Both CBRE and Yardi Martix have recently issued reports which discussed the prospects for the multifamily housing market in 2021. This article describes some of the key take-aways from those reports.

The long view

Both reports reproduced a chart from the U.S. Congressional Budget Office (CBO) projecting the US debt to GDP ratio into the future. The huge jump during the pandemic is both due to the high level of stimulus spending and also due to the shrinkage in the GDP resulting from the enforced shutdowns of businesses. The huge rise in the debt to GDP ratio after 2030 is due to entitlement spending outpacing the growth in revenue required to support it.

Yardi Matrix points out that the CBO used a projected GDP growth rate of only 1.6 percent when developing this chart. This is low by historical standards. However, GDP growth is driven by growth in the size of the labor force and by increases in productivity (output per worker). The rate of growth in the native US population has been falling for years and is now well below what is required to maintain stable population numbers. The effects of the pandemic are likely to further suppress birth rates. At the same time, immigration has been falling. The net result is that the current projected US population in the year 2046 is now 34 million people lower than was the estimate in 2012. Along with the aging of the population, these trends will reduce the size of the US labor force, resulting in a lower GDP than in earlier forecasts.

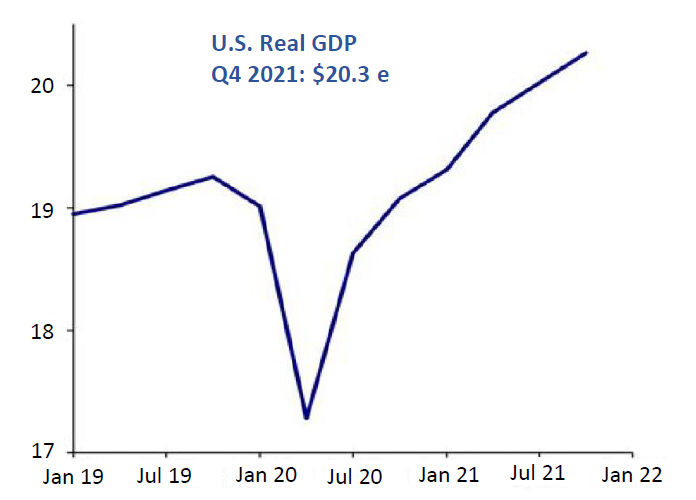

In the shorter term, Both CBRE and Yardi Matrix expect GDP to shrink by about 4 percent in 2020. CBRE projects growth of 4.5 percent in 2021 while Yardi Matrix expects growth closer to 6 percent. The Yardi Matrix short-term view of GDP growth is shown in the next chart.

A rosier outlook

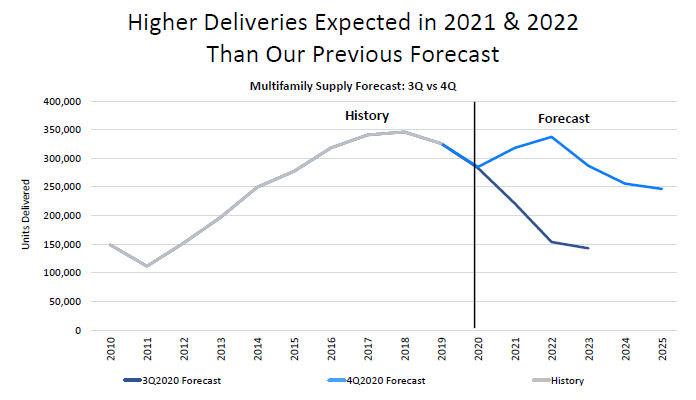

No one knows how the COVID-19 pandemic and its related shutdowns will play out against the economy in general and against the multifamily housing industry in particular. The availability, acceptance and efficacy of a COVID-19 vaccine will have a large impact of people’s behavior. Still, Yardi Matrix has recognized that the multifamily housing construction industry has not been as heavily impacted by the pandemic as they first supposed. This has caused them to update their forecast of new product deliveries from their estimate of last quarter and to increase their projections for deliveries over the next two years. Deliveries are now expected to peak at 337,000 units in 2022. This is shown in the next chart, below.

By contrast, CBRE expects deliveries of new units in 2021 to drop to 280,000 from a projected level of 300,000 in 2020.

