The Mortgage Bankers Association (MBA) reported that growth in multifamily mortgage debt outstanding in Q1 2024 was up significantly from the revised level reported for Q4 2023. However, the growth in debt outstanding in Q4 was revised lower by $10 billion. This revision represents a 40 percent reduction in the Q4 growth reported in last quarter’s report.

The MBA reported that multifamily mortgage debt outstanding rose by $23.74 billion in Q1, well above the $14.78 billion revised increase in Q4. Total multifamily debt reached a level of $2.099 trillion. Compared to the year-earlier level, debt was up $98.3 billion (4.9 percent).

The total of all commercial mortgage debt, including multifamily debt, outstanding at the end of Q1 rose 0.9 percent from its Q4 2023 level to $4.698 trillion. Multifamily mortgage debt represented 44.7 percent of commercial mortgage debt outstanding.

Earlier, the MBA had reported that multifamily mortgage originations had fallen 29 percent in Q1. The Q1 2024 multifamily originations index was reported to be down 7 percent from its level in Q1 2023.

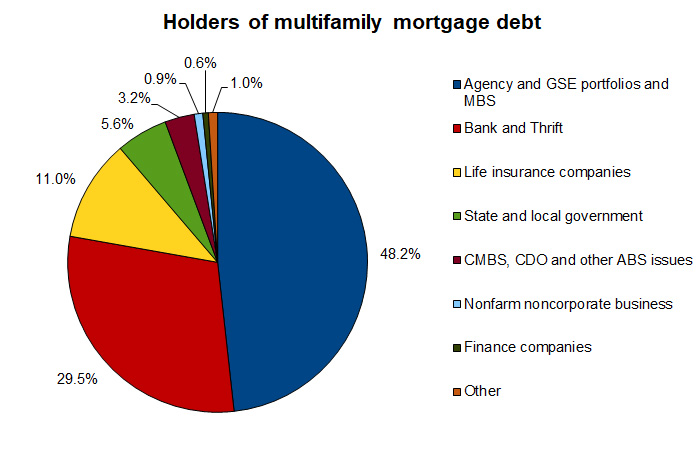

Visualizing market share

The shares of multifamily mortgage debt held by various classes of suppliers are shown in the first chart, below.

Of the increase in multifamily mortgage debt outstanding in the quarter, $10.2 billion, or 43.0 percent, was held by “Agency and GSE portfolios and MBS”. These are agencies, like the Federal Housing Administration and Government Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac, who buy up mortgages and sell some of the debt as Mortgage-Backed Securities (MBS). At the end of Q1, the GSEs holdings of multifamily debt fell 0.1 percentage point to 48.2 percent of the total outstanding.

Banks and Thrifts, the second largest holders of multifamily mortgages, increased their holdings by $9.1 billion. The Q1 figure represents 38.3 percent of the increase in multifamily mortgage debt outstanding, much higher than the banks’ holdings of 29.4 percent of total debt outstanding.

Life Insurance companies were reported to increase their direct holding of multifamily mortgage debt by $3.82 billion in the quarter. However, their reported holdings for Q3 were revised lower by $4.97 billion, so their reported holding in the Q1 report are actually lower than what was reported last quarter. Based on the revised data, their increase in holdings represented 16.1 percent of the total net increase. This brings their holdings to $230.0 billion. Their share of total multifamily mortgage debt outstanding rose 0.1 percentage point from the revised level of the quarter before to 11.0 percent. However, the figures for life insurers do not account for the multifamily mortgages these companies hold through commercial mortgage-backed securities (CMBS).

State and local governments held 5.6 percent of outstanding multifamily mortgage debt at the end of Q1, the same portion as reported for Q4. They increased their holdings by $901 million to a total of $116.8 billion at the end of the quarter.

CMBS, CDO (collateralized debt obligations) and other ABS (asset backed securities) issuers increased their holdings of multifamily mortgage debt in Q4 by $66.8 million. Their share of debt outstanding was unchanged at 3.2 percent.

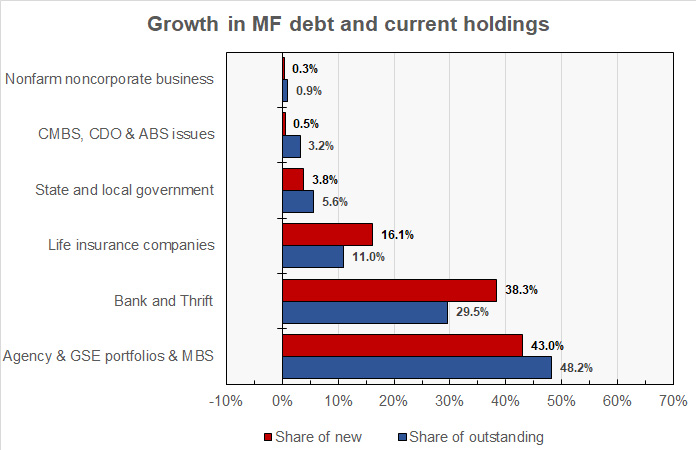

Who’s growing?

The next chart, below, plots the current share of multifamily mortgage debt outstanding for a given class of lender alongside that class of lender’s share of net new mortgage debt outstanding in Q4. When the latter share is greater than the former, that class of lender is increasing its share of the multifamily mortgage market.

The chart shows that, while the GSEs were again the largest contributor to increasing multifamily mortgage lending during the quarter, they were not dominant. Banks remained the second leading contributor to the mortgage debt increase, achieving 89 percent of the increase in holdings of the GSEs. Life insurance companies grew their holdings at a higher rate than their share of multifamily mortgage debt outstanding. However, that was also true in last quarter’s report, but subsequent revisions wiped out the growth. As was the case last quarter, the shares of the growth in multifamily debt outstanding of the other lender types in the top 6 were less than their shares of existing mortgage debt. Therefore, these lenders are continuing to become relatively less important as sources of funds.

The report does not cover loans for acquisition, development or construction, or loans collateralized by owner-occupied commercial properties. The full report also includes information on mortgage debt outstanding for other commercial property types. The full report can be found here.