The Job Openings and Labor Turnover (JOLT) report for July was released by the Bureau of Labor Statistics (BLS) recently. Its data on the parts of the job market of interest to the multifamily industry, real estate management and construction, diverged with weakness in real estate management employment but strength in construction employment.

For the entire jobs market, the BLS reported that there were 6.7 million job openings at the end of June, that 5.7 million people got new jobs in June and that 5.5 million people left their old job, voluntarily or otherwise. This resulted in a small net gain in employment for the month.

Multifamily jobs market softens

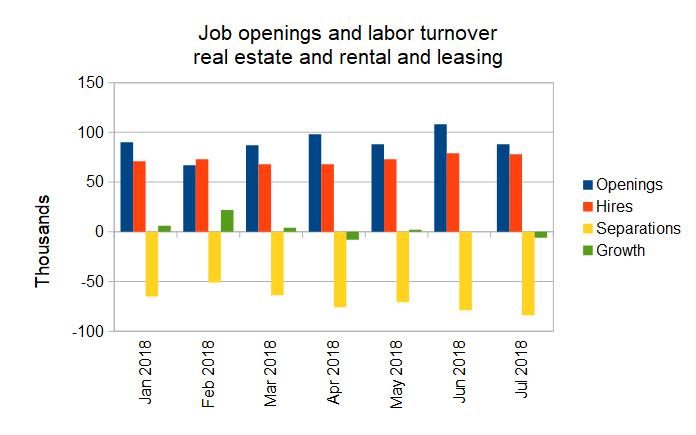

Multifamily jobs market growth is tracked in a part of the jobs market the BLS calls “real estate and rental and leasing” (RERL), which also includes similar businesses in other industries. The jobs data for this segment showed a loss in employment as the number of separations rose while the number of hires remained flat. At the same time, the number of job openings at the end of the month fell by about 18 percent from the June level to 88,000, indicating the potential for continued weakness in hiring.

The following chart shows the recent data for the RERL jobs market.

The construction jobs market rebounds

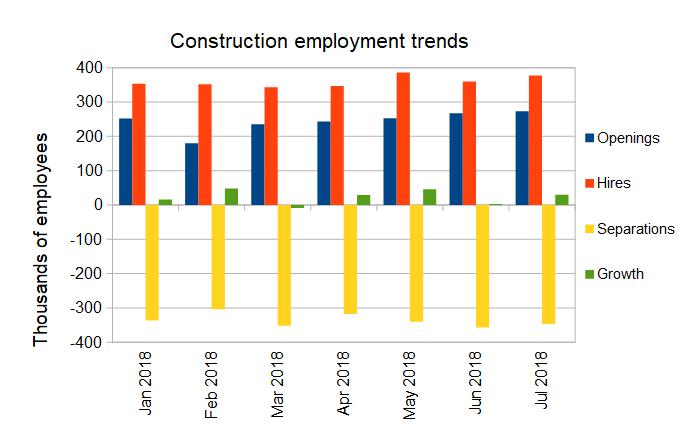

The next chart shows the turnover in the construction jobs market. Once again, the number of hires in the construction jobs market was higher than the number of job openings at month-end. The jobs market as a whole is like the RERL jobs market segment where the number of openings generally exceeds the number of hires in any given month.

The chart shows that the number of construction job openings was up in July from the June level, which was revised down. The number of separations was down while hiring was up, resulting in a gain in employment for the month.

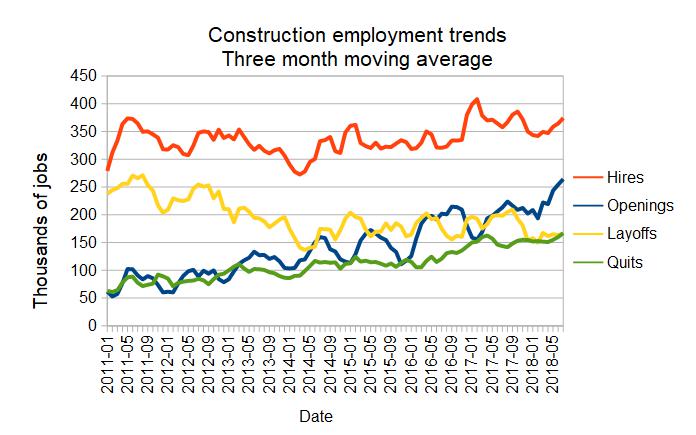

The final chart, below, shows long-term trends in the construction job market. It tells a story of a strengthening jobs market with steady hiring, workers with the confidence to quit their jobs and employers reluctant to layoff the workers they have.

The numbers given in the JOLT report are subject to revision and it is common for small adjustments to be made in subsequent reports. The full current report from the BLS can be found here.