A pair of forecasts, one from Fannie Mae and one from the Federal Reserve anticipate that a period of significantly higher inflation than had been predicted in earlier forecasts may be on the way.

Fannie Mae issues a monthly forecast for the economy and for housing production. The forecast provides both quarterly and annual estimates for standard economic metrics through the end of 2022.

The forecast from the Federal Reserve (Fed) was released in conjunction with the recent meeting of the Federal Open Market Committee (FOMC), which meets 8 times per year. The Fed forecast presents yearly figures through 2023 and a “longer run” forecast for the more distant future. The consensus Fed forecast is developed by the combining the forecasts of 18 economists. Each of the economists assumes that the Fed will follow “appropriate” monetary policy during the term of the forecast.

Inflation expected to rise

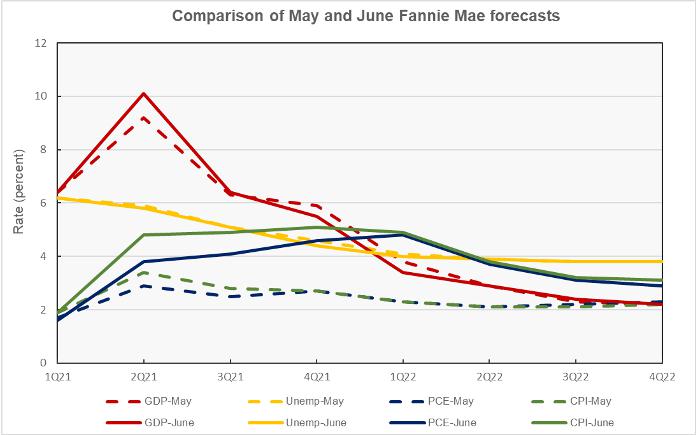

Since Fannie Mae releases its forecast reports monthly, the changes from one report to the next are generally small. However, significant revisions to expectations for inflation were made in June’s report. Fannie Mae provides forecasts for two measures of inflation. One is the Consumer Price Index (CPI), and one is the Personal Consumption Expenditures (PCE) index. The former index is the one most cited in the press while the latter index is favored by the Fed.

Fannie Mae’s forecast for inflation as measured by the CPI for 2021 was revised upward to 5.1 percent from the 2.7 percent forecast in May. It is remarkable that the 2021 inflation forecast would rise by nearly 90 percent given that we are 5 months into the year. The annual inflation forecast (CPI) for 2022 was revised upward to 3.1 percent from the 2.2 percent forecast in May.

Fannie Mae’s forecast for inflation as measured by the PCE for 2021 was revised upward to 4.8 percent from the 2.7 percent forecast in May. The annual inflation forecast (PCE) for 2022 was revised upward to 2.8 percent from the 2.3 percent forecast in May.

Fannie Mae’s quarterly inflation forecast figures, along with other economic metrics from the last two forecasts, are illustrated in the first chart, below.

The Fed’s forecast for PCE inflation for 2021 is now 3.4 percent. This is up from the 2.4 percent forecast in the Fed’s last report, which was released in March. The Fed’s PCE inflation forecast is now 2.1 percent for 2022 and 2.2 percent for 2023.

Note that the Fannie Mae forecast for inflation is significantly higher than that of the Fed. Since the inflation rate is a key parameter that the Fed uses in setting interest rates, they may be slow to respond if inflation in line with what Fannie Mae is predicting catches them by surprise.

Housing and inflation – it’s complicated

In its commentary on June’s results, Fannie Mae discussed how the rapid run-up in housing prices, both for home purchases and for rent, feed through into the inflation data. The basic idea in how the CPI treats rent is that renters are not out in the market renting a new apartment every month. A renter who signed a new lease in January is not faced with the rapid rent increases being seen today; that renter will only see them if the rent increases are still in place when his lease expires. Therefore, rental costs used in calculating the CPI are averaged over many months leading up the CPI report date.

The result of this averaging is that a rapid increase in housing prices, such as we are seeing now, does not immediately show up in the CPI. The May CPI figures would have been even worse if this had not been the case. On the other hand, the housing price increases will show up eventually and make future readings of the CPI higher, even if there is a decline in the other prices which are currently driving up the CPI.

GDP forecast slightly higher for 2021

Fannie Mae has revised their growth forecast for 2021 marginally higher compared to last month. Forecast growth for 2021 is now 7.1 percent, up from the 7.0 percent forecast in May. However, the forecast for GDP growth in 2022 was revised downward slightly to 2.7 percent from the 2.8 percent predicted last month.

The Fed is now forecasting that real GDP growth in 2021 will be 7.0 percent. This is up from the 6.5 percent they forecast in their March report. The Fed is now forecasting real GDP growth of 3.3 percent in 2022 and 2.4 percent in 2023. The Fed expects that the long-term rate of GDP growth will be 1.8 percent.

Unemployment forecast about the same

Fannie Mae’s forecasts for the unemployment rate were unchanged from the May report. The unemployment rate is expected to be 5.4 percent in 2021 and 3.9 percent in 2022.

The Fed forecast for the unemployment rate is nearly unchanged from their March forecast. The Fed now expects unemployment to be 4.5 percent (unchanged) in 2021, 3.8 percent (down 0.1 percent) in 2022 and 3.5 percent (unchanged) in 2023.

Housing: less single-family, more multifamily

Fannie Mae’s forecasts for the housing construction market is shown in the final chart, below, along with last month’s forecast. For 2021 as-a-whole, Fannie Mae now expects single family starts to be 1,190,000 units, down 3.7 percent from the level forecast in May. Their forecast for single-family starts in 2022 was also revised downward to 1,146,000 units, 9,000 units below the level forecast in May.

Fannie Mae expects multifamily starts (2+ units per building) to be 426,000 units in 2021, up 3.9 percent from the level forecast in April. The forecasts for multifamily starts in 2022 was unchanged at 393,000 units.

Fannie Mae Multifamily Market Commentary focused on the student housing sector and its improving prospects as the Covid-19 pandemic recedes.

The Fannie Mae forecast summary can be found here. There are links on that page to the detailed forecast.