Fannie Mae recently issued its May forecasts for the economy and for housing. They show slightly higher growth in 2021 and much higher multifamily housing starts than did the February forecast.

GDP forecast higher for 2021

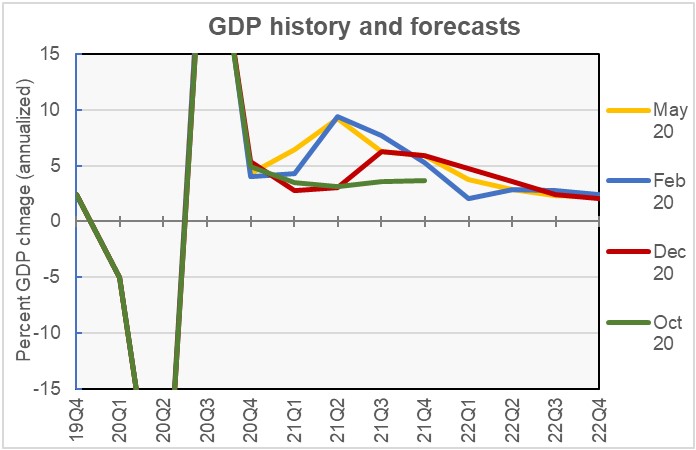

Fannie Mae has revised their growth forecast for 2021 higher compared to their February forecast. Forecast growth for 2021 is now 7.0 percent, up from the 6.7 percent forecast in February. One reason for this revision is that Q1 2021 GDP growth came in higher than expected at 6.4 percent. Fannie Mae’s recent GDP forecasts are illustrated in the first chart, below.

The chart shows that the current GDP forecast has been “smoothed out” compared to the February forecast. For 2021, the forecast for Q2 has been revised down marginally, the forecast for Q3 has been revised downward significantly and the forecast for Q4 has been revised upward. The assumption behind these adjustments is that consumer spending, which Fannie Mae had projected for later in the year, occurred earlier than previously expected. Thus, the timing of GDP growth was impacted more than was the level.

The current forecasted growth for 2022 is 2.8 percent, the same as was forecast in February. Again, while the annual level of GDP growth did not change, the timing did. The current forecast has higher growth in Q1 but lower growth in Q3 and Q4 than did the February forecast.

Inflation advances moderately

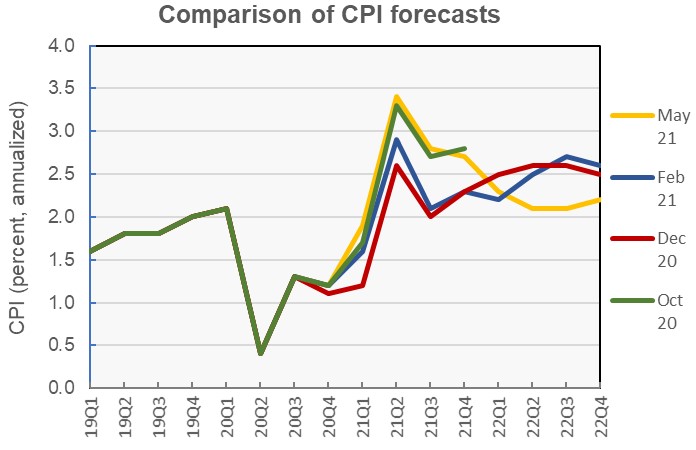

Four recent forecasts for changes in inflation as measured by the consumer price index (CPI) are shown in the next chart, below. The chart shows that the outlook for inflation has changed significantly since February.

While Fannie Mae’s forecast for inflation for 2021 was only revised upward to 2.7 from the 2.3 percent forecast in February, the quarterly levels forecast for late in the year were adjusted upward significantly. However, the annual inflation forecast for 2022 was revised down from the 2.6 percent forecast in February to 2.2 percent in the current forecast.