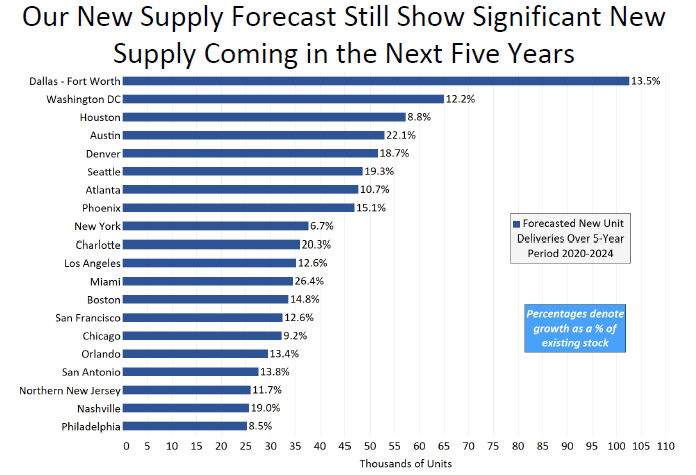

Much of the product to be delivered through 2022 is already in the pipeline, so Yardi Matrix expects that the recent pattern of the bulk of new supply being delivered to the urban core will continue through then. The cities expected to see the greatest growth as percentage of current supply is shown in the next chart, below.

CBRE predicts that rent growth will hit 6 percent and that occupancies will return to pre-pandemic levels in 2021. These trends will be driven by job market improvements which will allow people to move out of their parents’ or friends’ homes. By contrast, the Yardi Matrix report quotes rent growth and occupancy projections for the 30 top metro areas. None of these metros are expected to reach 6 percent rent growth. Yardi Matrix’s predictions for rent growth in 2021 range from a high of 4.4 percent in Austin to a low of -1.6 percent in San Francisco.

Financial impacts

As might be expected, the CBRE report focuses on financial measures. The report pointed out that the Federal Reserve has said that they will not raise interest rates quickly if inflation begins to exceed its target of 2 percent, provided that inflation had been low for an extended time before the rise. Because of this, CBRE projects that the average rate on the 10-year treasury will be only 0.8 percent in 2020, 1.3 percent in 2021, 1.6 percent in 2022 and 2.1 percent in the 2023-2027 period.

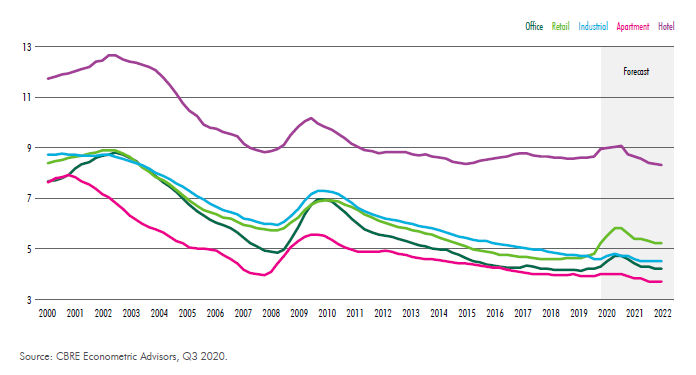

The CBRE report also provided a projection for cap rates on various commercial property types. This is shown in the next chart, below. It is interesting that, in spite of rising interest rates projected for 2021 and 2022, cap rates for industrial and apartment property classes are not projected to rise.

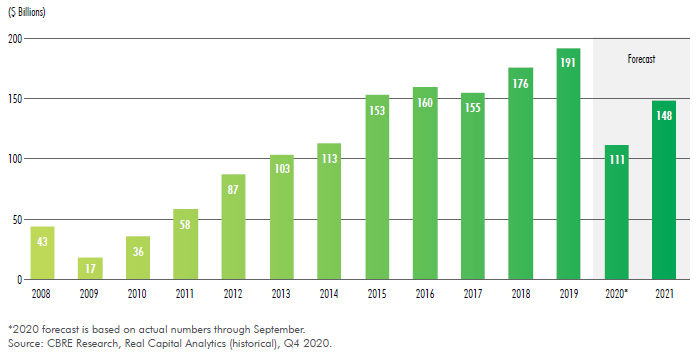

CBRE believes that the continued low interest rate environment in the US will cause the dollar to be relatively weak. This, in turn, will make US markets attractive to foreign investors. Some of the resulting foreign investment will flow into commercial real estate, helping to restart a market whose activity was reduced by COVID-19 related uncertainty. CBRE’s forecast for investment in multifamily housing is show in the last chart, below.

Yardi Matrix discussed their outlook for 2021 as part of a larger presentation, other parts of which were described in a previous article. The Yardi Matrix presentation can be found here. The CBRE forecast, which also covers other commercial real estate types, can be found here.