Apartment List is out with their rent report for August 2020. It shows a slight uptick in rents nationally but with wide local variations.

The big picture

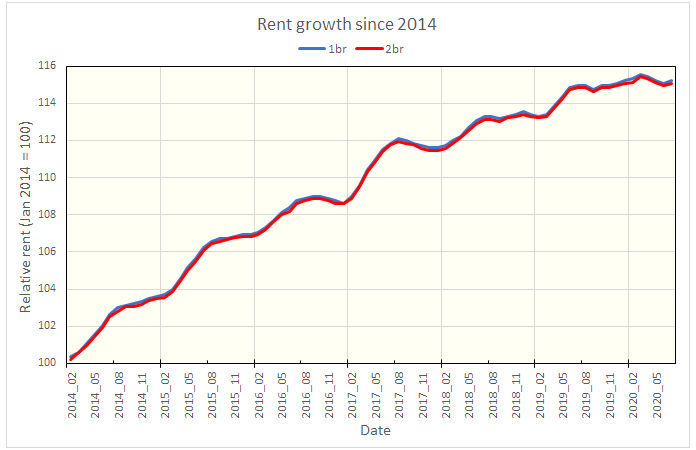

A summary of Apartment List’s data on rent changes since 2014 for one and two-bedroom apartments is shown in the chart, below. The data show the usual pattern of rents rising most strongly during the spring and summer “leasing season” and then either rising more slowly or stagnating over the rest of the year.

In 2020, rents started to follow the usual pattern. Then the economy was shut down in response to COVID-19 in March. Since then, rents for the country as-a-whole have mostly fallen, although they ticked up by 0.1 percent in August. While, rents in August were only 0.3 percent higher than their year-earlier levels nationally, Apartment List found large differences in rent growth performance on a city-by-city basis.

Who’s down

Of the 100 largest cities, the “leaders” in rent declines since the pandemic hit in March, were San Francisco (-4.7 percent), New York (-3.9 percent), San Jose (-2.8 percent), Miami (-2.4 percent) and Washington DC (-2.3 percent).

In looking for common factors contributing to the decline, Apartment List identified two. The first was that declines hit cities whose jobs were highly impacted by the shutdowns, particularly those depending on tourism and certain service sector jobs. The second group of cities with declines were those in which rents had become relatively unaffordable prior to the pandemic.

Who’s up

Of the 100 largest cities, the ones with the highest rates of rent growth since March were Virginia Beach (2.4 percent), Sacramento (1.7 percent), Kansas City (1.7 percent), Phoenix (1.7 percent) and Las Vegas (1.6 percent).

The common factor that Apartment List identified in the cities seeing positive rent growth was that they are secondary cities with relatively affordable rents. For example, the average rent for a two-bedroom apartment in Virginia Beach is less than half that for a two-bedroom unit in San Francisco. These secondary cities are also often within long commuting range of a large core city, such as those on the “who’s down” list. The shift to telecommuting inspired by the COVID-19 related shutdowns makes moving to the secondary cities more viable.

It was rather surprising to see Las Vegas on the list of rent growth leaders since the city is highly dependent on tourism. However, Nevada has been allowing its casinos to operate at 50 percent of capacity since June 4. After experiencing a surge in COVID-19 cases after reopening, the number of hospitalizations of confirmed COVID-19 patients has been falling. These patients now occupy less than 10 percent of the hospital beds in Clark County, where Las Vegas is located. The reopening may stick.

Regional case study: San Francisco Bay Area

Apartment List looked at rent changes since March in San Francisco and its surrounding counties. Rent declines were steepest in San Francisco itself, but were milder in outlying counties. Generally, the less urbanized the county, the smaller the rent decline. Napa County even managed to post 0.6 percent rent growth since March.

Studies have shown that many of the renters who are currently looking to move are doing so in order to save money. This is unsurprising given the level of recent job losses. Until employment recovers, pressure on rents will continue.

The full Apartment List report can be found here.