Fannie Mae notes that there is significant uncertainty in this forecast. Supply chain issues have caused many goods to currently be in short supply. In addition, consumers have accumulated significant savings during the shutdowns. If consumers decide to start spending those savings, it could put upward pressure on prices, particularly if the supply issues persist.

Unemployment forecast about the same

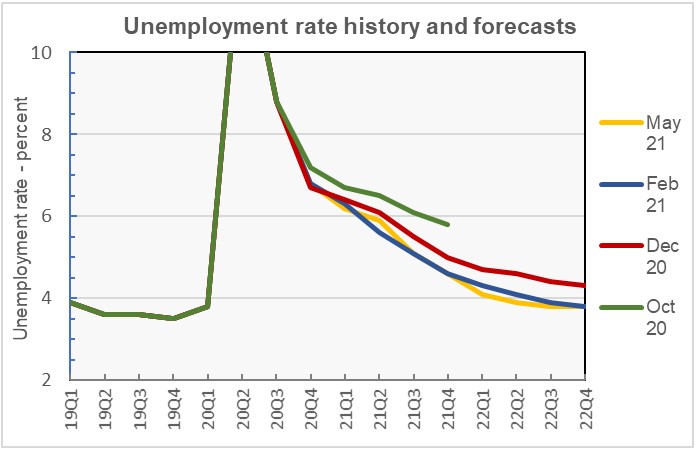

Fannie Mae’s May forecast for the unemployment rate for 2021 as-a-whole was unchanged from the February forecast in spite of the rate for Q2 being revised slightly upward. However, the rate for 2022 as-a-whole was revised downward by a tenth of a point. The next chart, below, shows four recent forecasts of how unemployment is expected to change over the next two years.

Fannie Mae suggested that the disappointing unemployment number reported for April may prove to be an anomaly. It was at odds with the relatively strong employment figure reported by ADP and also seems to be inconsistent with the pick up in activity indicated by other figures such as auto sales, air travel reservations and credit card usage.

Housing: multifamily starts rise

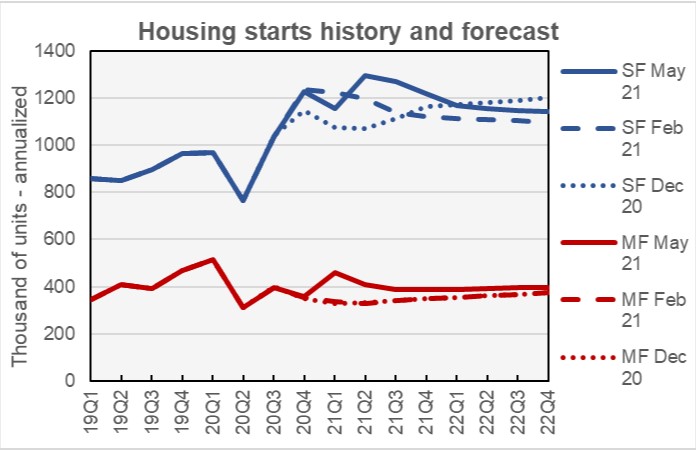

Fannie Mae’s forecasts for the housing construction market is shown in the final chart, below, along with two earlier forecasts. For 2021 as-a-whole, Fannie Mae now expects single family housing starts to be 1,236,000 units, up 5.1 percent from the level forecast in February and up 24.7 percent from the actual level in 2020. They expect multifamily housing starts (2+ units per building) to be 410,000 units, up 20.9 percent from the level forecast in February and up 5.4 percent from the actual level in 2020. The forecasts for starts in 2022 were also revised modestly upward.

Fannie Mae noted that the recent rise in average rents and relatively low vacancy rates are both positive for multifamily housing. However, they noted that the recovery of these rental metrics in the urban cores of some large metro areas is likely to be relatively weak in the near term.

The Fannie Mae forecast summary can be found here. There are links on that page to the detailed forecast.