. A new report from CBRE Research raises an interesting comparison to the office segment—a differentiation in performance by property subclass.

CBRE said...

Market demand sets stage for few rent hikes

While asking rents for new leases nationally are running nearly flat over the past 12 months, those figures are heavily influenced by the Sunbelt, where record-high supply has turned rent growth negative in some...

Market set for recovery

The multifamily housing market is showing promising signs of recovery, with recent data from CoStar Group revealing a significant increase in demand and stabilization of vacancy rates.

Absorption rates have notably risen from 118,000 units...

Professionally managed apartments report lower vacancies than the broader market

Professionally managed apartments report lower vacancies than the broader market, according to data from RealPage and the U.S. Census Bureau.

Since 2010, the professionally managed segment of the multifamily industry has averaged five...

The incredible disappearing Starwood CRE investor

The $10 billion fund from Starwood Capital Group has been trying to preserve its available cash and credit by limiting investor redemptions. In the first quarter, the fund was hit with $1.3 billion in...

INFOGRAPHIC: A luxury vibe

High-income millennials and Gen Zers are choosing Class A apartments over home ownership. Is it a lifestyle choice or the economy?

National Class A rents average $660 to $2,000 below the average monthly mortgage

Hospitality-focused apartments

Class...