Sub-prime bail out

Encouraged by the housing bubble, easy credit, along with the expectation that housing prices would continue to appreciate, many subprime borrowers took out mortgages they could not afford in the long run, particularly if...

We don’t have to ditch capitalism to fight climate change

It is of course possible that the 95 percent-plus of scientists who have explored the topic and the National Scientific Academies of every major nation are mistaken, and that the uncontrolled emissions of greenhouse...

The recession is a media myth

But over the last half-year, the media and politicians have said we were in a recession even while the economy was still growing.

Gas prices are going up. The economy is slowing. Talk of recession...

The moral economy

But despite the politicians' rhetoric, it is not hard to understand why America is in trouble.

First, there has been too much madcap real estate speculation. In recent years, housing prices were driven sky-high on...

10 ways to supercharge the American economy

He's spot-on since Obama's progressive pottage has left us with a sluggish economy, unemployment over 9 percent and a 14.3 percent poverty rate—more poor people than we have had in a half-century.

Our economy suffers...

Dangerous trends

The real precedent was set with the 1998 multi-state tobacco settlement of $365.5 billion. Tobacco is a legal substance. In the mafia, this is called a shake down. If the government can attack one...

Agency borrowing: Why the multifamily industry relies on GSEs

First, there are the portfolio lenders including banks and insurance companies. These lenders retain loans "in their portfolio" by making loans using funds from deposits or insurance premiums and then keeping those loans on...

Why business despairs of Obama

Those who might help us escape are now being held back by the anti-business policies of President Barack Obama.

Obama's administration predicted a V-shaped recovery, based on the historical experience of the 1970s and 1980s....

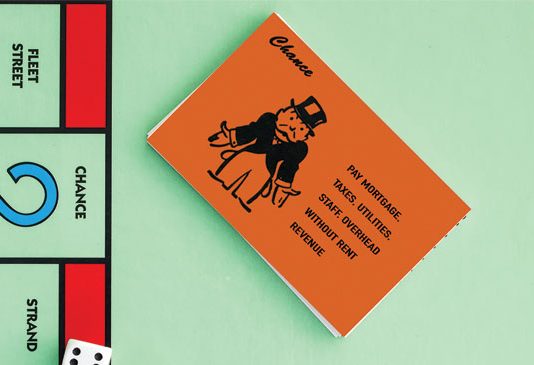

Mourning the loss of freedom to fail

It is perhaps even stranger to claim that we should actually fear losing the freedom to fail. Most of us are hardwired to avoid losing, and giving up the prospect does not logically seem...

The success of the U.S. at creation destruction

But as the government steps in to bail out automakers and financial institutions, is the world's largest economy undermining the very process of creative destruction that has propelled it thus far?

Steven Davis, a professor...

Building a strong foundation for a housing recovery

The federal government, which now owns or guarantees some 37 million mortgages because of the Fannie Mae and Freddie Mac bailouts, is forced to take possession of properties at huge expense to the taxpayer....

Does it really take Hercules to fix the federal budget deficit?

That got us thinking about Hercules and the budget. All we're talking about is how to ensure the government takes in enough money to cover what it spends. Is tackling the country's massive deficits...

Government must step in to prevent rental housing shortage

Rents are starting to rise dramatically and in every major metropolitan area are expected to rise from 3 percent to 10 percent in 2011 and beyond. That means a family paying $1,700 a month...

Apartment industry at a crossroads

It is obvious that there has been a fundamental change in the demand for homeownership over the last few years. Fiscal policies and social pressures have encouraged American consumers to buy homes, oftentimes biting...

Home ownership may fall more than expected

Then JPMorgan CEO, Jamie Dimon, suggested that his bank could get out of the mortgage ownership business in the future. "Owning consumer assets may be something we don't want to do," Dimon said on...