Multifamily housing construction stats lower across the board

The Census Bureau’s new residential construction report for May showed weakness in all areas of multifamily housing construction. Permits, starts, units under construction and completions were all down from April’s levels.

Multifamily housing permits continue...

Growth in multifamily mortgages outstanding rises in Q1

The Mortgage Bankers Association (MBA) reported that growth in multifamily mortgage debt outstanding in Q1 2024 was up significantly from the revised level reported for Q4 2023. However, the growth in debt outstanding in...

Multifamily property investment environment improves in Q1

Freddie Mac recently released its Apartment Market Investment Index (AIMI) for Q1 2024. The national index was up 8.8 percent in the quarter, indicating improving conditions for multifamily property investment. The improvement was largely due...

LA County extends rent increase cap

The Los Angeles County Board of Supervisors extended their 4 percent cap on rent increases for certain properties for another 6 months. The cap is now expected revert to its former level at the...

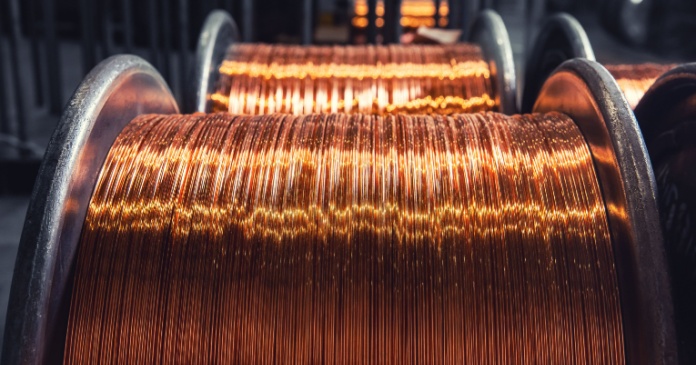

Construction material prices flat in May despite jump in copper wire prices

The producer price index (PPI) report from the Bureau of Labor Statistics (BLS) stated that construction material prices were unchanged month-over-month in May on a seasonally adjusted basis. However, the change in construction material...

Yardi Matrix reports on a bifurcated economy

Yardi Matrix recently released their mid-year update on the state of the multifamily housing market. It discusses the state of the economy, the impact of anticipated new supply on rents and the impact of...

Fed foresees only one rate cut in 2024

Federal Open Market Committee (FOMC) met this week and decided to keep interest rates unchanged. The Fed forecast that interest rates will end 2024 higher than they predicted in recent forecasts and will decline more...

DoE defines zero

The U.S. Department of Energy (DoE) has released a document defining what qualifies a building to be called “zero emissions”. The DoE states that they intend their definition to “support the buildings sector moving...

Employment growth accelerates in May

The Employment Situation Report from the Bureau of Labor Statistics (BLS) reported higher than expected overall employment growth in May. However, employment levels in 2 of the 4 of the multifamily-related job categories we...

Rents continue slow growth in May

Yardi Matrix reported that national average apartment rent was up $6 in May compared to the revised level of the month before at $1,733 per month. The national average year-over-year apartment asking rent growth was...

Multifamily construction spending in decline

The Census Bureau’s report on construction spending said that the value of multifamily residential construction put in place in April was down 0.30 percent from the revised level of the month before. Spending on...

Multifamily CMBS delinquency rate edges higher in May

Trepp reported that delinquency rate for multifamily commercial mortgage-backed securities (CMBS) loans rose slightly in May, climbing 10 basis points.

Overall CBMS delinquency rate also down slightly

For delinquencies, Trepp focuses on loans that are 30...

Construction employment falls as quits rise

The Job Openings and Labor Turnover (JOLT) report from the Bureau of Labor Statistics (BLS) said that, despite higher construction job openings, April saw a net loss of 8,000 construction jobs as quits jumped...

SFR rent growth rate edges higher in March

CoreLogic reported that their single-family rent index (SFRI) for March rose 3.4 percent from its year-earlier level. This matches last month’s reported year-over-year rent growth but is down from the 4.3 percent annual rent...

Despite growth, rents trail last year

The latest rent report from Apartment List shows that the national median monthly rent growth in May was +0.5 percent. However, year-over-year rent growth was -0.8 percent. Rents have now fallen on a year-over-year...