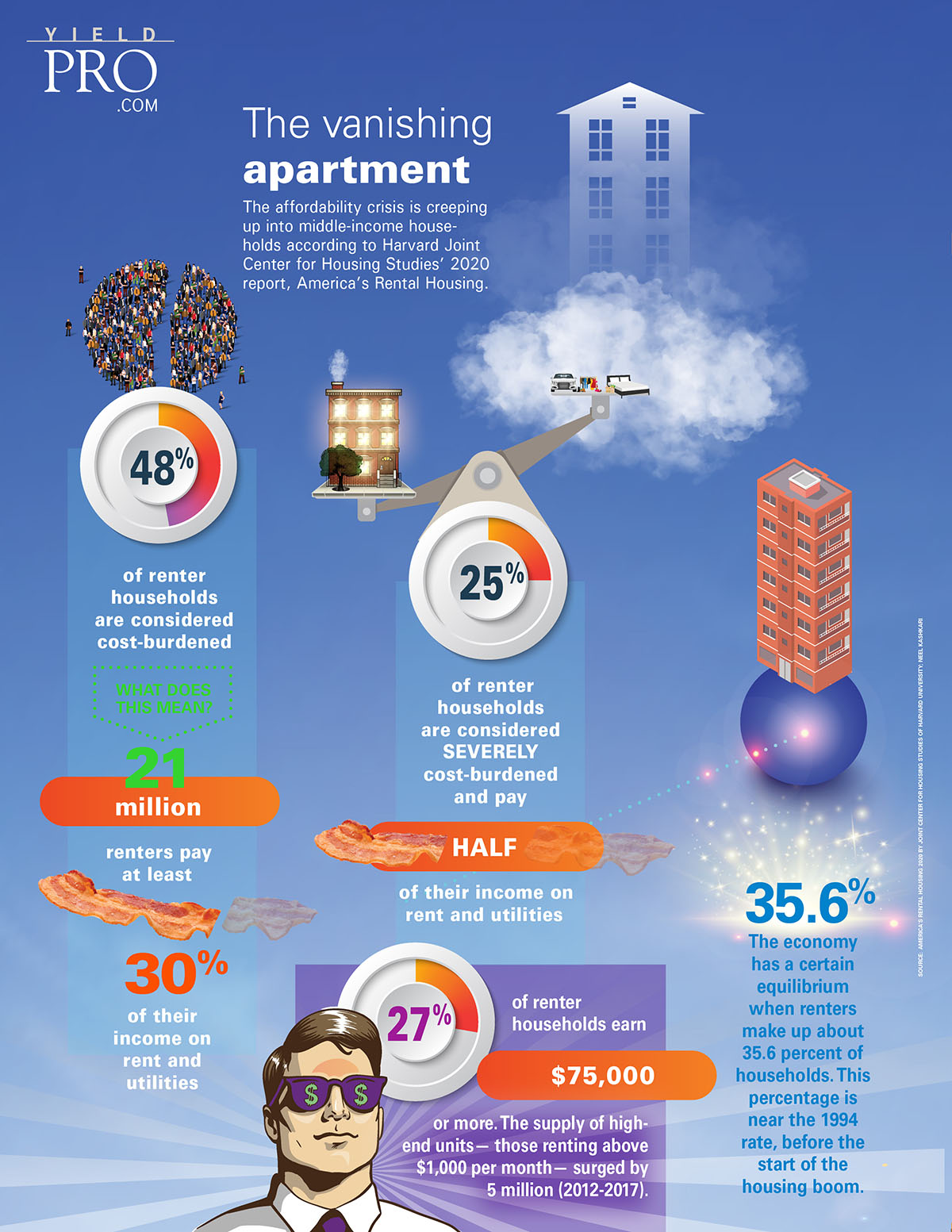

The affordability crisis is creeping up into middle-income households according to Harvard Joint Center for Housing Studies’ 2020 report, America’s Rental Housing.

48% of renter households are considered cost-burdened. What does this mean? 21 million renters pay at least 30% of their income on rent and utilities.

25% of renter households are considered SEVERELY cost-burdened and pay HALF of their income on rent and utilities.

27% of renter households earn $75,000 or more. The supply of high-end units—those renting above $1,000 per month—surged by 5 million (2012-2017).

