With COVID disrupting the economy, there is high interest in assessing how many renters are failing to make their rent payments. This article examines alternatives to the NMHC rent tracker.

Focus on the big guys

The NMHC rent tracker project has provided valuable information on how well residents have complied with their obligation to pay rent despite the economic disruptions caused by the response to the COVID-19 pandemic. However, NMHC gathers its data from properties which are using property management system (PMS) software supplied by the larger software suppliers to the industry. As a consequence, these tend to be properties managed by large, sophisticated companies and they may not represent the experience of the rental housing market as a whole. This market is highly fragmented with many small suppliers who manage only relatively few units.

Asking people directly

One alternate source of rent payment data is Apartment List, which has been surveying a sample of 4000 people during the first week of the month. This survey encompasses both renters and owners, so it represents a much smaller sample size than does the NMHC report. However, it may be a sample that includes more renters who live at smaller multifamily properties or in single family rental homes.

Renters can be grouped into three categories of payers: those who made full rent payments, those who made partial payments and those who made no payments. NMHC reports on the percentage of renters who have made full or partial rent payments, while Apartment List reports on the percentage of renters who have made no payment or only partial payment. Because of this, the numbers they report are not directly comparable.

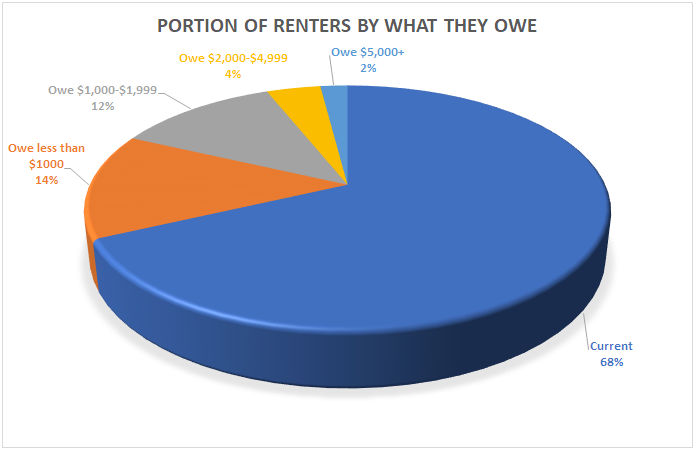

Apartment List reports that 32 percent of renters had made no rent payment or only a partial payment by the end of the first week of September. Stated another way, this means that 68 percent of renters had made a full payment by that date. By comparison, NMHC had reported that 76.5 percent of renters had made a full or partial rent payment by September 6. These numbers are in the same ballpark and would agree exactly if the portion of renters making partial payments was 8.5 percent. However, neither organization reports that number.

Apartment List also reports on how much is owed by those behind on their rent. These results are shown in the following chart.

Taking our pulse

Another source of information is the weekly Pulse survey that the Census Bureau has been running to assess how the population of the country is reacting to the fallout from COVID-19. This survey asks a variety of questions about how the respondent is coping financially including questions about paying for housing. A difficulty in using this survey is that the results are presented based on the number of adults responding in a certain way, not on the number of households. When looking at housing, a view from the perspective of households would have made more sense.

The week 13 Pulse survey was taken in the last week of August. Of the people who reported that they paid rent for their housing, 85 percent said that they were current on their rent payments, while 15 percent said that they had a rent delinquency. By comparison, Apartment List reported that 10 percent of renters had a delinquency at the end of August and NMHC reported that 5.5 percent of renters had made no rent payment for August by the end of the month.

The Pulse survey shows that people who are behind on their rent payments are poorer than those who are current. Of those who are delinquent, 53 percent have a household income below $35,000 per year. For the group that is current, only 39 percent have a household income in this range. However, income alone does not explain why people are late with their rent payments given that 5 percent of those who are delinquent have household incomes above $100,000 per year.

Some of the greatest differences in Pulse survey responses between those who are current on their rent payments and those who are behind are summarized in the following table.

| In the last 7 days: | Percent of respondents who are current on their rent saying yes | Percent of respondents who are behind on their rent saying yes |

| I relied on regular sources of income like those used before the pandemic |

64 |

31 |

| I borrowed from family or friends |

18 |

48 |

| I lost employment income |

50 |

77 |

Clearly, those who are behind on their rent are under more financial duress than those who have paid their full rent.

Of those reporting that they are must pay rent, 73 percent reported moderate or high confidence that they would be able to pay next month’s rent.

Summing up

While there have been reports of smaller landlord being disproportionately impacted by residents not paying their rent due to COVID-19, the data from Apartment List and from the Census Bureau seem to be in line with that collected from the large property management companies by the NMHC.