Tag: inflation

Multifamily starts forecast to rise starting in late 2025

Fannie Mae’s December housing forecast calls for multifamily housing starts to bottom out in mid-2025 and then to steadily increase through the rest of...

Fed backs off plans for interest rate cuts

The economic projections released by the Federal Open Market Committee (FOMC) after this week’s meeting indicate that they will be keeping interest rates higher...

Construction materials prices up again in November

The producer price index (PPI) report from the Bureau of Labor Statistics (BLS) stated that construction materials prices rose 0.3 percent month-over-month in November...

Multifamily starts forecast to rise throughout 2025 and 2026

Fannie Mae’s November housing forecast calls for multifamily housing starts to bottom out at the end of 2024 and then to steadily increase through...

Construction materials prices rise in October

The producer price index (PPI) report from the Bureau of Labor Statistics (BLS) stated that construction materials prices rose 0.3 percent month-over-month in October...

Multifamily starts forecast revised higher

Fannie Mae’s October housing forecast calls for more multifamily housing starts in 2024 and 2025 than did last month’s forecast. The current forecast is...

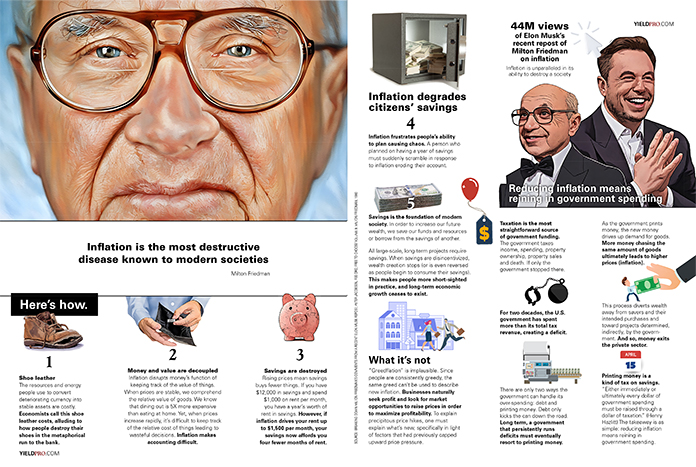

Inflation is the most destructive disease known to modern societies —Milton Friedman

Here’s how.

1 Shoe leather

The resources and energy people use to convert deteriorating currency into stable assets are costly. Economists call this shoe leather costs,...

Multifamily starts forecast revised lower

Fannie Mae’s September housing forecast calls for fewer multifamily housing starts in 2024 and 2025 than in last month’s forecast. The downward revision follows...

Fed delivers large interest rate cut

Federal Open Market Committee (FOMC) met this week and, in an unusual pre-election move, decided to lower their target interest rate by 0.5 percentage...

Why housing costs remain a major hurdle for lowering inflation

Housing inflation continues to be a stubborn impediment to the consumer price index (CPI) falling back to the Federal Reserve’s target.

Despite broader economic inflation...

Outlook for multifamily starts brightens

Fannie Mae’s August housing forecast calls for a higher level of multifamily housing starts in 2024 than predicted in last month’s forecast. This is...

Higher growth for multifamily starts predicted

Fannie Mae’s July housing forecast calls for higher levels of multifamily housing starts in 2024 and 2025 than in their two most recent past...

Multifamily starts predicted to pick up in 2025

Fannie Mae’s May economic forecast calls for multifamily housing starts to reach their low point in Q2 2024 and then to rise, if unevenly,...

Fed foresees only one rate cut in 2024

Federal Open Market Committee (FOMC) met this week and decided to keep interest rates unchanged. The Fed forecast that interest rates will end 2024 higher...

Forecast: multifamily starts lower as interest rates to remain high

Fannie Mae’s May economic forecast calls for multifamily housing starts to decline through the end of 2024 before slowly recovering in 2025 despite persistently...