The economy has a certain equilibrium when renters make up about 35.6 percent of households. This percentage is near the 1994 rate, before the start of the housing boom.

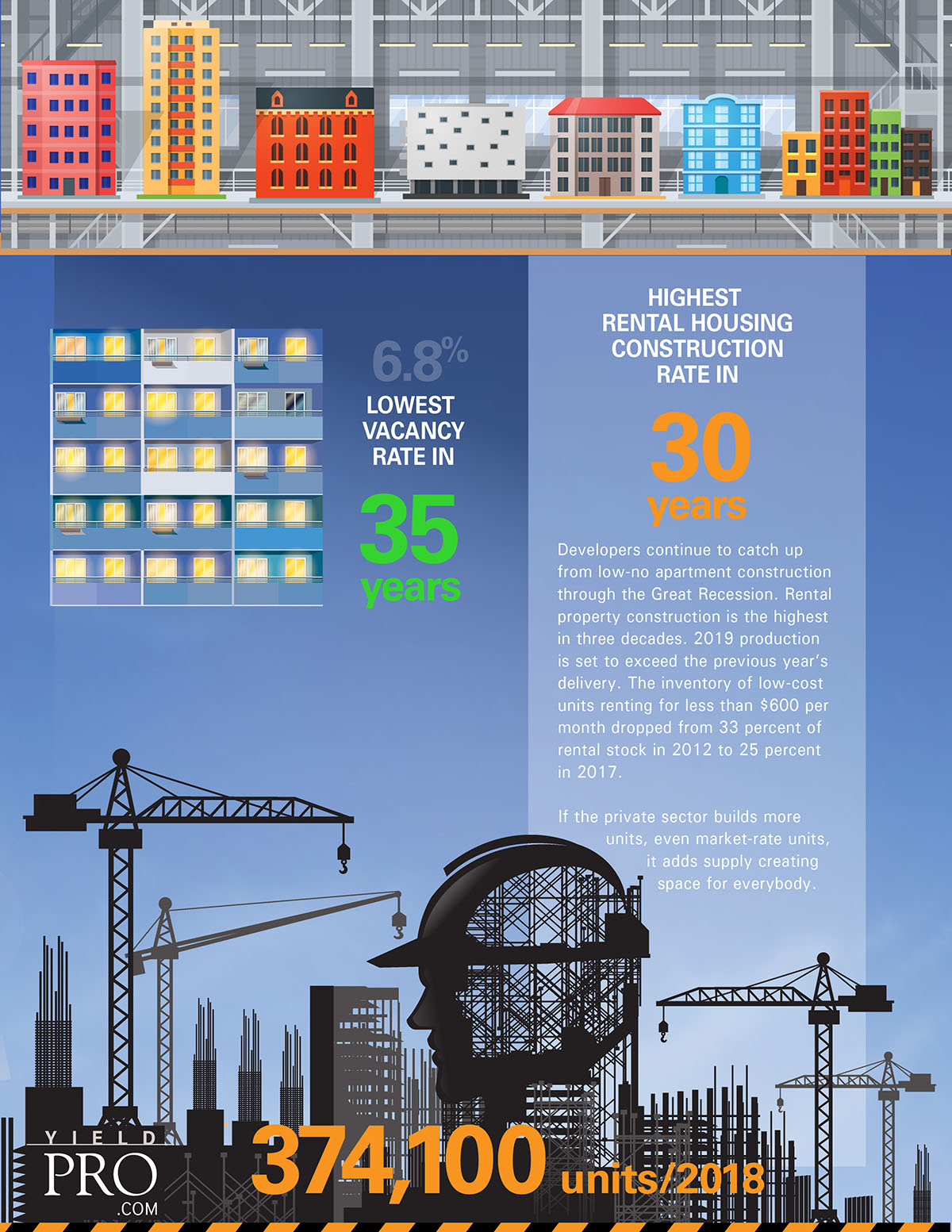

6.8% lowest vacancy rate in 35 years

Highest rental housing construction rate in 30 years

Developers continue to catch up from low-no apartment construction through the Great Recession. Rental property construction is the highest in three decades. 2019 production is set to exceed the previous year’s delivery. The inventory of low-cost units renting for less than $600 per month dropped from 33 percent of rental stock in 2012 to 25 percent in 2017.

If the private sector builds more units, even market-rate units, it adds supply creating space for everybody.