Fannie Mae issued its February forecasts for the economy and for housing. They predict slightly higher growth in 2021 but slightly lower growth in 2022.

GDP growth shifts

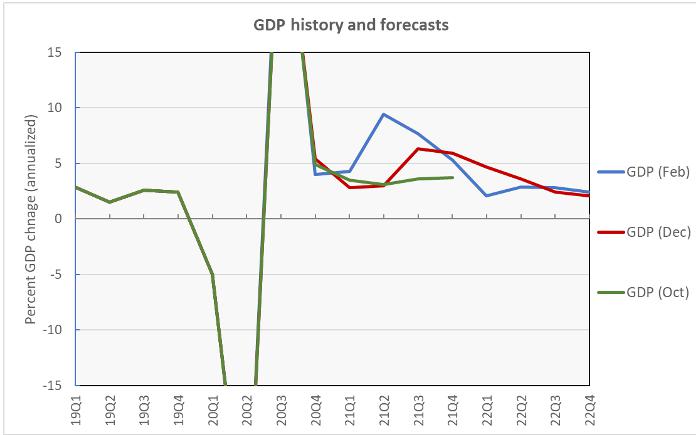

Compared to the last time we checked in with Fannie Mae in December, they have raised their estimate for GDP growth for 2021 but have lowered it for 2022. Forecast growth for 2021 is now 6.7 percent, up from the 4.5 percent forecast in December. However forecast growth for 2022 is now 2.8 percent, down from the 3.2 percent forecast in December. The revisions to the growth forecast result from advances made in the fight against COVID and from anticipation of another stimulus bill being passed on top of the $900 billion bill which was passed at the end of 2020. Comparisons of the predicted growth trends from three recent forecasts are sown in the first chart, below.

The good news on the COVID front is that the vaccine rollout is underway and that case levels are dropping. In response, some of the state-imposed lockdowns are being eased and economic activity is picking up. The current forecast assumes that this easing will continue into the spring and that the vaccine proves effective even in the face of evolving strains of the virus.

Given the Democrat control of the presidency and both houses of Congress, Fannie Mae believes that another stimulus bill will be passed in the next few months. They expect it to be slightly smaller than the $1.9 trillion figure currently being discussed; they use a figure of $1.7 trillion in their estimates. However, they point out that this figure, along with the $900 billion stimulus passed in December represent about 12 percent of GDP. They note that economic output at the end of 2020 was only down about 2.5 percent below its peak level and was only down 4.5 percent from where its growth trend would have placed it if the pandemic had not happened.

This level of stimulus, along with $1.5 trillion in “excess savings” that people have accumulated over the last year present the risk of driving up inflation. Whether it does depends on consumer behavior. Consumers have been relatively cautious since the pandemic began, hence the accumulated excess savings. However, consumer credit card spending has been rising recently so the risk remains.

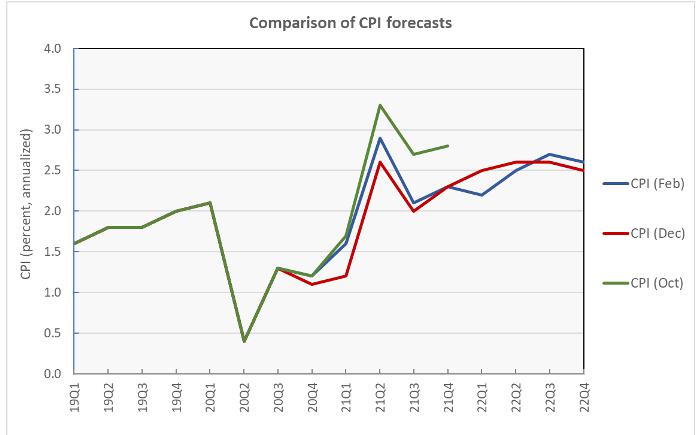

Inflation advances moderately

In spite of the risks discussed above, Fannie Mae forecasts that inflation in 2021 and 2022 will be only slightly higher than the levels they forecast in December. The two forecasts are shown in the next chart, below.

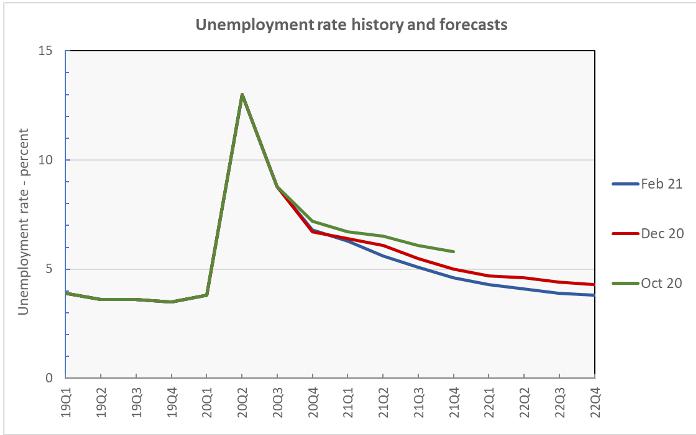

Unemployment improves

The February forecast predicts that the unemployment rate will fall faster than was expected in December. The average unemployment rate for 2021 is now forecast to be 5.4 percent, down from the forecast of 5.7 percent made in December. The average unemployment rate for 2022 is now forecast to be 4.0 percent, down from the forecast of 4.5 percent made in December. The next chart, below, shows three recent forecasts of how unemployment is expected to change over the next two years.

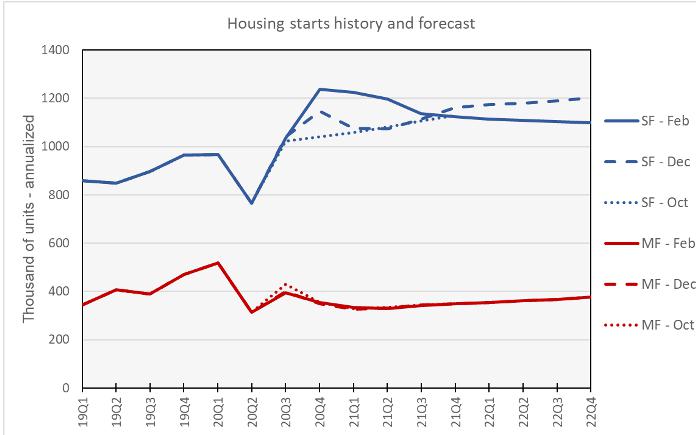

Housing: more, sooner

Fannie Mae’s forecasts for the housing construction market is shown in the final chart, below. In keeping with the theme of the economy generating higher growth in 2021 at the expense of growth in 2022, Fannie Mae has raised their single family starts forecast for 2021 and lowered it for 2022. They now forecast 1,176 single family housing starts in 2021, up from 1,129 forecast in December. They now forecast 1,106 single family housing starts in 2022, down from 1,188 forecast in December. Fannie Mae’s forecast for multifamily housing starts (2+ units per building) was nearly unchanged from that in December. Their forecast by quarter is shown in the last chart, below. Note that the October forecast only extended to the end of 2021.

Fannie Mae observed that the pace of new single family home starts in January reached the highest level since September 2006. They interpret this as homebuilders restocking their inventory after strong sales last year. They expect this pace to moderate going forward.

Fannie Mae expects multifamily housing construction to continue in suburban locations but they expect fewer large urban projects until there is more clarity on the staying power of the work from home trend that emerged during the pandemic.

The Fannie Mae forecast summary can be found here. There are links on that page to the detailed forecast.