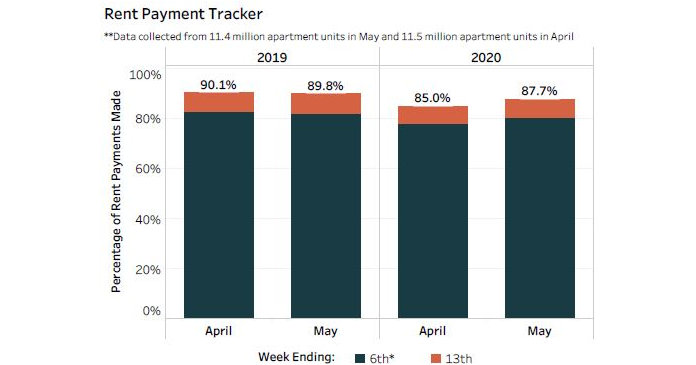

The NMHC rent tracker project has released its second reading on rent collections in the month of May. A total of 87.7 percent of residents had made a payment by May 13, 2020. This compares to 89.8 percent of residents who had made a payment by the same point in May 2019 and 85.0 percent who had made a payment by the same point last month.

Reviewing the results

As in past reports, the data was collected from 11.5 million units managed using software from five major property management software providers. These companies are Entrata, MRI, RealPage, ResMan and Yardi Systems. Representatives of these companies attended the webcast accompanying the release of the data. Providing the apartment operator’s perspective for this week’s webcast was Larry Curtis, president and managing partner at Winn Development.

In attempting to explain May’s strong rent collections performance in spite of massive job losses, Greg Willett of RealPage postulated that the enhanced unemployment benefits being distributed are giving residents the ability to pay and they are making this a priority. He also credited owners and operators, saying, ”they’re really working hard to get these collections in and they’re being very proactive in communicating with residents.”

Chase Harrington of Entrata agreed that owners and operators are being very flexible in working with residents. He also noted that other consumer spending is decreasing, indicating that residents are prioritizing paying the rent over other spending.

Willett said that rent collections for class C rental products trail other asset classes by about 5 percentage points and that geographical variations follow the pattern noted in the last report. Trouble spots remain New York, New Orleans, Las Vegas and, to some degree Los Angeles. Texas and the Carolinas were cited are regions that are doing relatively well.

Jeff Adler of Yardi said that availability has spiked significantly in discretionary (class A) properties relative to other property classes. While the level of property searches remains high, approved applications are down in discretionary properties compared to pre-epidemic levels but up in mid-range and workforce housing. At the same time, notices to vacate are up in discretionary properties but down in mid-range and workforce housing. So, while current occupancy rates have not yet changed significantly, there are signs that this will change for class A properties.

Assessing changes in demand, Adler said “young professional who are in studios or small one-bedrooms are leaving and going back home. Two-bedrooms and two baths are in more demand.” Price reductions and increased concessions may be being used to try to pull class B renters up into class A properties.

Larry Curtis said that rent collections for his company, which largely manages high quality workforce housing products, is somewhat behind the levels being quoted in the NMHC rent tracker data. He said that collections for April were at about 90 percent at month’s end, down from 96 percent in March. He attributes this relatively strong performance despite of the eviction moratoriums in place to “the good will that quality operators and owners have, and also the programs that have been around that have allowed for the affordable housing and workforce housing that has gotten created to be largely product undifferentiated from high end market-rate housing.” This gives the residents of such housing a strong incentive to try to stay there.

What’s coming

Looking ahead, Elizabeth Francisco of ResMan said that there is a sense of anxiety among operators. Past downturns have given them insight into where to look for early indicators of a downturn. The trends in Class A properties highlighted by Adler are signs that trouble may be coming.

While a lot of focus has been put on the number of people who have lost their jobs, Francisco said “there’s also a big portion of our renters who maybe maintained employment but at a pay decrease.” Pay reductions of 10 to 20 percent are not uncommon, shaking renters’ confidence. A sign of the uncertainty among renters is the number of them who are now on month-to-month agreements. It is unknown when they will again have the confidence to sign long term leases.

Brian Zrimsek of MRI said that notices to vacate are actually down in their customers’ properties, although his data is not sorted by product class. While MRI has not seen as many applications or move-ins compared to the period before the epidemic, traffic is recovering. However, he said, “concession volume is up and that’s a little worrisome…” Zrimsek noted that MRI has seen a slight increase in the number of residents using credit cards to pay their rent and in the number using of the payment plans that operators have made available to them.

The next release of NMHC rent tracker data will be on Friday, May 22.